Our Momentum Scanner Picked Up These

3 Stocks This Week

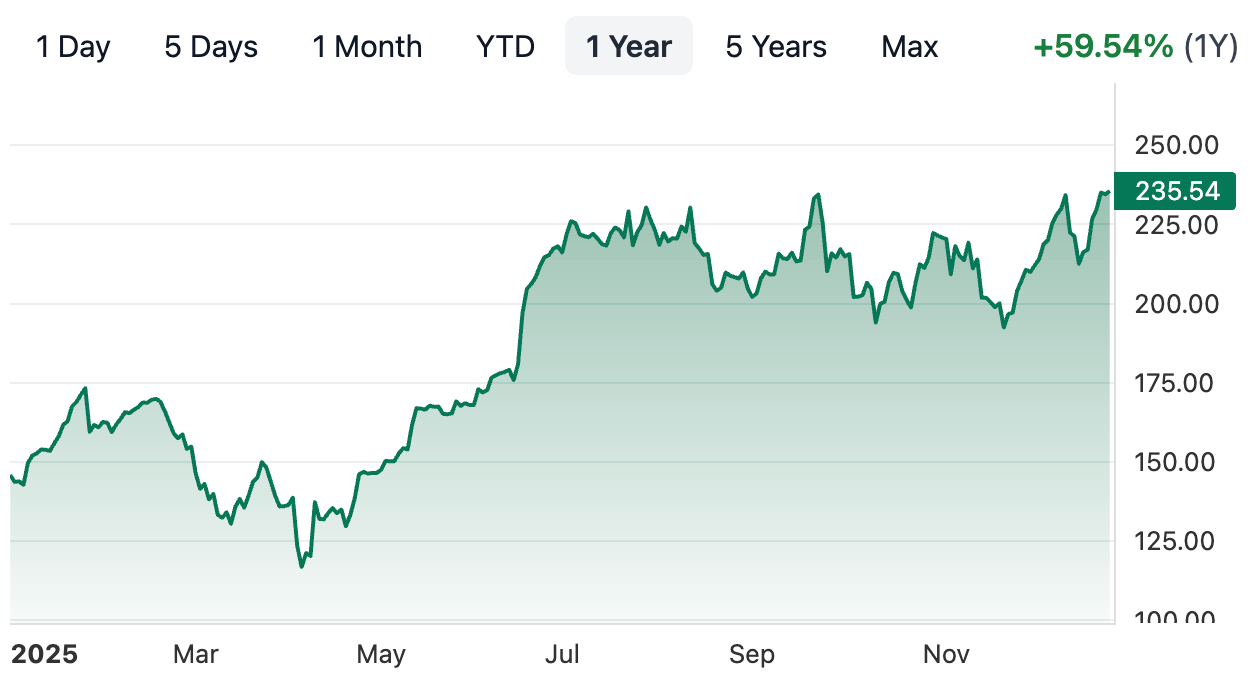

1 year performance

TSLA - 3%

JBL - 59%

ZM - 3%

Before we dive in…

⚠️ WANT EARLY ACCESS TO OUR PRICE BREAKDOWNS ?

The report below covers the top 3 stocks showing signs of early momentum.

But for those who also want:

Full technical price breakdowns on all 3 stocks

Price examples where support has historically held

Price examples that would invalidate the momentum

Early full market reports every Sunday

Free Trial Offer expires 12/31

Our latest Elite alert: $LITE → Up 78% since OCT 27

Let’s Talk About On Each One!

Tesla, Inc. (TSLA)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $1.59T

Company Info:

Tesla (NASDAQ: TSLA) is a vertically integrated technology company developing electric vehicles, energy storage systems, and AI-driven software designed to accelerate the global transition to sustainable energy. Tesla’s ecosystem spans EV manufacturing, battery technology, autonomous driving software, and energy generation and storage, positioning it as more than just an automaker.

Its flagship vehicles and Full Self-Driving (FSD) platform represent a major milestone in the evolution of transportation, while its energy products support grid resilience and renewable adoption. By combining hardware, software, and AI at scale, Tesla sits at the forefront of electric mobility and intelligent energy systems, shaping the future of transportation and power infrastructure worldwide.

Why it’s a buy:

The stock is a buy in 2025 because Tesla sits at the intersection of electric vehicles, AI, robotics, and energy infrastructure, positioning it as far more than a traditional automaker. Unlike legacy car manufacturers, Tesla operates a vertically integrated model spanning EV production, battery technology, AI-driven software, and energy storage, giving it unmatched control over cost, innovation, and scale.

