Let's be honest: November tested you.

The S&P 500 dropped about, the Nasdaq Composite slipped, and if you're holding growth stocks, you probably felt it in your portfolio.

But here's what separates winning traders from the crowd:

→ While others panic-sell, we're scanning for oversold opportunities

→ While everyone's frozen, we're identifying which stocks have real support

→ While the news screams "crash," we're positioning for the bounce

This is where momentum research matters most.

Anyone can find stocks going up in a bull market. The real edge is knowing:

Which stocks are getting irrationally hammered (and due for a snap-back)

Which ones are breaking critical support (and should be avoided entirely)

Where institutional money is quietly positioning

That's what this week's watchlist is about.

⚠️ WANT TO SEE THE STOCKS WE’RE WATCHING?

We just dropped a new batch of setups inside Crown Elite — and you're invited.

Elite members got this morning:

Full technical breakdowns on all 3 stocks (including exact entry zones)

Stop-loss levels to protect capital if we're wrong

Risk/reward analysis (so you know when to cut losses)

Position sizing guidance based on current volatility

Our latest Elite alert: $LITE → Up 78% since OCT 27

3 STOCK PICKS THIS WEEK

1 year performance

SYM - 218%

RIVN - 42%

W - 140%

This Week (Here’s our top 3 stock picks)

Symbotic Inc. (NASDAQ: SYM)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $50.52B

Company Info:

Symbotic Inc. (NASDAQ: SYM) is a robotics and automation company developing AI-powered warehouse systems that transform how large retailers and logistics providers move, store, and distribute goods. Its flagship Symbotic System uses fleets of autonomous robots, advanced vision technology, and real-time AI orchestration to fully automate warehouse operations from inbound pallets to outbound orders.

Why it’s a buy:

The stock is a buy in 2025 because Symbotic is a clear front-runner in the AI-driven warehouse automation boom, a sector that is rapidly transforming how major retailers and distributors operate. The company is in the middle of a massive national rollout with Walmart, has expanding deployments with Target, C&S Wholesale, and Albertsons, and is scaling production through its joint venture with SoftBank, GreenBox, which aims to bring Symbotic’s technology to hundreds of additional warehouses over the next decade.

Symbotic continues to post strong revenue growth as demand for high-speed robotic logistics systems accelerates across the U.S. retail supply chain. Its AI-powered platform replaces traditional manual labor with swarms of autonomous robots, offering faster throughput, lower costs, and significantly higher efficiency — a value proposition that keeps driving new multi-year deals. With a deep backlog, industry-wide adoption, and mission-critical technology underpinning the future of retail logistics, SYM is positioned as a long-term winner in the trillion-dollar global automation market, offering durable upside as warehouses shift fully into the AI era.

Revenue:

Rivian Automotive Inc. (NASDAQ: RIVN)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $21.3B

Company Info:

Rivian Automotive Inc. (NASDAQ: RIVN) is an electric vehicle manufacturer developing next-generation battery-electric trucks, SUVs, and delivery vans built for both consumer adventure and commercial fleets. Its flagship vehicles, the R1T pickup and R1S SUV, are designed with advanced off-road capability, long-range performance, and premium technology. Rivian is also producing electric delivery vans for Amazon, with large-scale commercial deployments already underway across the U.S.

Why it’s a buy:

The stock is a buy in 2025 because Rivian is emerging as one of the strongest contenders in the next-generation electric vehicle market, combining premium consumer vehicles with a rapidly expanding commercial division. The company continues to ramp production of its R1T and R1S models, is preparing to scale its more affordable R2 platform, and is reinforcing long-term revenue visibility through its deep partnership with Amazon, which includes nationwide deployment of Rivian’s electric delivery vans.

Rivian is also gaining momentum operationally, improving manufacturing efficiency, lowering material costs, and expanding its proprietary charging network to support growing adoption. Its vertically integrated design — spanning in-house battery technology, powertrain engineering, and software systems — gives Rivian a defensible edge as consumer demand for high-performance EVs accelerates. With a strong brand, diversified revenue streams, and a product roadmap aligned with mass-market electrification, RIVN is positioned as a long-term winner in the trillion-dollar EV transition, offering compelling upside as production scales and margins continue to improve.

