Our Momentum Scanner Picked Up These

3 Stocks This Week

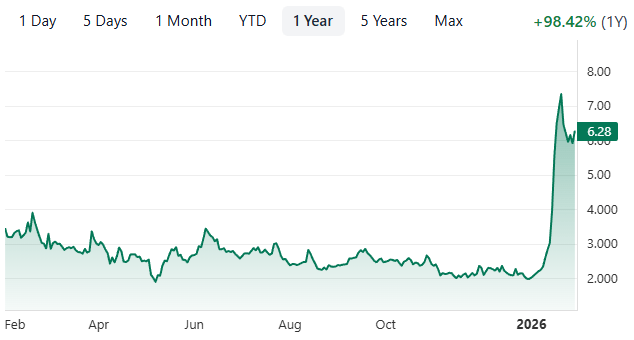

1 year performance

IBRX - 98.42%

HUT - 185%

LITE - 407%

Let’s Talk About On Each One!

ImmunityBio, Inc. (IBRX)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $6.1B

Company Info:

ImmunityBio, Inc. (NASDAQ: IBRX) is a commercial-stage biotechnology company focused on developing and commercializing immunotherapies that enhance the body’s natural immune response to treat cancer and infectious diseases, with a primary focus on cytokine-based and cell-mediated immune platforms.

Why it’s a buy:

The stock is a buy in 2026 because ImmunityBio is positioned within the long-term shift toward immune-based cancer treatments, where durable immune activation is increasingly favored over traditional chemotherapy approaches. The company’s lead asset, ANKTIVA (N-803), targets the innate immune system and represents a differentiated approach within immuno-oncology, particularly in areas of high unmet medical need.

ImmunityBio achieved a key milestone with FDA approval of ANKTIVA in combination with BCG for BCG-unresponsive non–muscle invasive bladder cancer, marking its transition from a development-stage biotech to a commercial company with approved therapy and revenue potential. While the business remains capital intensive and subject to the typical regulatory, manufacturing, and execution risks associated with biotechnology companies, the approval provides clinical validation and a foundation for potential label expansion and broader adoption over time. With immunotherapy continuing to gain relevance across oncology, ImmunityBio offers long-term exposure to a validated immune-based platform with relevance that extends beyond a single indication and into future treatment paradigms.

Revenue:

Hut 8 Corp. (HUT)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $6.03B

Company Info:

Hut 8 Corp. (NASDAQ: HUT) is a North America-based energy infrastructure and digital asset company that develops and operates power, data center, and compute facilities while also participating in Bitcoin mining and related digital infrastructure services.

Why it’s a buy:

The stock is a buy in 2026 because Hut 8 offers exposure to two secular growth trends within digital economy infrastructure. The company has built a vertically integrated platform combining energy and compute infrastructure with Bitcoin mining operations, positioning itself where essential digital processing and high-power compute intersect. Its diversified model includes self-mining, hosting services, and digital infrastructure operations that extend beyond pure mining activity into broader compute and data center roles.

Hut 8 has seen significant interest as the Bitcoin and digital asset ecosystem continues to mature, and recent expansion of its infrastructure footprint reflects demand for larger scale compute capacity. Although the business remains sensitive to Bitcoin price cycles and the capital intensity of infrastructure build-outs, Hut 8 also holds strategic Bitcoin reserves and operates assets across multiple regions, supporting long-term participation in digital infrastructure adoption. As broader digital economy demand for compute and energy-aligned infrastructure grows, Hut 8 provides investors with leveraged exposure to both digital asset mining and the underlying infrastructure that supports compute-heavy workloads.

Revenue:

Lumentum Holdings Inc. (LITE)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $9.05B

Company Info:

Lumentum Holdings Inc. (NASDAQ: LITE) is a global technology company that designs and manufactures optical and photonic products used in high-speed telecommunications networks, consumer electronics, 3D sensing, and industrial applications, supplying critical components that enable data transmission and sensing functions for a range of end markets.

