WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

Our Latest pick ONDS is up over 80% since SEP 12.

3 STOCK PICKS THIS WEEK

1 year performance

GH - 231%

ACLX - 4%

COMP - 50%

This Week (Here’s our top 3 stock picks)

Guardant Health Inc. (NASDAQ: GH)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $12.45B

Company Info:

Guardant Health Inc. (NASDAQ: GH) is a precision oncology company developing blood-based liquid biopsy tests that enable early cancer detection, treatment selection, and ongoing disease monitoring through advanced genomic analysis. Its flagship platforms—Guardant360®, Guardant Reveal™, and Shield™—use cutting-edge ctDNA technology to identify tumor mutations from a simple blood draw, offering faster, less invasive alternatives to traditional tissue biopsies. Guardant’s mission is to transform cancer care through data-driven diagnostics, empowering clinicians with real-time insights that support earlier intervention, personalized therapy, and improved patient outcomes across the cancer care continuum.

Why it’s a buy:

The stock is a buy in 2025 because Guardant Health (GH) is at the forefront of the rapidly growing liquid biopsy and precision oncology market, offering blood-based genomic tests that are transforming how cancer is detected and monitored. As healthcare systems shift toward earlier diagnosis and personalized treatment, Guardant’s flagship platforms—Guardant360®, Reveal™, and Shield™—are seeing expanding clinical adoption across oncology practices, hospitals, and screening programs.

The company continues to deliver strong clinical validation for its early detection test, Shield, positioning it as a major contender in the multi-billion-dollar colorectal cancer screening market. With regulatory milestones underway, increasing reimbursement coverage, and a diversified pipeline in minimal residual disease (MRD) and early cancer detection, GH offers high-conviction exposure to one of the most important shifts in modern medicine. As precision diagnostics become standard-of-care globally, Guardant stands out as a first mover with scalable technology and meaningful long-term growth potential.

Arcellx Inc (ACLX)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $5.28B

Company Info:

Arcellx Inc. (NASDAQ: ACLX) is a clinical-stage biotechnology company developing next-generation CAR-T cell therapies designed to treat difficult-to-manage cancers, with an initial focus on relapsed or refractory multiple myeloma. The company’s lead program, anito-cel (formerly CART-ddBCMA), has demonstrated strong clinical efficacy and durable responses in early trials, supported by a strategic global partnership with Gilead’s Kite Pharma, one of the leaders in cell therapy commercialization. Arcellx’s mission is to redefine cell therapy safety, consistency, and durability through its innovative synthetic binding domains and engineered immune-cell platforms, positioning it at the forefront of the next wave of precision cellular oncology.

Why it’s a buy:

The stock is a buy in 2025 because Arcellx (ACLX) is emerging as a leading innovator in next-generation CAR-T therapies, a field transforming the treatment of blood cancers. The company’s lead candidate, anito-cel, has delivered highly compelling clinical results in relapsed or refractory multiple myeloma—one of the fastest-growing markets in oncology—and is being advanced through late-stage development in partnership with Kite Pharma, one of the world’s top cell-therapy commercializers. This collaboration not only validates Arcellx’s technology but also provides the manufacturing scale, regulatory experience, and commercialization muscle needed to bring anito-cel to a global market.

Beyond its lead program, Arcellx is building a diversified pipeline of tunable, modular cell therapies designed to improve safety, durability, and patient outcomes—addressing key limitations of first-generation CAR-T products. With multiple clinical catalysts ahead, strong pharma backing, and growing demand for more effective myeloma treatments, ACLX stands out as a high-conviction biotech play offering significant long-term upside as next-generation cell therapies evolve into a new standard of care.

