Our Momentum Scanner Picked Up These

3 Stocks This Week

1 year performance

APLD - 290%

CVNA - 102%

HL - 480%

Let’s Talk About On Each One!

Applied Digital Corporation (APLD)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $10.54B

Company Info:

Applied Digital Corporation (NASDAQ: APLD) is a digital infrastructure company powering the next generation of high-performance computing through purpose-built data centers optimized for energy-intensive workloads.

Why it’s a buy:

The stock is a buy in 2026 because Applied Digital Corporation sits at the center of the global shift toward AI, high-performance computing, and energy-intensive digital workloads, acting as critical infrastructure for next-generation compute rather than a speculative application-layer company. Unlike traditional data center operators built for generic cloud workloads, APLD benefits from a purpose-built, asset-heavy infrastructure model optimized for HPC, AI, and specialized compute, with deep alignment to power availability, long-term contracts, and scalable capacity.

Despite near-term pressure from capital intensity, financing cycles, and execution risk, Applied Digital continues to expand data center capacity, contracted revenue visibility, and exposure to AI-driven demand. As compute requirements scale exponentially and AI workloads increasingly strain legacy infrastructure, APLD is positioned as a long-term winner in digital and energy-backed infrastructure. With AI and high-performance computing still in the early innings, Applied Digital offers investors leveraged exposure to the physical backbone of the AI economy, supported by structural demand growth, long-duration contracts, and secular tailwinds that extend well beyond 2026.

Revenue:

Carvana Co. (CVNA)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $103B

Company Info:

Carvana Co. (NYSE: CVNA) is a digital automotive retail platform transforming the used-car buying ecosystem through its end-to-end e-commerce marketplace, logistics network, and proprietary financing infrastructure.

Why it’s a buy:

The stock is a buy in 2026 because Carvana Co. sits at the center of the global shift from physical car dealerships to digital-first automotive retail, acting as a vertically integrated e-commerce platform for used vehicles rather than a traditional dealer network. Unlike legacy dealerships that rely on fragmented inventory, in-person sales, and opaque pricing, Carvana benefits from a platform-driven, technology-enabled model powered by centralized inventory, proprietary logistics, data-driven pricing, and integrated financing.

Despite near-term pressure from interest rate volatility, balance sheet leverage, and cyclical auto demand, Carvana continues to improve unit economics, gross profit per unit, and operational efficiency as scale returns to the model. As consumers increasingly expect online purchasing, transparent pricing, and home delivery for big-ticket items, Carvana is positioned as a long-term winner in digital automotive commerce. With auto retail still in the early innings of e-commerce penetration, Carvana offers investors leveraged exposure to the modernization of a massive consumer market, supported by operational leverage, brand recognition, and structural tailwinds that extend well beyond 2026.

Revenue:

Hecla Mining Company (HL)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $21.32B

Company Info:

Hecla Mining Company (NYSE: HL) is a leading precious metals producer powering the silver and gold supply chain through its portfolio of long-life, low-cost mining operations in politically stable jurisdictions. Hecla’s assets are embedded in critical North American mining districts, giving it a unique position at the intersection of precious metals production, industrial silver demand, and monetary hedging, with leveraged exposure to silver’s dual role as both an industrial input and a store of value.

Why it’s a buy:

The stock is a buy in 2026 because Hecla Mining Company sits at the center of the global shift toward strategic and monetary metals, acting as a pure-play, long-life silver producer rather than a diversified mega-miner. Unlike mining companies dependent on short-cycle assets or unstable jurisdictions, Hecla benefits from a high-quality, asset-backed model powered by long-duration reserves, politically stable operations, and leveraged exposure to silver’s dual role as both an industrial and monetary metal.

Despite near-term pressure from metal price volatility, cost inflation, and operational variability, Hecla continues to grow silver production, reserve life, and cash flow durability. As global demand for silver accelerates—driven by electrification, solar energy, and AI-related infrastructure, alongside renewed interest in hard-asset hedges—Hecla is positioned as a long-term winner in strategic metals supply. With silver still in the early innings of a structural demand cycle, Hecla offers investors leveraged exposure to a tightening silver market, supported by scarcity value, operating leverage, and secular tailwinds that extend well beyond 2026.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