Why it’s a buy:

The stock is a buy in 2026 because Lumentum sits at the center of secular growth drivers in optical networking and photonics, including the expansion of high-speed data transmission, 5G network buildouts, and continued demand for advanced sensing in consumer and industrial segments. As data traffic increases globally and network operators upgrade infrastructure to support higher bandwidth needs, Lumentum’s high-performance optical components serve as essential building blocks in modern communications systems, giving the company exposure to durable demand rather than discrete product cycles.

Lumentum has a diversified product portfolio that spans multiple end markets, reducing reliance on any single segment, and benefits from long-term customer relationships with major network equipment manufacturers and technology customers. While the business operates in a competitive environment with cyclicality tied to capital expenditure patterns in telecom and data infrastructure, its technology leadership and broad adoption of optical solutions position it to capture structural growth as network capacity requirements rise. With photonics and optical networking remaining fundamental to global connectivity and digital infrastructure, Lumentum offers investors exposure to foundational technology demand that extends beyond short-term cycles.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

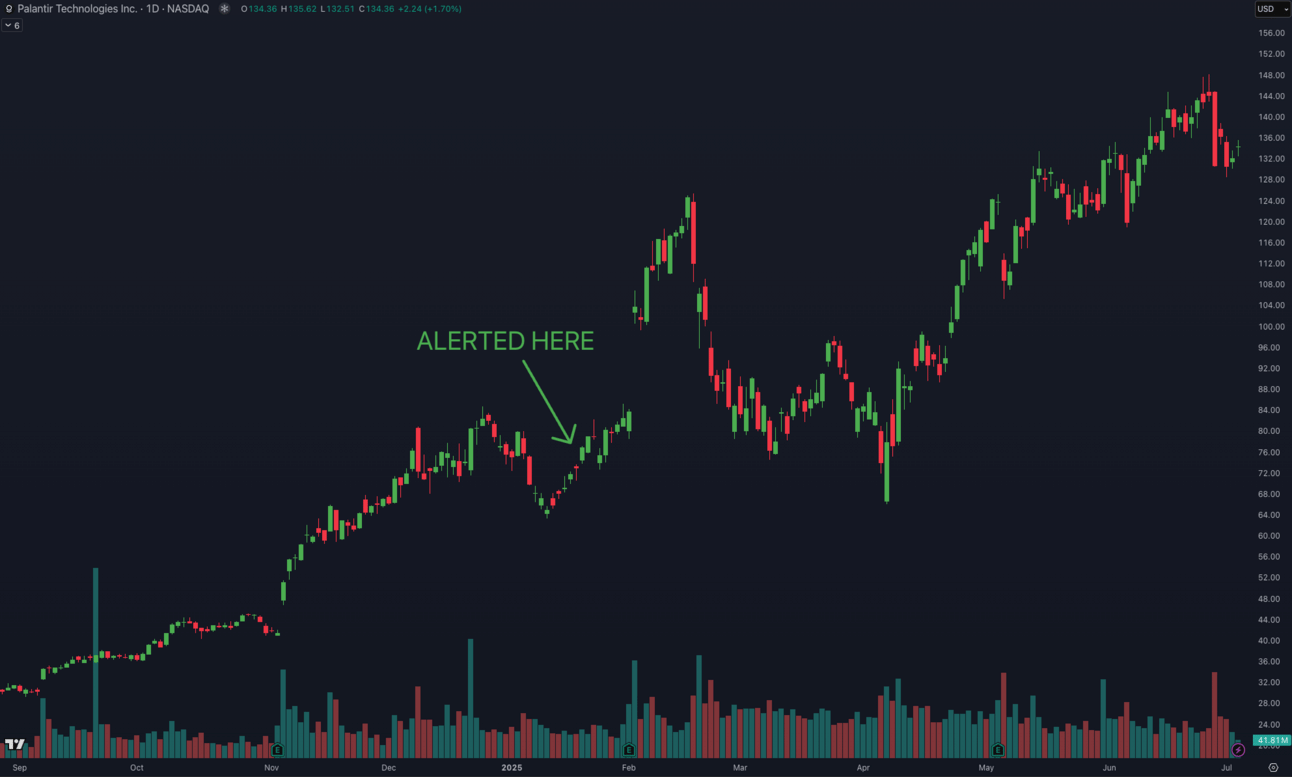

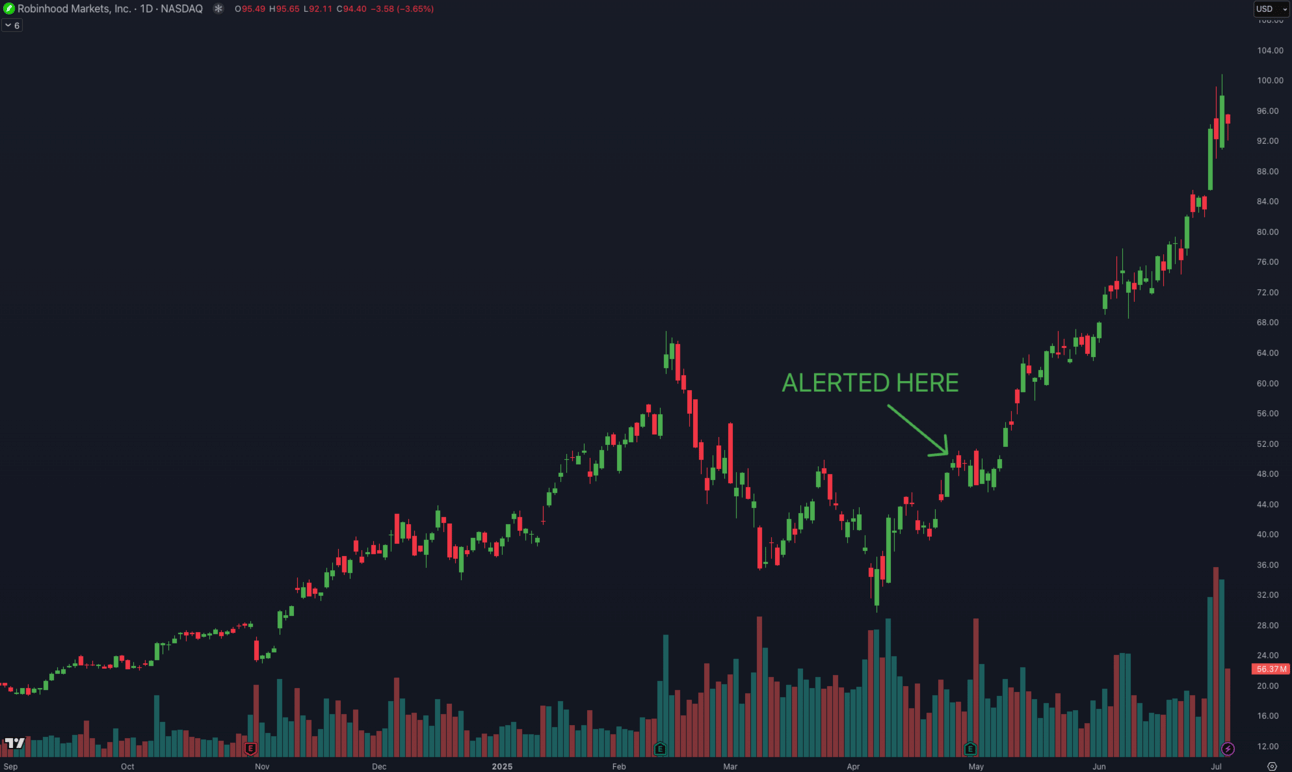

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.