3 Stocks Heating Up Mid-December

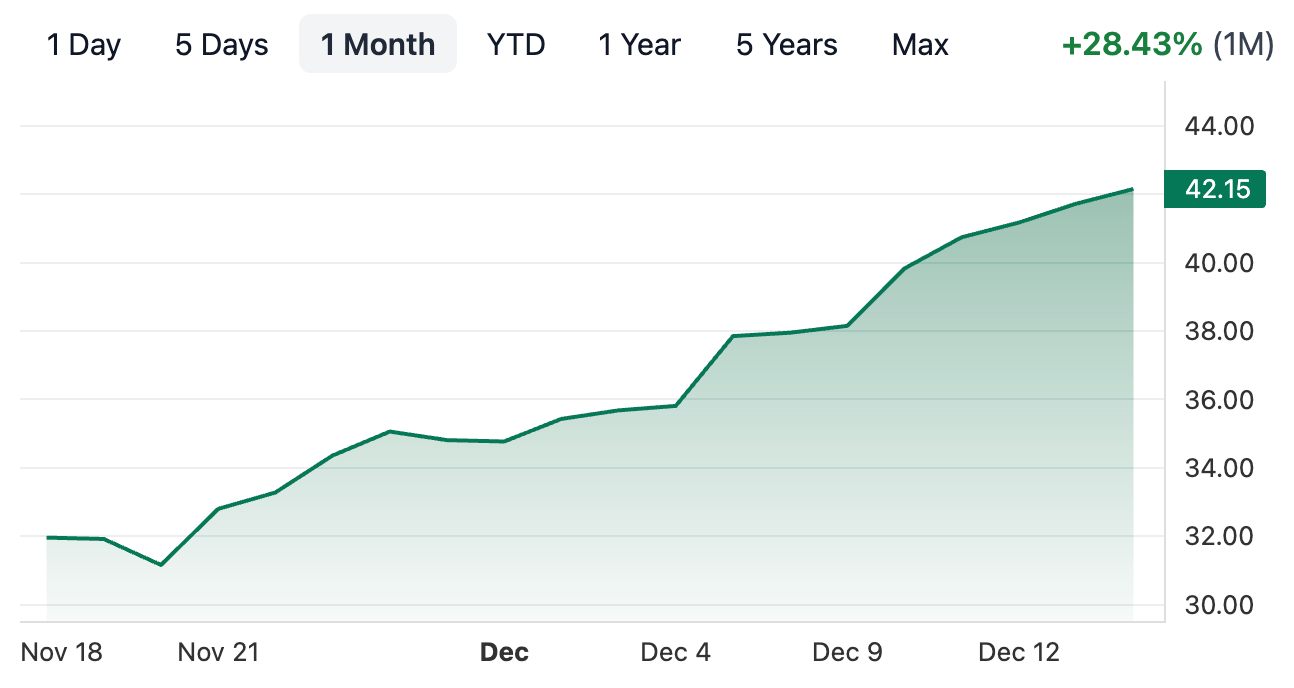

Southwest Airlines Co. (LUV)

Southwest Airlines Co. (LUV) has surged +28% over the past month as investors rotate back into travel and cyclical recovery plays. The rally reflects growing confidence that airline demand is stabilizing, costs are normalizing, and Southwest is moving past the operational disruptions and margin pressure that weighed on the stock over the last year.

Momentum accelerated as the company showed improving capacity utilization, better pricing discipline, and progress on cost controls, while benefiting from strong domestic travel demand and a resilient consumer. With a fortress balance sheet, a simplified fleet, and renewed focus on profitability, Southwest is re-emerging as one of the strongest momentum names in the airline sector, positioning LUV as a compelling recovery and re-rating story as sentiment toward travel continues to improve.

1 Month Performance:

Dollar General Corporation (DG)

Dollar General Corporation (DG) has surged +29% over the past month as investors rotate back into defensive consumer and value-oriented retail names. The rally reflects renewed confidence in Dollar General’s ability to stabilize margins and capitalize on persistent value-driven consumer behavior amid ongoing economic uncertainty.

Momentum accelerated as management signaled improving inventory discipline, cost controls, and a clearer path to margin recovery, while traffic trends showed signs of stabilization across its nationwide store base. With a massive rural footprint, strong private-label offerings, and pricing power in essential goods, Dollar General is re-emerging as one of the strongest momentum names in defensive retail, positioning DG as a compelling recovery play as consumer trade-down dynamics continue.

1 Month Performance:

Dollar Tree, Inc. (DLTR)

Dollar Tree, Inc. (DLTR) has surged +25% over the past month as investors rotate aggressively into defensive retail and value-focused consumer names. The move reflects renewed confidence in Dollar Tree’s ability to benefit from trade-down spending behavior, as consumers increasingly seek lower-priced essentials amid ongoing economic pressure.

Momentum picked up as expectations improved around margin stabilization, better inventory management, and pricing power across the Dollar Tree banner, following recent strategic changes and cost controls. With a massive national footprint, exposure to essential categories, and resilience during economic slowdowns, DLTR is re-emerging as one of the strongest momentum names in the discount retail space right now.

1 Month Performance:

We track momentum stocks like this all year inside Momentum.

Members get access to the price setup ideas we’re actively watching as breakouts begin to form — BEFORE the market piles in.

Inside Momentum, you’ll see:

Example buy zones and exit references

Risk context to understand downside scenarios

Weekly watchlists and market reports

And more…

Sign up before December 22 and you’ll also get my Top 5 Elite Stocks for December 2025 list.

After the 22nd, the bonus is gone.

Talk soon,

— Jordan

👑 Crown Trading