WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

Our Latest pick ONDS is up over 80% since SEP 12.

3 STOCK PICKS THIS WEEK

1 year performance

TSEM - 116%

HL - 164%

NTRA - 55%

This Week (Here’s our top 3 stock picks)

Tower Semiconductor Ltd. (TSEM)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $11.08B

Company Info:

Tower Semiconductor Ltd. (NASDAQ: TSEM) is a leading specialty semiconductor manufacturer that provides advanced analog and mixed-signal process technologies for automotive, industrial, consumer, and RF applications. The company operates high-value fabrication facilities across the globe, producing power management, imaging, and wireless communication chips used in a wide range of connected devices. Tower’s mission is to enable innovation through precision analog manufacturing, delivering customized, high-performance semiconductor solutions that power the next generation of smart, energy-efficient technologies.

Why it’s a buy:

The stock is a buy in 2025 because Tower Semiconductor (TSEM) is a global leader in specialty analog and mixed-signal chip manufacturing, positioned to benefit from accelerating demand across automotive, industrial, and power management markets. The company’s expertise in analog, RF, and sensor technologies makes it a critical supplier for applications driving the electrification, connectivity, and automation of modern devices and vehicles.

With its strong customer base, expanding global fabrication footprint, and strategic focus on high-value analog production, Tower offers consistent revenue visibility and margin stability. The company is also expected to benefit from rising semiconductor localization efforts and partnerships that enhance capacity and innovation. As industries continue to adopt smarter, energy-efficient technologies, TSEM stands out as a high-quality, undervalued play on the analog semiconductor renaissance—a vital foundation of the next industrial and digital revolution.

Hecla Minig Company (HL)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $10.13B

Company Info:

Hecla Mining Company (NYSE: HL) is one of the largest and oldest precious metals mining companies in North America, specializing in the production of silver, gold, lead, and zinc. The company operates several high-grade mines across the United States, Canada, and Mexico, including the Greens Creek and Lucky Friday mines—two of the most productive silver operations in the Western Hemisphere. Hecla’s mission is to responsibly produce the metals essential for economic growth and clean energy technologies, positioning it as a key player in the global transition toward electrification and sustainable resource development.

Why it’s a buy:

The stock is a buy in 2025 because Hecla Mining Company (HL) is a leading U.S.-based silver and precious metals producer, well-positioned to benefit from the global push toward electrification, renewable energy, and industrial demand for silver. As one of the largest primary silver miners in North America, Hecla provides strategic exposure to a critical metal used in solar panels, electric vehicles, and advanced electronics—markets expected to see strong growth through the decade.

The company’s high-grade, low-cost operations at its flagship Greens Creek and Lucky Friday mines support robust production and cash flow, even in volatile price environments. With expanding reserves, improved operational efficiency, and rising silver prices driven by green energy demand, HL stands out as a top-tier, long-term play on the transition to a cleaner, electrified global economy while maintaining solid leverage to precious metals price appreciation.

Revenue:

Natera Inc. (NTRA)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $28.74B

Company Info:

Natera Inc. (NASDAQ: NTRA) is a leading genetic testing and diagnostics company specializing in cell-free DNA (cfDNA) technology for early detection and monitoring of genetic conditions, cancer, and organ health. The company’s innovative testing platforms—Panorama®, Signatera®, and Prospera®—enable precise, non-invasive analysis that supports personalized healthcare across prenatal screening, oncology, and transplant medicine. Natera’s mission is to improve and extend human lives through advanced genetic insights, positioning it at the forefront of molecular diagnostics and precision medicine in a rapidly expanding global genomics market.

Why it’s a buy:

Natera Inc. (NASDAQ: NTRA) is a global leader in genetic testing and molecular diagnostics, pioneering the use of cell-free DNA (cfDNA) technology to advance early detection and personalized medicine. Its proprietary platforms—Panorama® for prenatal screening, Signatera® for oncology, and Prospera® for organ health—are transforming how diseases are detected, monitored, and managed across multiple medical fields. Natera’s mission is to empower clinicians and patients with actionable genetic insights, driving innovation in precision healthcare and early disease intervention.

The stock is a buy in 2025 because Natera is at the forefront of the genomic medicine revolution, with strong tailwinds from rising global adoption of genetic testing, early cancer detection, and personalized treatment monitoring. Its Signatera® minimal residual disease (MRD) test is rapidly gaining traction among oncologists, while expanding reimbursement coverage continues to drive revenue growth and margin improvement. With a diversified pipeline, scalable testing infrastructure, and growing clinical partnerships, NTRA stands out as a high-growth healthcare technology play, offering long-term upside as genomic testing becomes a cornerstone of modern medicine.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Buy Levels, Price Targets and Stop Losses to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