Despite near-term volatility tied to pricing pressure, margins, and macro conditions, Tesla continues to build long-term strategic moats through Full Self-Driving (FSD), AI training data, and expansion into energy storage and grid solutions. With global governments pushing electrification, rising demand for battery storage, and increasing focus on autonomous systems, Tesla stands out as a category-defining first mover, offering investors leveraged exposure to multiple multi-trillion-dollar markets with transformational upside into and beyond 2025.

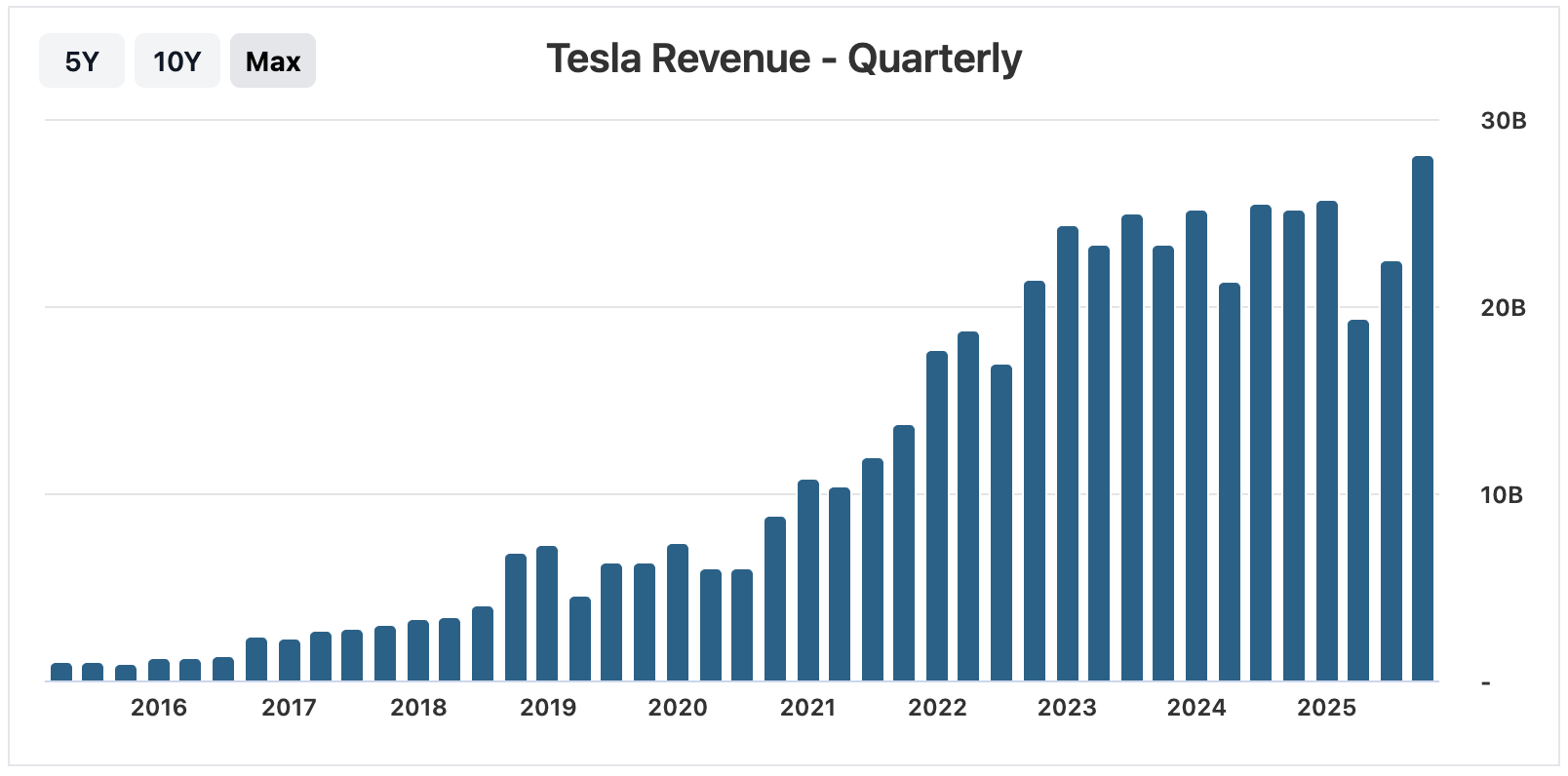

Revenue:

Jabil Inc. (JBL)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $25B

Company Info:

Jabil (NYSE: JBL) is a global manufacturing solutions provider specializing in the design, engineering, and production of complex electronic and mechanical systems for leading technology companies worldwide. Jabil operates across industries including cloud infrastructure, automotive, healthcare, industrial, and consumer electronics, serving as a critical backbone of modern supply chains.

