WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

Our Latest pick CELH is up over 20% since AUG 8.

Sponsored By Osisko Development Corp.

Osisko Development Corp. (NYSE/TSX-V: ODV) is a North American gold developer aiming to become a mid-tier producer through three core projects across Canada, the U.S., and Mexico.

The company is led by the same team that built Canadian Malartic, Canada’s largest gold mine. Its flagship asset is the Cariboo Gold Project in British Columbia, a fully permitted, shovel-ready development with a US$450 million project loan secured from Appian Capital Advisory.

Cariboo is expected to produce ~190,000 ounces of gold annually for 10 years, with a projected NPV of C$943M at $2400/oz and up to C$2.1B at $3300/oz, and an IRR ranging from 22–38%. The project holds 2.07 million ounces in reserves and a 3.3 million ounce inferred resource, with construction targeted for late 2025 and first gold in 2027.

In the U.S., Osisko is advancing the Tintic/Trixie Mine in Utah, located in a historic high-grade gold-silver district. Early results from underground work have revealed grades over 4,700 g/t gold, highlighting significant near-term production potential and exploration upside. Meanwhile, in Mexico, Osisko holds the San Antonio Project, a past-producing open-pit heap leach asset currently on care and maintenance, with optionality for restart, sale, or joint venture.

Osisko’s value proposition lies in its multi-asset pipeline, anchored by a fully permitted Tier-1 project and supported by high-grade exploration and near-term production opportunities. Despite the scale and economics of its Cariboo asset, Osisko’s market cap remains well below its project valuations, creating a valuation disconnect that may appeal to investors.

Disclaimer: We have partnered with Osisko Development Corp. for this post. Crown Trading was compensated for this post on behalf of Cashu Technologies inc. This post is for informational purposes only and does not constitute financial advice. Viewers should consult a financial professional before making investment decisions.

3 STOCK PICKS THIS WEEK

1 year performance

NIO - 59%

NXT - 61%

RKLB - 598%

This Week (Here’s our top 3 stock picks)

Nio Inc (NIO)

1 Year Chart:

Category: Growth

Market Cap: $14B

Company Info:

Nio Inc. (NYSE: NIO) is a Chinese electric vehicle (EV) manufacturer focused on designing, developing, and selling smart, premium EVs. The company differentiates itself with innovations like battery swapping technology, a subscription model, and a strong emphasis on autonomous driving and in-car AI.

Why it’s a buy:

The stock is a buy in 2025 because Nio is one of the most ambitious EV players in China, with a compelling mix of technology, branding, and infrastructure advantages. It continues to expand its lineup with premium sedans and SUVs while also investing heavily in its battery swap network, which gives it a competitive edge over traditional charging.

Nio has also begun scaling internationally, particularly in Europe, and is accelerating development of its in-house chips and autonomous driving systems, which could help improve margins over time. As EV demand rebounds in China and globally, Nio is well-positioned to benefit thanks to its vertically integrated model, strong government support for domestic EVs, and continued improvements in vehicle delivery and battery innovation.

Revenue:

Nextracker Inc (NXT)

1 Year Chart:

Category: Growth

Market Cap: $10B

Company Info:

Nextracker Inc. (NASDAQ: NXT) is a leading provider of solar tracker systems, which are used to optimize the angle of solar panels throughout the day for maximum energy output. The company serves utility-scale solar developers and energy companies globally, playing a key role in accelerating the transition to renewable energy.

Why it’s a buy:

The stock is a buy in 2025 because Nextracker sits at the center of the booming solar infrastructure buildout. Its technology increases the efficiency and ROI of large solar farms, making it critical as the world shifts toward clean energy mandates.

With over 100 GW of trackers already deployed and a growing backlog of projects, the company has shown strong revenue growth and consistent profitability. Nextracker also benefits from long-term tailwinds such as the U.S. Inflation Reduction Act, global decarbonization efforts, and utility companies racing to expand their renewable portfolios. Its capital-light model, expanding international footprint, and role in utility-scale energy projects give it a durable competitive edge in one of the fastest-growing energy sectors.

