WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

Our Latest pick CELH is up over 24% since AUG 8.

Sponsored By Minehub Technologies Inc.

This SaaS stock could be one of the most overlooked digital infrastructure plays in commodities and here’s why.

This company is MineHub Technologies ticker symbol MHUB on the TSXV and MineHub is a rapidly emerging SaaS company digitising the traditionally archaic, paper-based supply chains of the global mining and metals industry.

They have massive clients such as Codelco and Sumitomo and are processing nearly US$15B annually. With 198 counterparties onboard and 100% renewal from flagship clients, MineHub has proven real-world utility and strong network effects.

The market opportunity is huge and global settlement inefficiencies tie up over US$2T each year, and MineHub’s platform could unlock billions in working capital. Yet the stock trades at just C$0.57 with a C$52M market cap, while analysts have a price target of C$0.80.

With new Tier-1 customer wins and FY2026 results ahead, MineHub could be one of the most under-the-radar digital infrastructure plays in commodities.

This is not financial advice. Please read the full disclaimer. We partnered with MineHub Technologies Inc. to make this content.

Disclaimer: We have partnered with MineHub Technologies Inc for this post. Crown Trading was compensated for this post on behalf of Cashu Technologies inc. This post is for informational purposes only and does not constitute financial advice. Viewers should consult a financial professional before making investment decisions.

3 STOCK PICKS THIS WEEK

1 year performance

MDB - 11%

CHWY - 55%

STX - 86%

This Week (Here’s our top 3 stock picks)

Mongodb Inc (MDB)

1 Year Chart:

Category: Growth

Market Cap: $26B

Company Info:

MongoDB Inc (NASDAQ: MDB) is a leading modern database platform provider best known for its document-oriented NoSQL database used by developers to build scalable, high-performance applications. Its flagship product, MongoDB Atlas, is a fully managed cloud database service that integrates with major cloud platforms like AWS, Azure, and Google Cloud.

Why it’s a buy:

The stock is a buy in 2025 because MongoDB is positioned at the heart of the developer-first, cloud-native software revolution. As enterprises shift from legacy databases to more flexible and scalable architectures, MongoDB stands out as a key enabler. Its recurring subscription-based revenue model continues to expand, driven by strong Atlas adoption, which now makes up the majority of revenue.

With deep partnerships across all major cloud vendors, MongoDB benefits from strong multi-cloud demand and continued developer evangelism. As AI and real-time analytics further drive demand for unstructured and semi-structured data handling, MongoDB remains a mission-critical component of the modern tech stack.

Revenue:

Chewy Inc (CHWY)

1 Year Chart:

Category: Growth

Market Cap: $17B

Company Info:

Chewy Inc (NYSE: CHWY) is a leading online retailer of pet food, supplies, and healthcare products in the United States. The company operates a direct-to-consumer e-commerce model, known for its exceptional customer service, fast delivery, and growing portfolio of veterinary and pharmacy offerings.

Why it’s a buy:

The stock is a buy in 2025 because Chewy continues to gain traction in a massive and resilient $140+ billion pet care market, where consumer spending remains strong even in downturns. The company is expanding beyond pet food into high-margin health services like Chewy Pharmacy and insurance, creating stickier customer relationships and higher lifetime value.

With a loyal, growing customer base and improving margins through automation and logistics optimization, Chewy is transitioning from a growth story to a potential cash-generating leader in pet wellness. As more pet owners shift their recurring purchases online, Chewy is positioned to become the Amazon of pet care.

Revenue:

Seagate Technology Holdings PLC (STX)

1 Year Chart:

Category: Growth

Market Cap: $40B

Company Info:

Seagate Technology Holdings PLC (NASDAQ: STX) is a global leader in data storage solutions, best known for its hard disk drives (HDDs), solid-state drives (SSDs), and storage systems used across cloud, enterprise, and consumer markets. The company plays a critical role in powering data centers, AI infrastructure, and edge computing, with over four decades of storage innovation.

Why it’s a buy:

The stock is a buy in 2025 because Seagate is entering a new cycle of demand fueled by the AI and hyperscale data center boom, where massive storage capacity is essential.

The company is ramping production of its 30+ terabyte HAMR drives, which offer industry-leading density and are expected to drive a wave of upgrades among cloud giants. Seagate is also actively managing costs and improving its balance sheet, setting up for stronger operating leverage as demand rebounds. With its strategic positioning at the core of AI infrastructure and long-term data growth trends, STX offers both cyclical upside and secular tailwinds in a data-driven world.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Pro-level market breakdowns to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