With deep expertise in advanced manufacturing, supply chain optimization, and precision engineering, Jabil enables its customers to scale next-generation technologies efficiently and cost-effectively. Its diversified end markets, long-term customer relationships, and focus on high-value manufacturing position Jabil as a key enabler of global innovation and the future of connected, technology-driven industries.

Why it’s a buy:

The stock is a buy in 2025 because Jabil is a critical enabler of next-generation technology, sitting at the heart of global manufacturing and supply chains. Unlike traditional contract manufacturers, Jabil operates a high-value, diversified platform spanning AI data-center hardware, automotive electrification, healthcare devices, and industrial automation, allowing it to benefit from multiple secular growth trends at once.

Despite near-term margin pressure and cyclical demand fluctuations, Jabil continues to expand its advanced manufacturing capabilities, long-term customer partnerships, and high-margin segments. As investment accelerates across AI infrastructure, reshoring, and complex electronics production, Jabil stands out as a scalable, cash-generative operator with deep technical expertise, offering investors leveraged exposure to the physical backbone of the digital economy with durable upside into and beyond 2025.

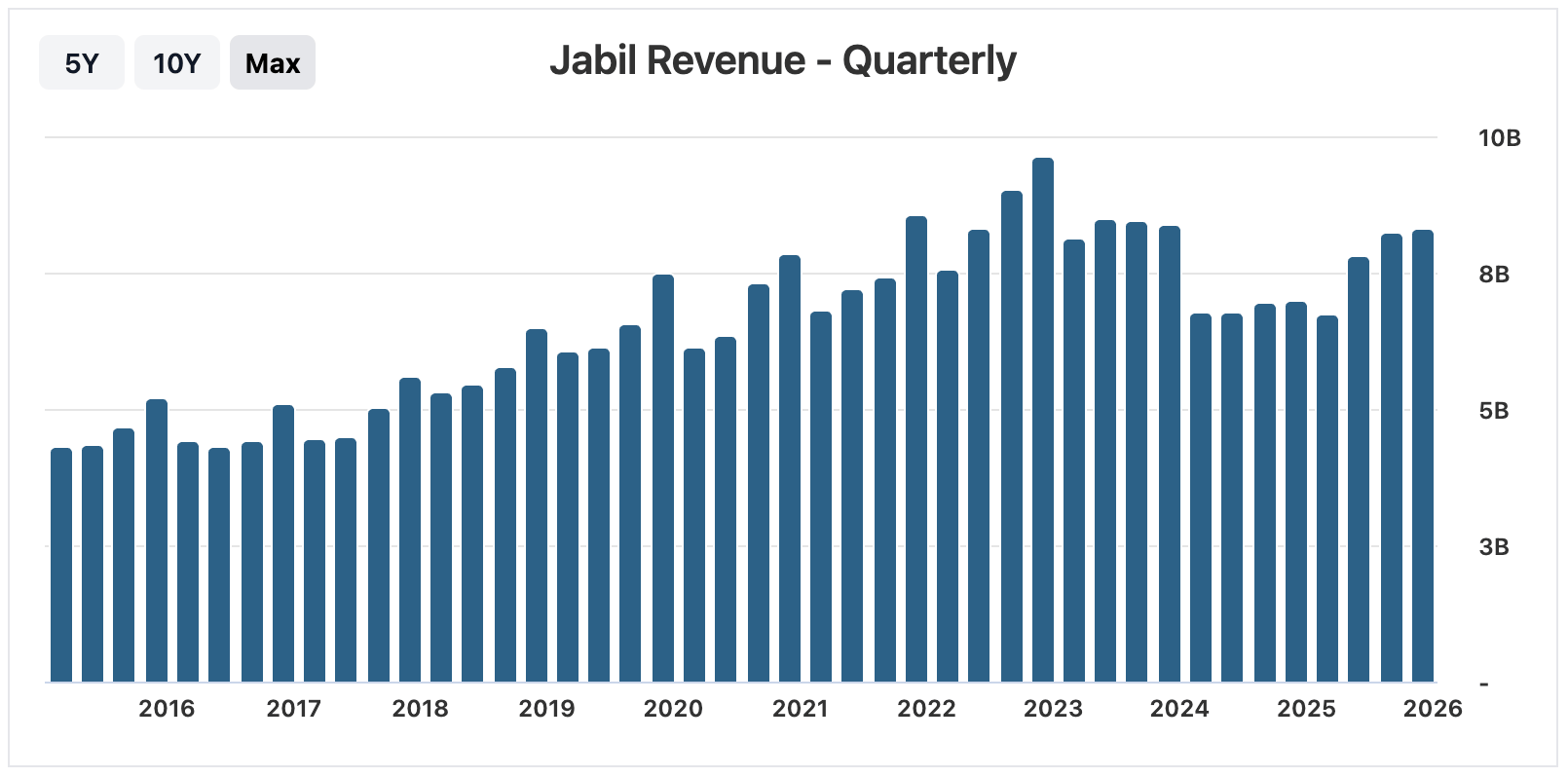

Revenue:

Zoom Communications, Inc. (ZM)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $26B

Company Info:

Zoom (NASDAQ: ZM) is a communications technology company developing cloud-based video, voice, chat, and collaboration solutions designed to enable seamless, reliable, and scalable digital communication. Its flagship Zoom Meetings platform became the global standard for virtual communication, trusted by enterprises, governments, and individuals worldwide.

Built on a highly reliable, easy-to-use cloud architecture, Zoom has expanded beyond video conferencing into enterprise communications, contact center software, and AI-powered productivity tools. By combining simplicity, scale, and performance, Zoom has established itself as a foundational layer of modern work and digital collaboration, shaping the future of how organizations connect and operate globally.

Why it’s a buy:

The stock is a buy in 2025 because Zoom remains a foundational layer of the modern digital workplace, powering how enterprises, governments, and teams communicate at scale. Unlike single-product SaaS companies, Zoom has evolved into a full communications platform, spanning video meetings, enterprise phone systems, contact center software, and AI-powered productivity tools, all built on a highly reliable, low-latency cloud infrastructure.

Despite near-term growth normalization following the post-pandemic reset, Zoom continues to generate strong cash flow, maintain a debt-light balance sheet, and expand its enterprise footprint. As work becomes increasingly hybrid, customer engagement shifts toward digital-first channels, and AI enhances workflow efficiency, Zoom stands out as a trusted, mission-critical platform. This positions the company to benefit from long-term enterprise adoption, offering investors defensive quality with optional upside as AI-driven communications reshape how organizations operate beyond 2025.