Revenue:

Rocket Lab Corp (RKLB)

1 Year Chart:

Category: Growth

Market Cap: $23B

Company Info:

Rocket Lab USA, Inc. (NASDAQ: RKLB) is a space launch and satellite systems company that designs and manufactures rockets, spacecraft, and satellite components. Its flagship rocket, Electron, is a leading small satellite launch vehicle, and the company is also developing a larger rocket called Neutron for medium-lift missions.

Why it’s a buy:

The stock is a buy in 2025 because Rocket Lab is one of the few vertically integrated space companies with real commercial traction outside of SpaceX. It has launched dozens of successful missions and is rapidly expanding into satellite manufacturing, deep space missions, and government defense contracts.

The company’s Neutron rocket is expected to compete in the booming medium-lift market, unlocking larger revenue opportunities. Rocket Lab’s diversification into space systems, national security launches, and reusable rocket technology positions it as a long-term player in the new space economy. With defense spending rising and private space investment accelerating, RKLB stands out as an early mover with real revenue, tech edge, and strong government relationships.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Pro-level market breakdowns to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

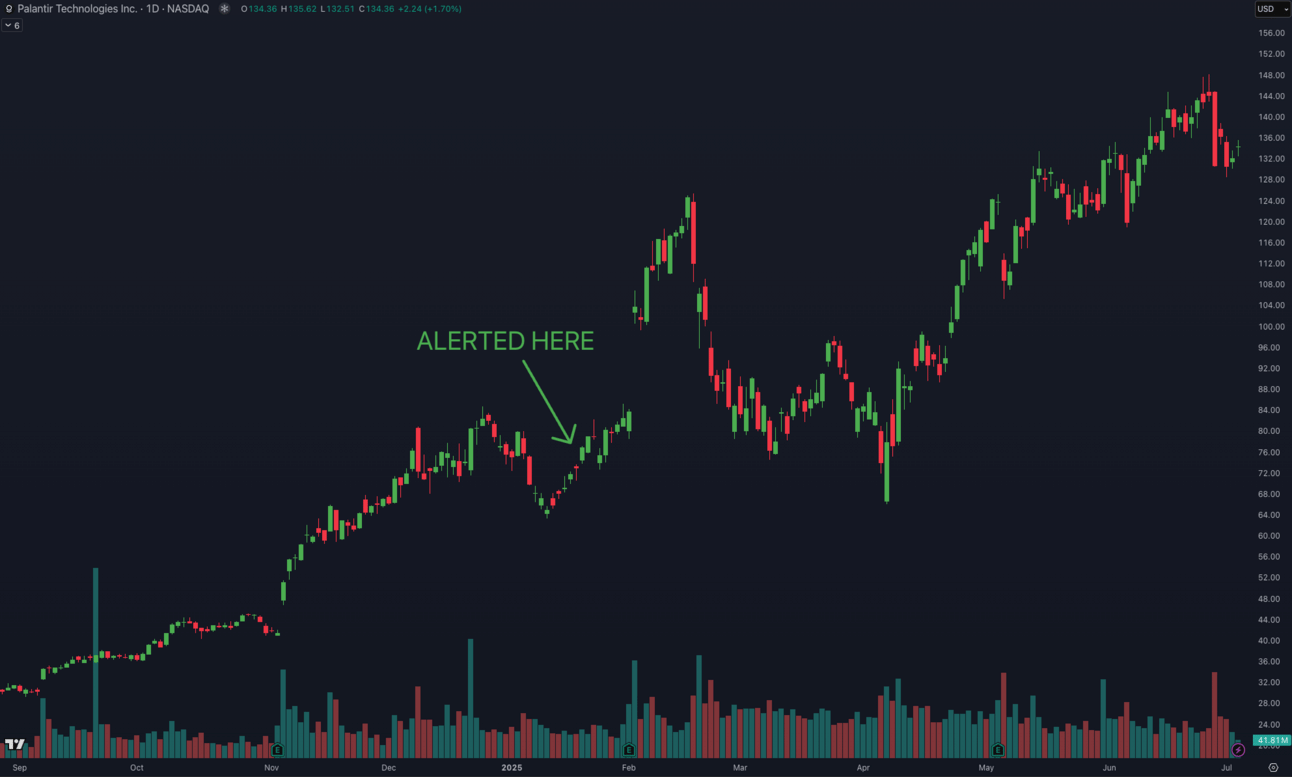

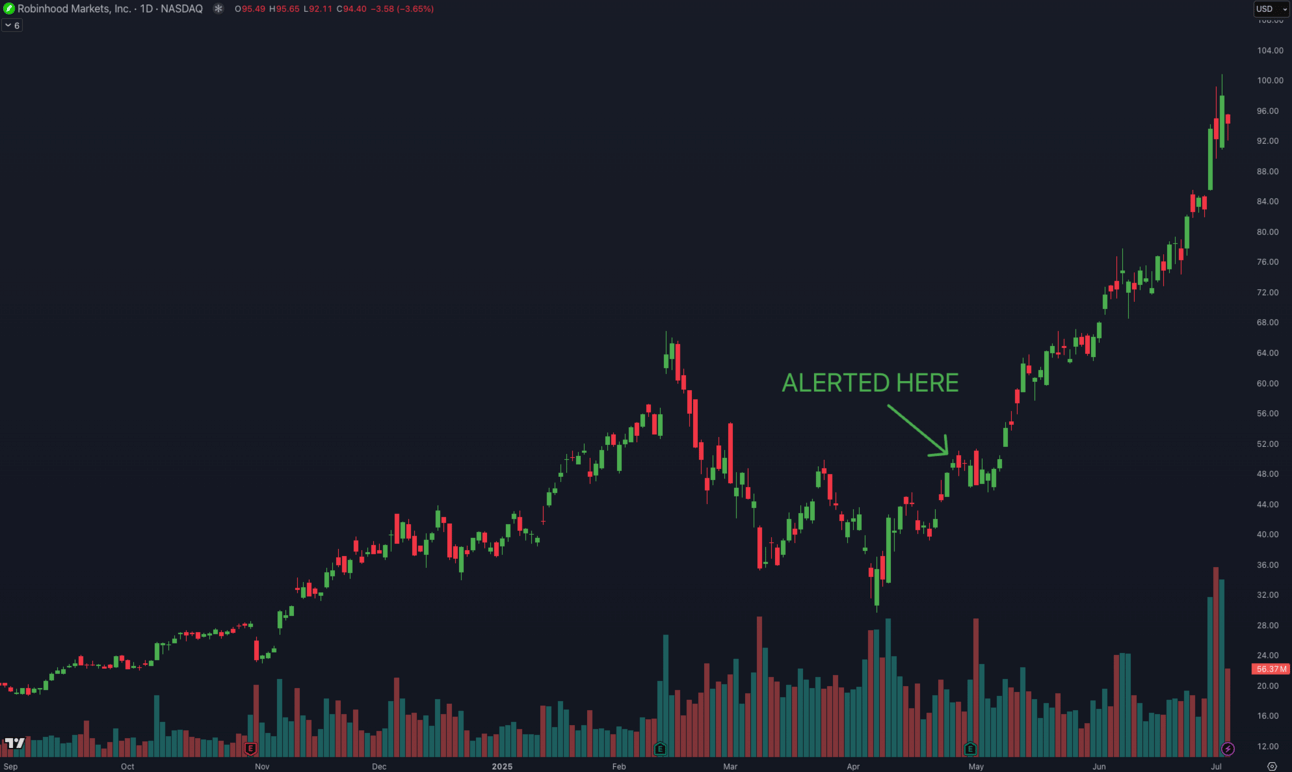

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.