Our Momentum Scanner Picked Up These

3 Stocks This Week

1 year performance

TPR - 104%

FORM - 121%

ALGN - -15%

Sponsored on behalf of Miata Metals

Gold just hit fresh all-time highs — and when that happens, early-stage gold explorers with real drill programs start getting attention.

One name that’s been moving is Miata Metals, ticker MMET on the CSE and MMETF on the OTC.

Miata has a tight share structure with just 103 million shares outstanding, and management owns about 22% of the company, meaning they only win if shareholders win. The stock is already up roughly 20–40% over the past month, as gold momentum picks up.

The company operates in Suriname, part of the Guiana Shield, a proven gold-bearing greenstone belt. This isn’t theoretical geology — Newmont operates the Merian Mine nearby, and Zijin Mining runs the Rosebel Mine, showing this district can support large, producing gold operations.

Miata controls the option to earn 100% ownership of two gold projects, including Sela Creek, where they’ve already reported strong drill results. One highlighted intercept came in at 35.6 metres of 3.04 grams per tonne gold, including 14.5 metres of 4.95 grams per tonne, confirming real grade and system continuity.

What’s important right now is news flow. Miata has a fully funded 25,000-metre drill program planned for 2026, more than doubling last year’s pace. More drilling means more data, more catalysts, and more chances for market-moving results.

There’s also a quiet insider signal worth noting. Management recently exercised 1.3 million options at $0.23, selling only enough shares to cover the cost and holding the rest — generally viewed as a bullish confidence move, not a quick flip.

This is still an early-stage, high-risk exploration story, but it checks a lot of boxes investors watch when gold prices are strong: a proven jurisdiction, major mines next door, a tight cap table, insider ownership, and an active drill engine.

This is not financial advice. If you’re interested, read Miata’s investor materials and drill releases and do your own research before making any decisions.

Let’s Talk About On Each One!

Tapestry, Inc. (TPR)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $30.7B

Company Info:

Tapestry, Inc. (NYSE: TPR) is a modern luxury lifestyle company that designs, markets, and distributes premium handbags, accessories, and ready-to-wear through a portfolio of iconic brands including Coach, Kate Spade, and Stuart Weitzman, serving global customers across retail, wholesale, and digital channels.

Why it’s a buy:

The stock is a buy in 2026 because Tapestry holds a strong position within the global accessible luxury sector, supported by well-recognized brands with broad consumer appeal and diversified distribution. As demand for premium lifestyle products continues to grow globally, Tapestry’s focus on brand elevation, category expansion, and digital engagement helps it capture incremental share across key markets rather than relying on a single product category.

Tapestry has been investing in customer experience and omnichannel capabilities to strengthen brand loyalty and enhance direct-to-consumer sales, while its diversified brand portfolio helps reduce reliance on any one market or demographic. Although the luxury retail environment can be sensitive to macroeconomic shifts in consumer spending and promotional dynamics, Tapestry’s scale, brand equity, and multi-channel reach support durable performance over time. With continued global appetite for accessible luxury goods and lifestyle brands, Tapestry offers long-term exposure to brand-led consumer demand that extends beyond short-term retail cycles.

Revenue:

FormFactor, Inc. (FORM)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $7B

Company Info:

FormFactor, Inc. (NASDAQ: FORM) is a semiconductor equipment company that designs and manufactures precision probe cards, analytical systems, and related technologies used to test and validate advanced semiconductor devices during the manufacturing process, serving leading logic and memory chip producers globally.

Why it’s a buy:

The stock is a buy in 2026 because FormFactor plays a critical role in the semiconductor value chain by enabling accurate testing of increasingly complex chips used in high-performance computing, artificial intelligence, and advanced memory applications. As chip architectures continue to scale in complexity and performance requirements rise, demand for sophisticated testing and measurement solutions becomes essential rather than optional, positioning FormFactor as a key enabler of next-generation semiconductor production.