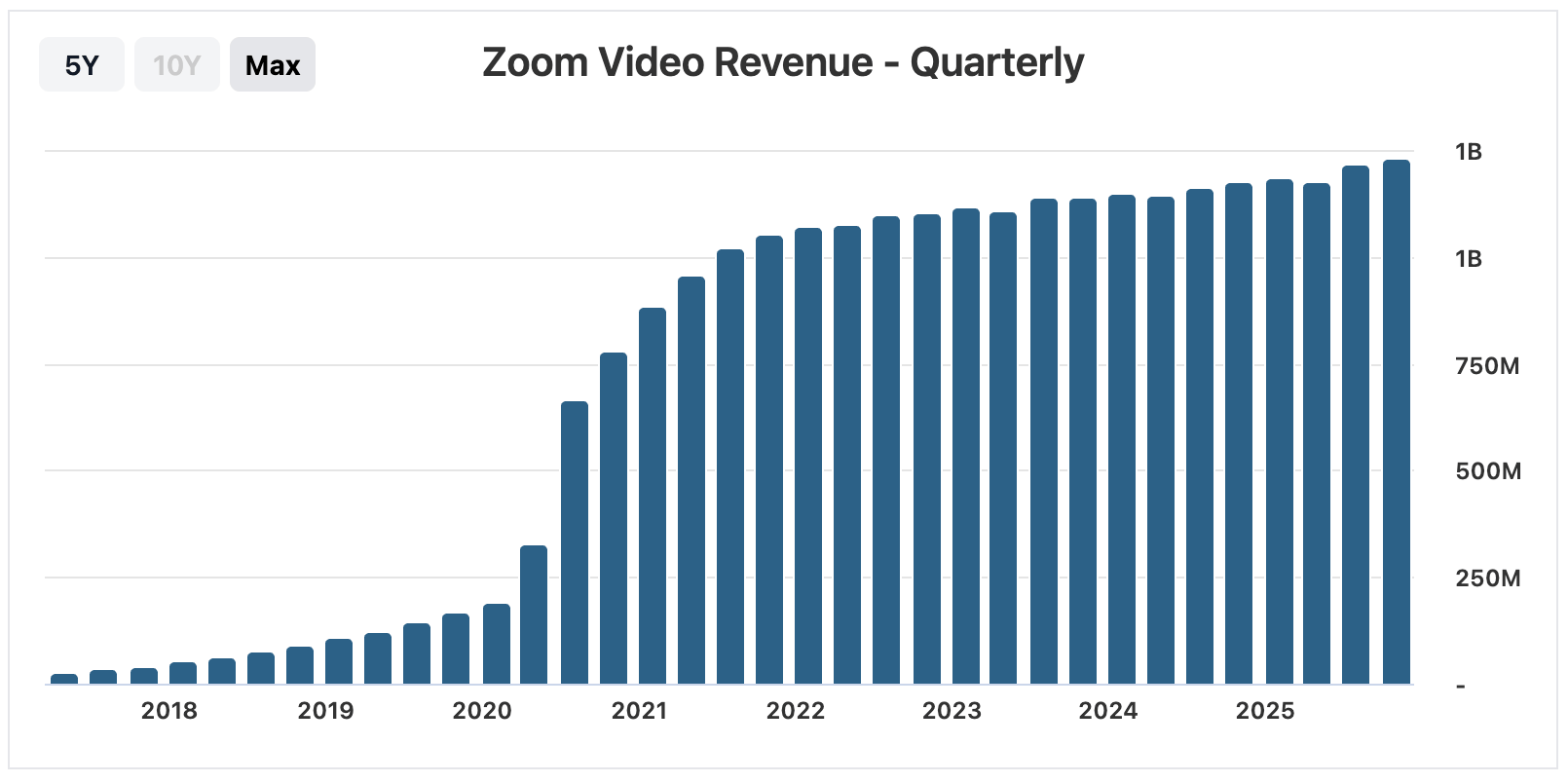

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

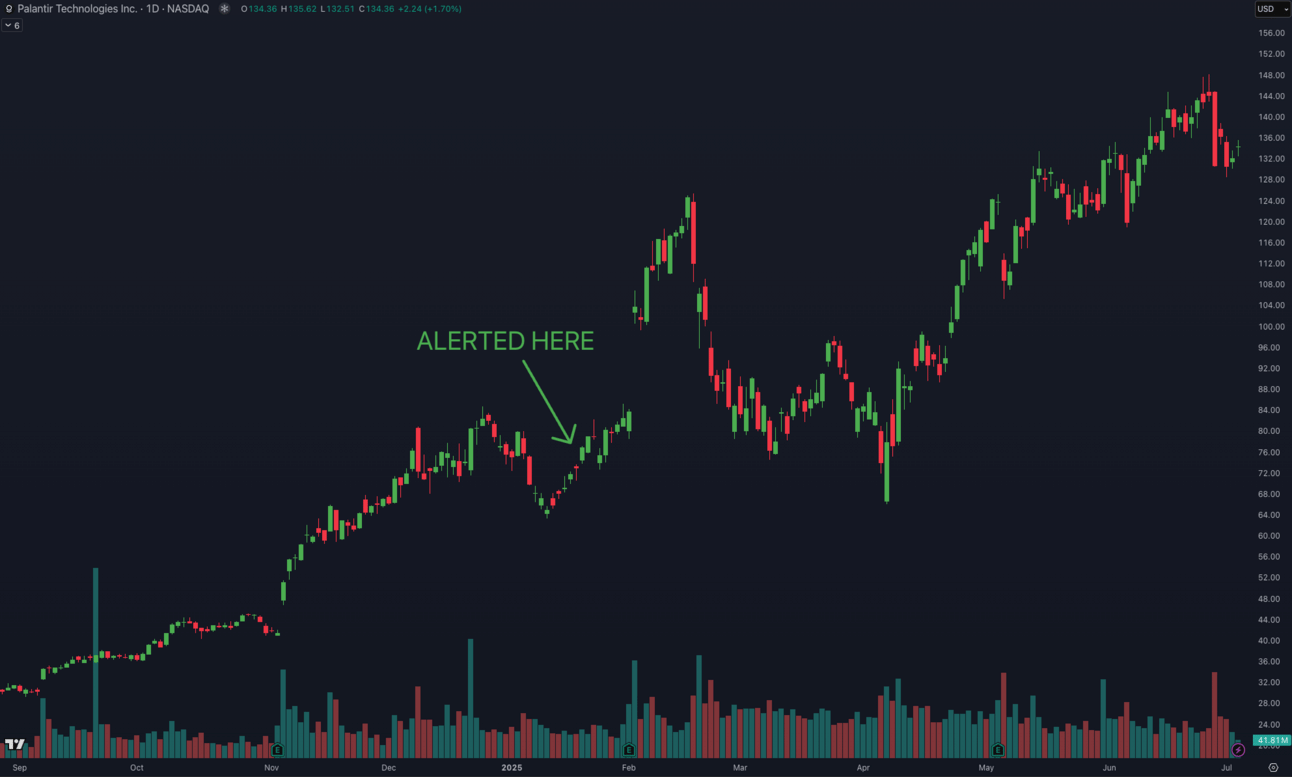