Revenue:

Compass Inc. (NYSE: COMP)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $5.30B

Company Info:

Compass Inc. (NYSE: COMP) is a technology-driven real estate brokerage that combines a nationwide network of top-performing agents with an integrated digital platform designed to simplify and optimize the buying, selling, and marketing of residential properties. The company’s end-to-end software suite—spanning pricing tools, client management, marketing automation, and transaction workflows—helps agents operate more efficiently while delivering a streamlined experience for homeowners. Compass’s mission is to modernize real estate through data, design, and technology, positioning it as a leading innovator in one of the largest and most traditional industries in the U.S.

Why it’s a buy:

The stock is a buy in 2025 because Compass Inc. (COMP) is poised to benefit from a recovering U.S. housing market and the increasing digitization of real estate transactions. Unlike traditional brokerages, Compass operates with a technology-first model—offering agents a fully integrated platform for pricing, marketing, client management, and transaction coordination—which enhances productivity and drives higher agent retention and performance. As mortgage rates stabilize and inventory gradually improves, Compass stands to capture market share from legacy firms that lack modern tools and data-driven capabilities.

Despite recent restructuring and market headwinds, Compass has significantly reduced operating costs, improved cash flow, and sharpened its focus on profitability. With a strong brand, a network of top-performing agents, and a proprietary software ecosystem that strengthens agent efficiency and customer experience, COMP offers leveraged upside to a real estate recovery and represents a compelling play on the long-term digital transformation of the residential property market.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Buy Levels, Price Targets and Stop Losses to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