FormFactor benefits from long-standing relationships with major semiconductor manufacturers and exposure to advanced technology nodes, where testing precision and reliability are especially important. While results can fluctuate with semiconductor capital spending cycles and customer investment timing, the company’s focus on advanced probe technology and high-value test solutions supports its relevance as the industry evolves. With semiconductor innovation continuing to drive demand across AI, data centers, and connected devices, FormFactor offers long-term exposure to foundational manufacturing infrastructure that underpins growth across the broader chip ecosystem.

Revenue:

Align Technology, Inc. (ALGN)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $13.28B

Company Info:

Align Technology, Inc. (NASDAQ: ALGN) is a global medical device company best known for its Invisalign system, a clear aligner solution that serves as an alternative to traditional braces, alongside digital scanning and treatment planning technologies used by dental and orthodontic professionals worldwide.

Why it’s a buy:

The stock is a buy in 2026 because Align Technology benefits from secular adoption of clear aligner therapy, supported by rising demand for digitally enabled orthodontic solutions and increased consumer preference for aesthetic dental treatments. The company’s integrated platform, spanning scanners, software, and aligners, allows it to participate across the orthodontic workflow rather than relying on a single product category.

Align has established a global footprint and continues to invest in digital workflows, clinical education, and product innovation, which supports sustained adoption among practitioners. While results can be influenced by dental capital spending cycles and competitive pressures, the company’s market leadership in clear aligners and expanding installed base help reinforce recurring demand. With orthodontic treatment needs remaining durable over time, Align offers long-term exposure to structural growth in oral health care that extends beyond short-term market conditions.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