Revenue:

Wayfair Inc. (NYSE: W)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $14.48B

Company Info:

Wayfair Inc. (NYSE: W) is an e-commerce company focused on home goods, furniture, and décor, offering one of the largest online selections in the industry. Its flagship platform provides millions of products across styles and price points, supported by a sophisticated logistics network designed to deliver bulky items quickly and efficiently. Wayfair serves both consumers and professional designers through brands like Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold, giving it broad reach across the home retail market.

As the company continues expanding its fulfillment network, refining logistics technology, and diversifying product offerings, Wayfair is positioning itself as a leading digital destination for modern home shopping and interior design.

Why it’s a buy:

The stock is a buy in 2025 because Wayfair is emerging as one of the strongest turnaround stories in the e-commerce and home goods sector, driven by improving profitability, tighter cost controls, and strengthening customer demand. After years of heavy investment in logistics and fulfillment, the company is now leveraging its scaled infrastructure to expand margins while increasing repeat purchasing across its core brands — Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold.

Wayfair continues to optimize its supply chain and delivery network, enabling faster shipping, better inventory management, and lower operational costs — all of which are boosting conversion rates and customer satisfaction. Its focus on data-driven merchandising and AI-powered personalization is helping attract higher-value shoppers and retain long-term customers. With a more efficient cost structure, a large addressable market, and renewed momentum in home-related spending, W is positioned as a long-term winner in the multi-trillion dollar online retail market, offering compelling upside as margins expand and demand stabilizes across the home furnishings category.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Buy Levels, Price Targets and Stop Losses to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