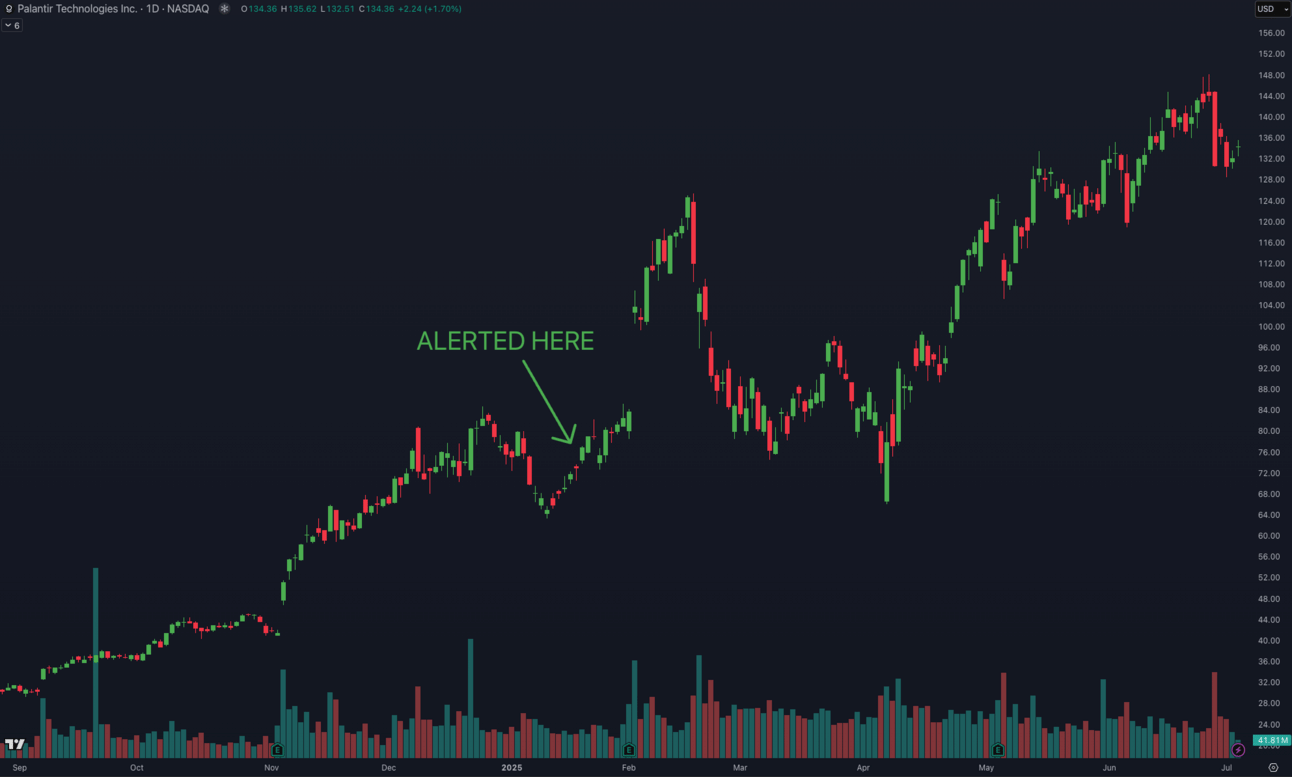

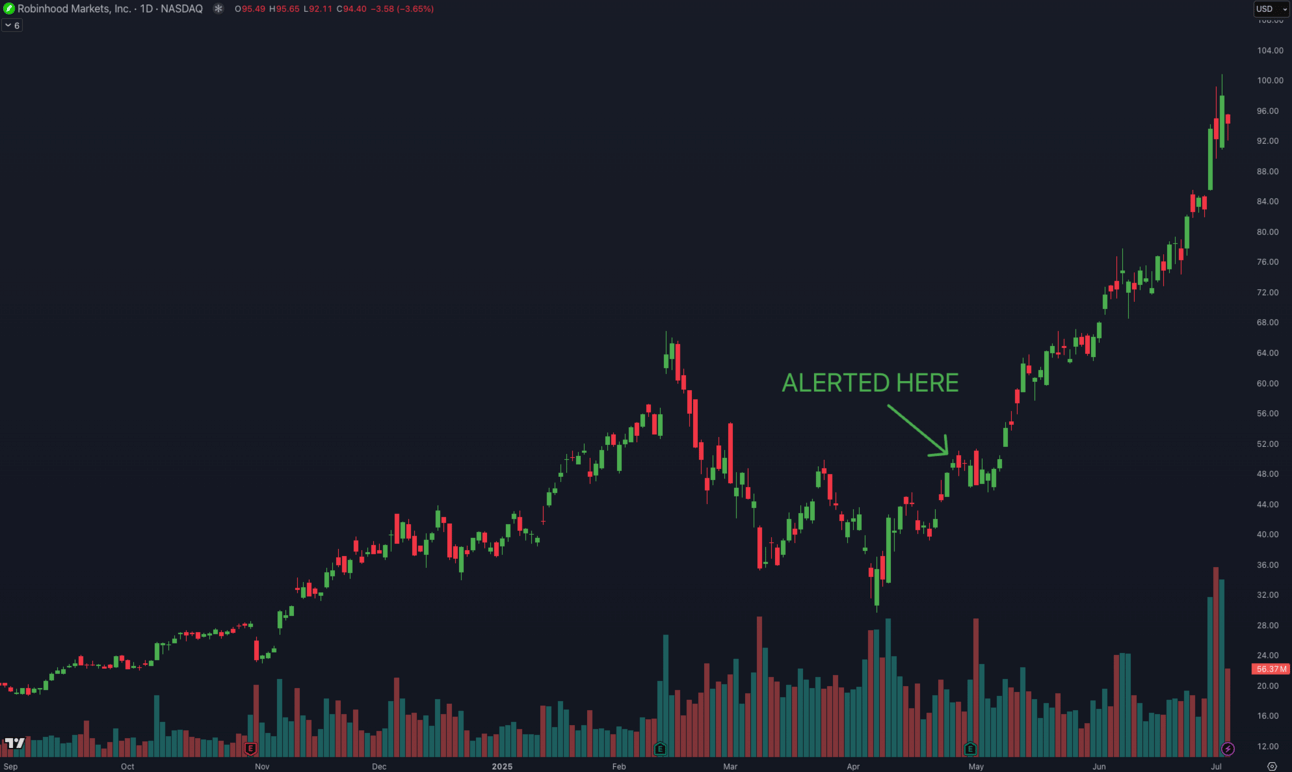

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.