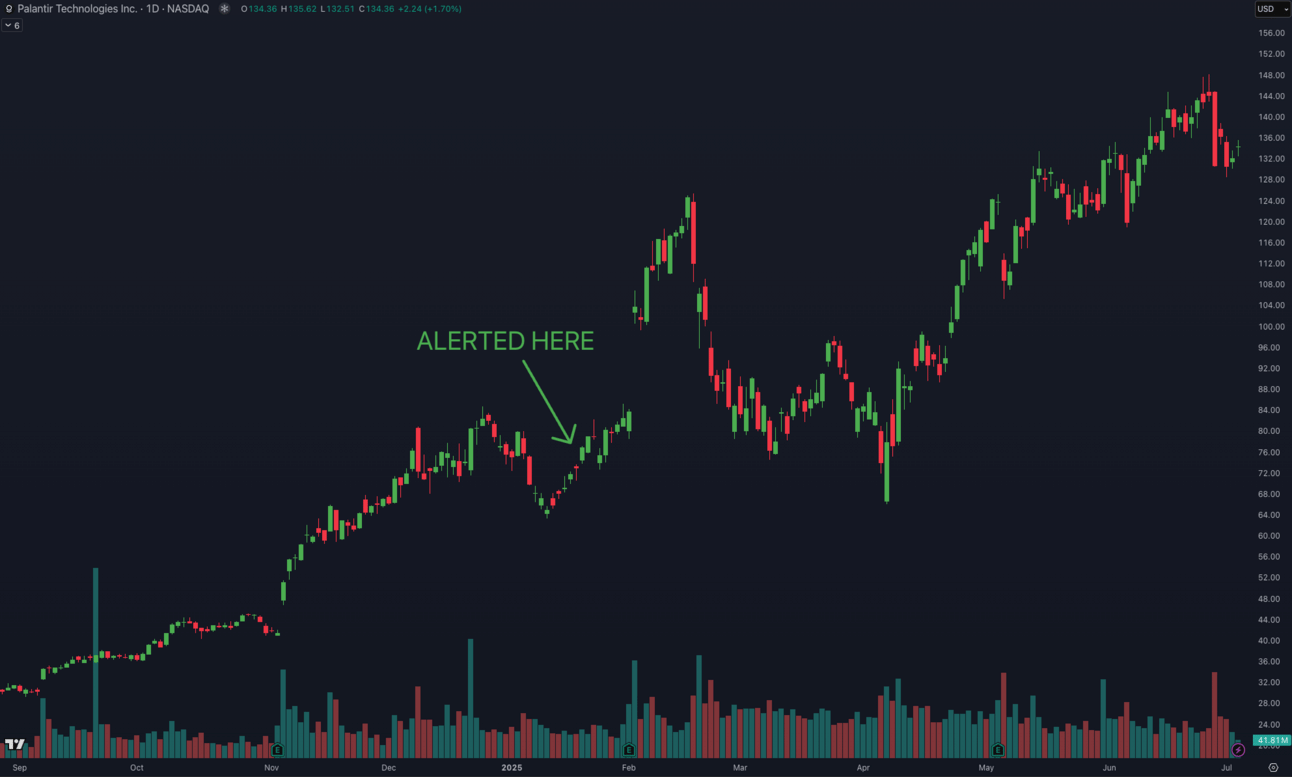

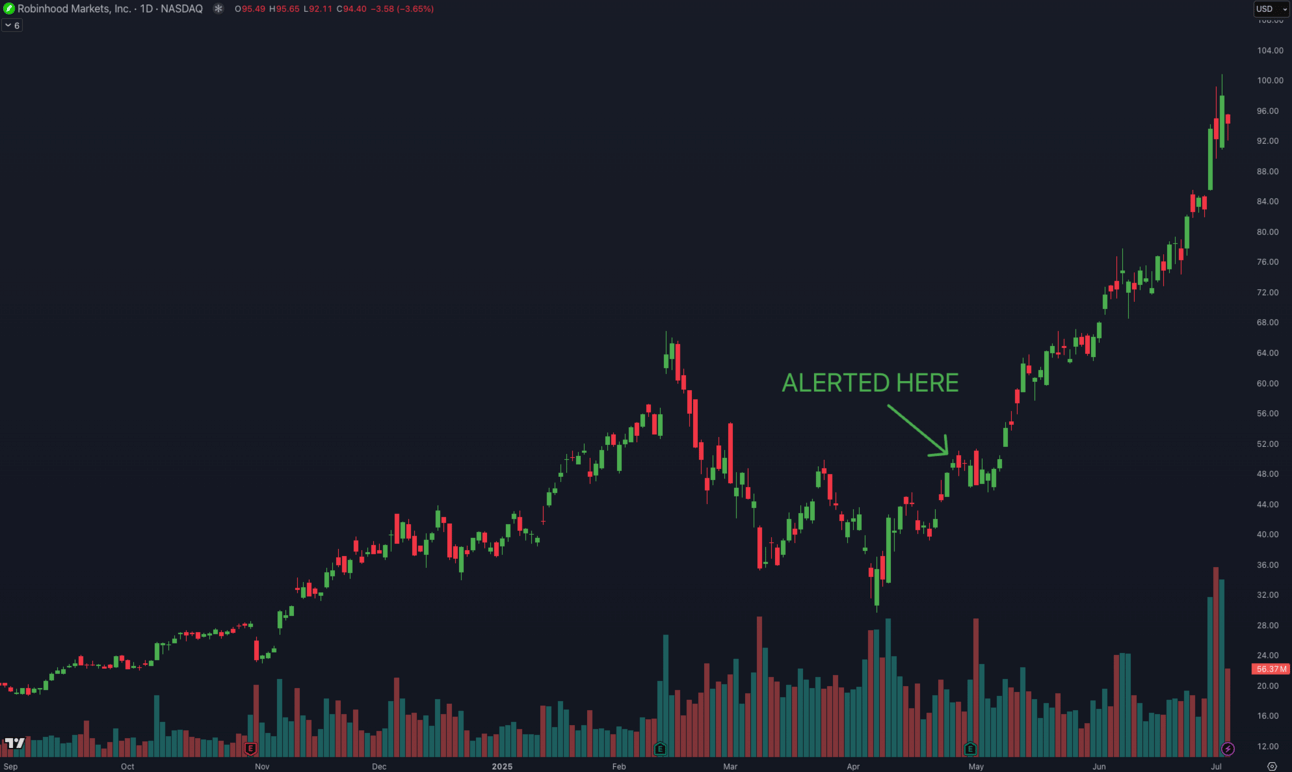

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.