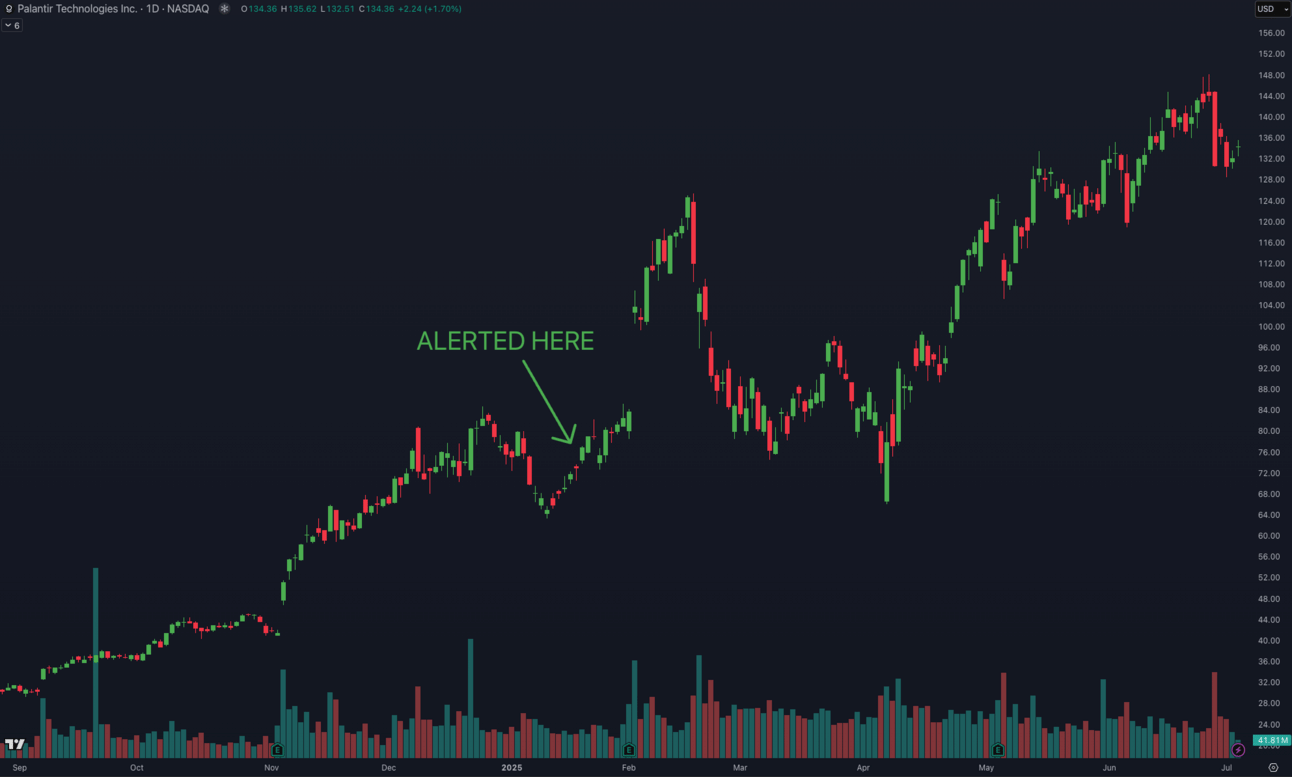

• PLTR +92.3%

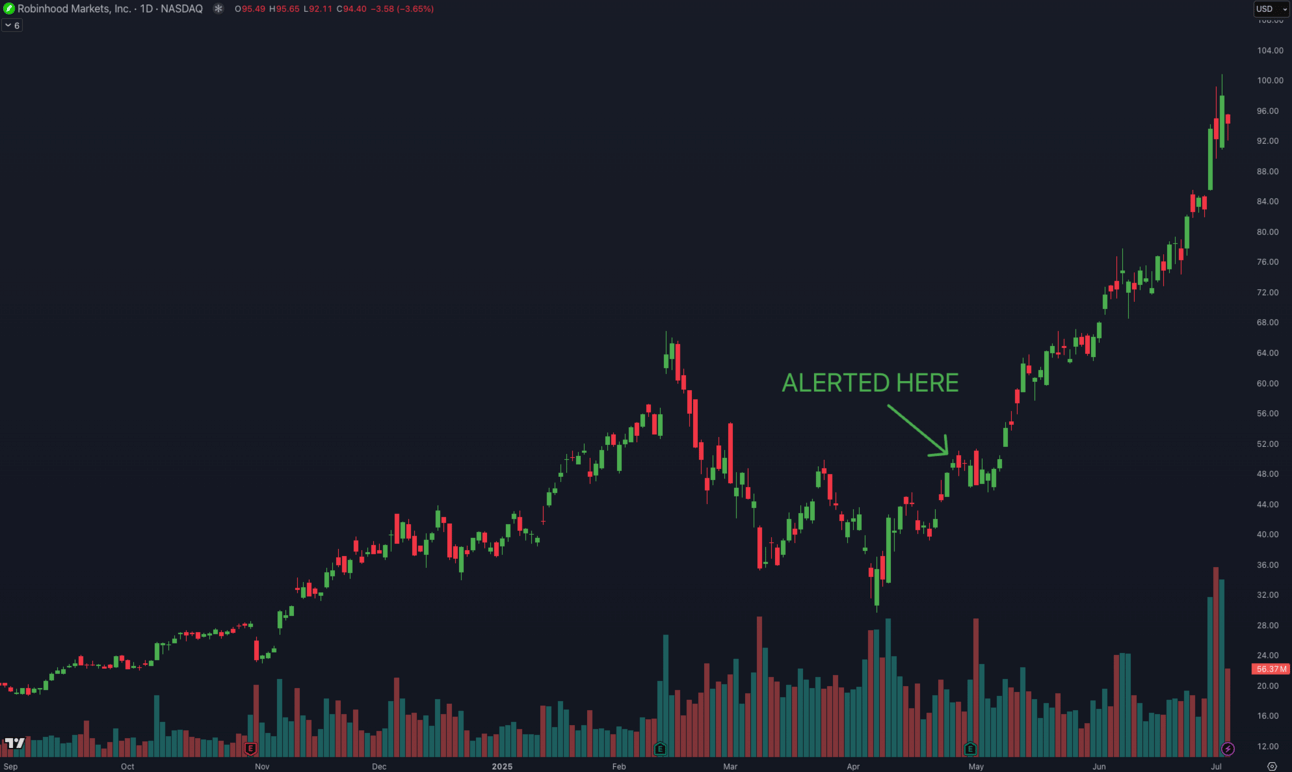

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.