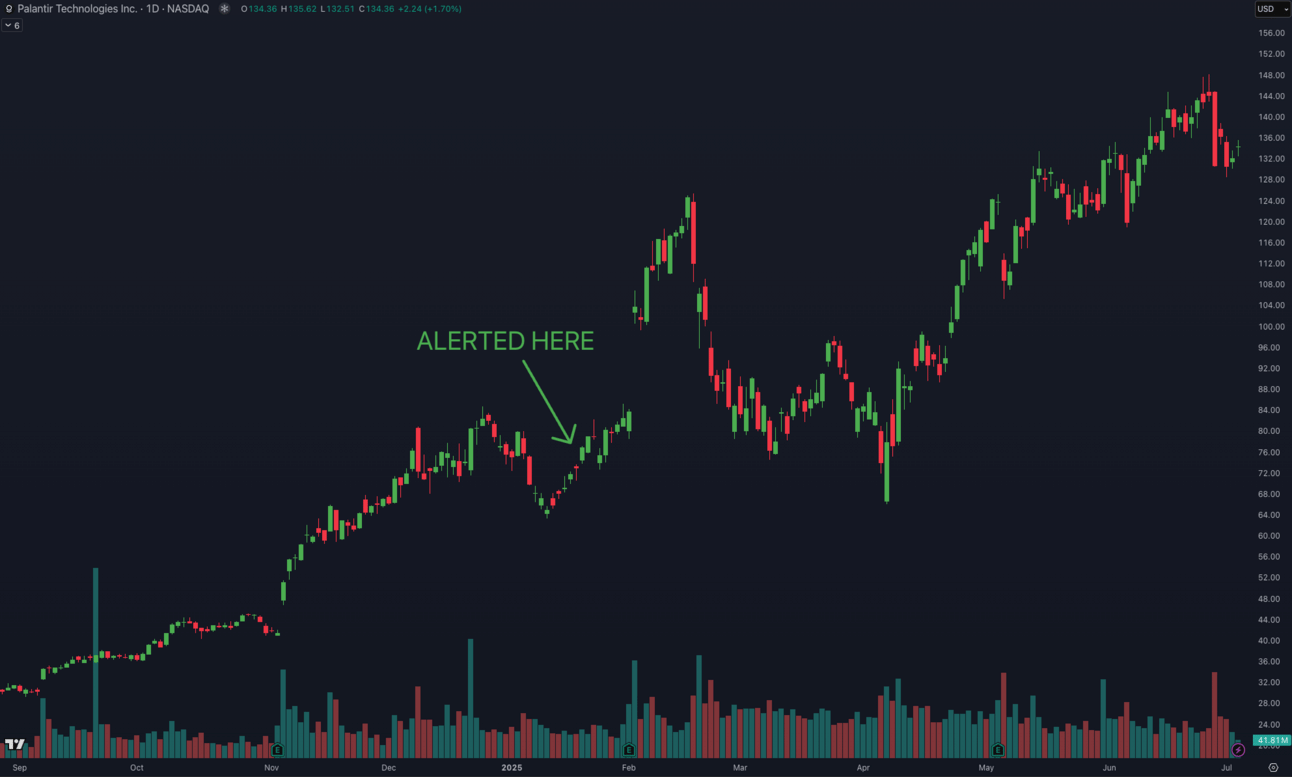

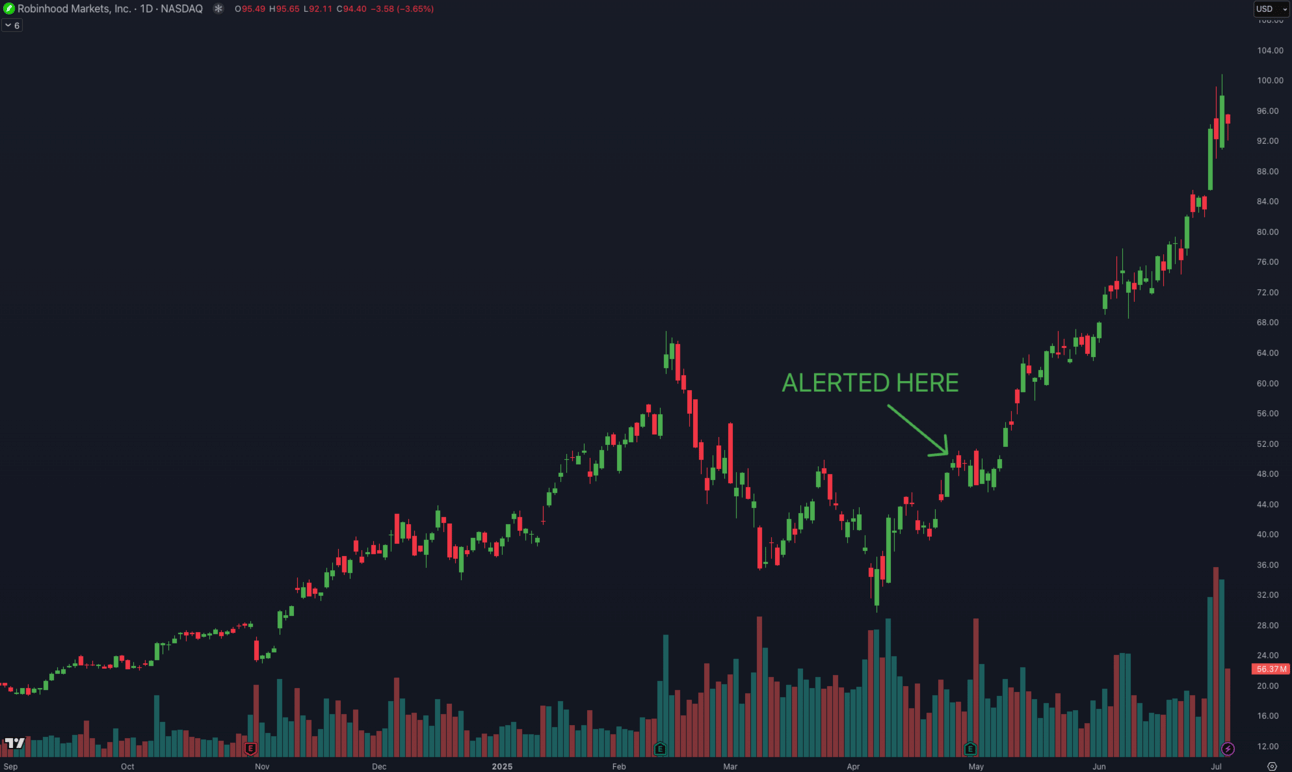

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.