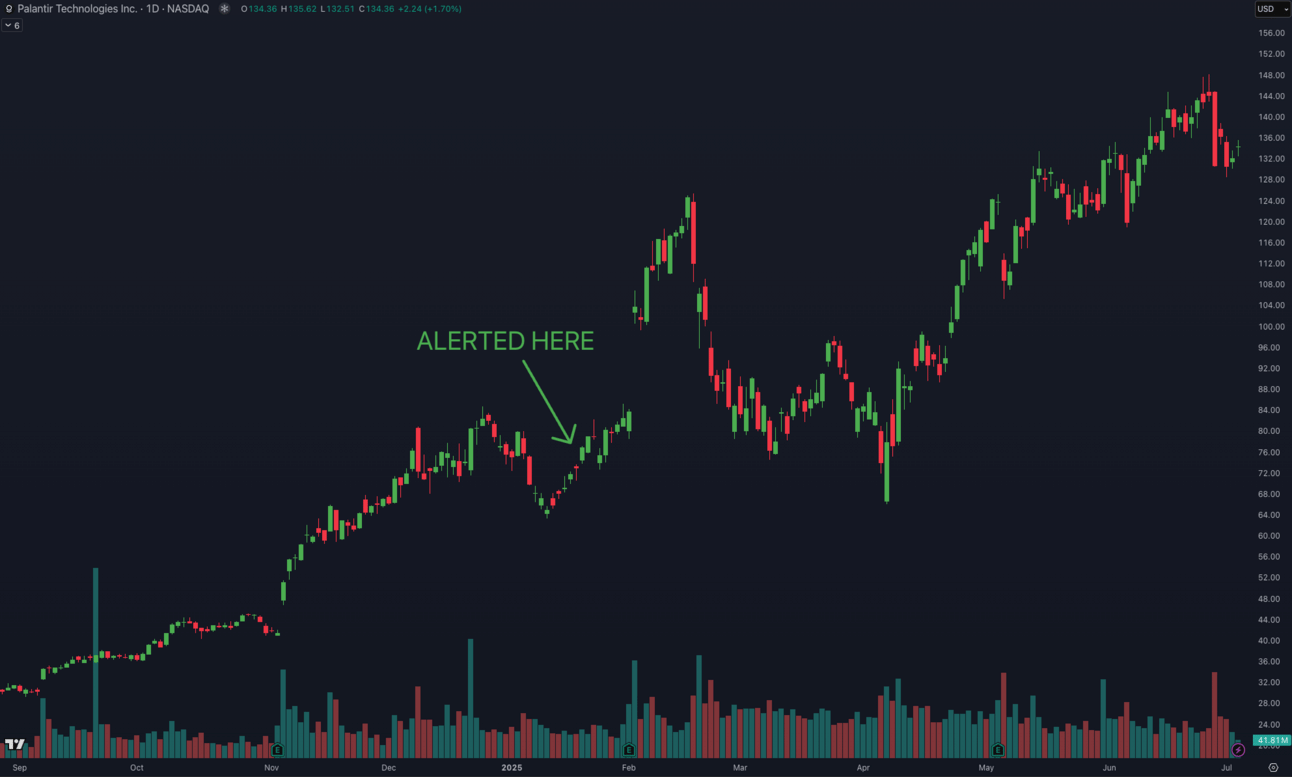

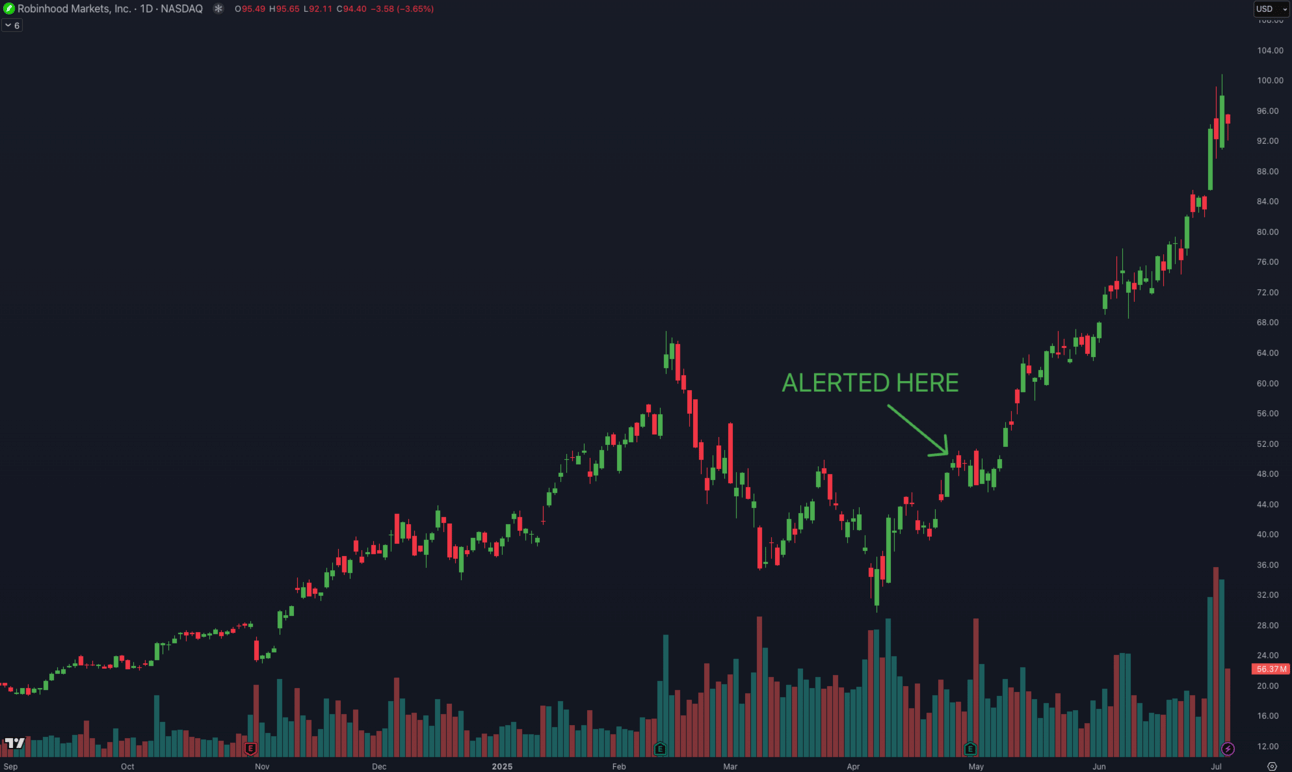

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.