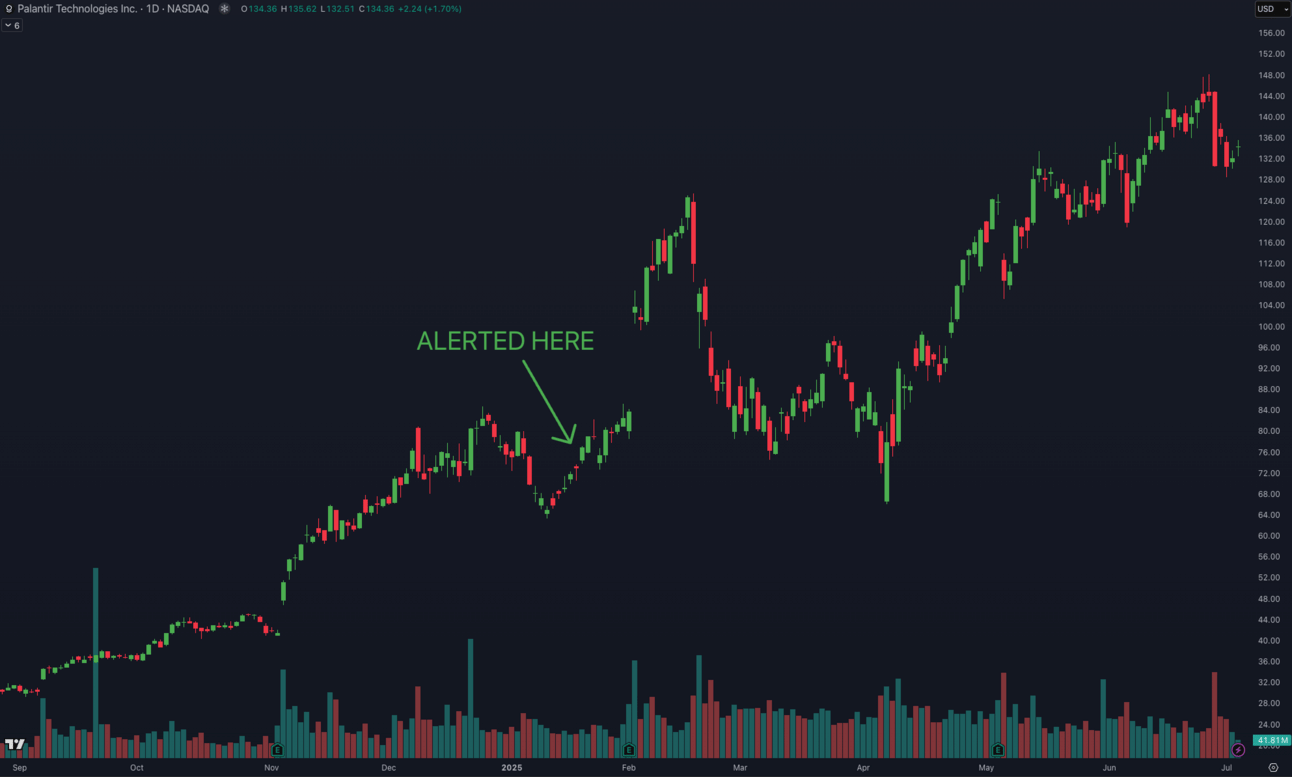

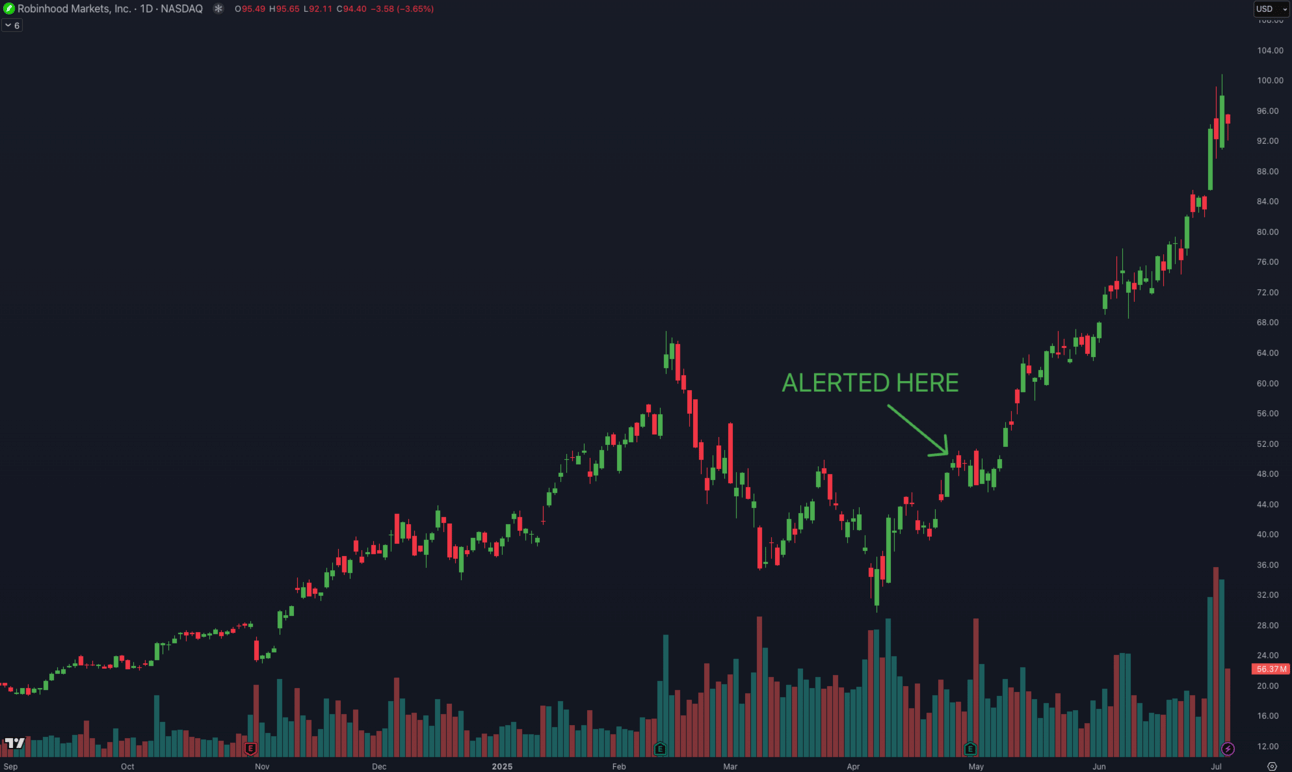

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.