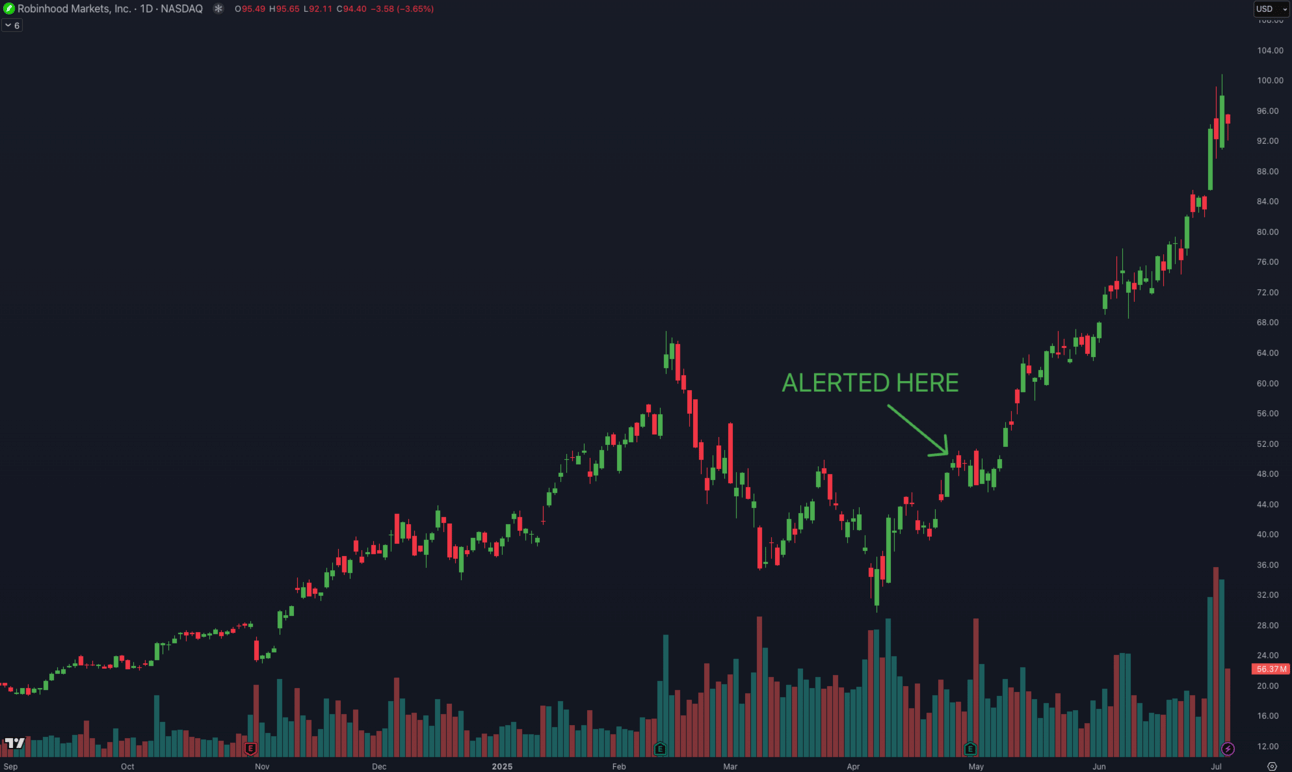

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.