Our Momentum Scanner Picked Up These

3 Stocks This Week

1 year performance

ASTS - 493%

FIGR - 195%

RKLB - 287%

Sponsored on behalf of

MAX Power Mining Corp.

America’s Push for Clean Energy Has a Hidden Bottleneck — and One Small Company Is Targeting a Resource Most Investors Don’t Even Know Exists

Hydrogen is essential to today’s industrial economy, yet all current hydrogen production relies on energy-intensive manufacturing processes. That high cost structure has limited hydrogen’s ability to scale, despite growing demand across energy, transportation, and industrial markets.

A different concept is now gaining attention: natural hydrogen — hydrogen that forms underground naturally as an end product.

One company positioning early in this space is MAX Power Mining Corp. (CSE: MAXX, OTC: MAXXF) with a just-reported first-of-its-kind discovery in Canada on a massive geological trend that extends into Montana and the Dakotas.

MAX Power owns Canada’s largest permitted land package dedicated to natural hydrogen exploration, totaling approximately 1.3 million acres in Saskatchewan. The company holds exclusive rights to explore for natural hydrogen across this land, creating district-scale exposure in an entirely new resource category.

Rather than focusing on theory, MAX Power is executing — the company has already drilled Canada’s first deep well dedicated to natural hydrogen, the Lawson well near Central Butte, Saskatchewan, about 100 miles south of Saskatoon. The company has reported free-flowing natural hydrogen from the uppermost basement complex to surface.

Following these results, MAX Power is advancing to 3D seismic imaging to further delineate the system, with a confirmation well planned to assess commercial potential. This is arguably the most significant development in the natural hydrogen space since the original discovery in Mali, West Africa, which proved that natural hydrogen deposits do exist.

⚠️ Disclaimer: We have partnered with MAX Power for this post. Crown Trading was compensated for this post on behalf of MAX Power Mining Corp. This post is for informational purposes only and does not constitute financial advice. Viewers should consult a financial professional before making investment decisions.

Let’s Talk About On Each One!

AST SpaceMobile, Inc. (ASTS)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $43B

Company Info:

AST SpaceMobile (NASDAQ: ASTS) is a space-based telecommunications company building the first global cellular broadband network delivered directly from satellites to standard smartphones. Unlike traditional satellite providers that require specialized hardware, AST SpaceMobile’s technology is designed to connect unmodified 4G and 5G phones from orbit, enabling seamless coverage in remote and underserved regions.

Why it’s a buy:

The stock is a buy in 2026 because AST SpaceMobile sits at the center of a global connectivity super-cycle, driven by exploding mobile data demand, coverage gaps in terrestrial networks, and the need for always-on global broadband. Unlike traditional satellite operators, ASTS is building the first space-based cellular network that connects directly to unmodified smartphones, creating a massive moat around its technology and partnerships with major mobile carriers.

Despite near-term volatility tied to satellite deployment timelines and capital intensity, AST SpaceMobile is entering a major catalyst phase as commercial service launches and additional satellites come online. With successful tests already validating direct-to-device connectivity and a growing roster of telecom partners, ASTS is positioned to become critical infrastructure for global mobile networks. As connectivity expands across remote regions, emergency services, maritime, and aviation markets, AST SpaceMobile offers investors high-conviction exposure to a once-in-a-generation shift in how mobile broadband is delivered, with outsized upside potential into and beyond 2026.

Revenue:

Figure Technology Solutions, Inc. (FIGR)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $15B

Company Info:

Figure Technology Solutions, Inc. (FIGR) is a financial technology company modernizing the lending and capital markets ecosystem through its blockchain-based platform. The company specializes in digitally native loan origination, servicing, and securitization, using distributed ledger technology to reduce costs, improve transparency, and dramatically speed up traditionally slow financial processes.

Why it’s a buy:

The stock is a buy in 2026 because Figure Technology Solutions, Inc. sits at the center of a structural shift in financial infrastructure, driven by the need to modernize lending, securitization, and capital markets workflows. Unlike traditional fintech lenders that compete on rates or marketing, Figure operates as a technology-first platform, using blockchain-based rails to compress timelines, reduce costs, and improve transparency across the entire loan lifecycle.

Despite near-term volatility tied to market conditions and adoption cycles, Figure is entering a multi-year scaling phase as banks, credit unions, and institutional investors increasingly adopt digitally native lending and securitization platforms. As legacy financial systems struggle with inefficiency, regulatory complexity, and rising costs, Figure stands out as a first-mover in modern financial plumbing, offering investors high-conviction exposure to the long-term transformation of capital markets with outsized upside potential into and beyond 2026.

Revenue:

Rocket Lab Corporation (RKLB)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $51B

Company Info:

Rocket Lab USA, Inc. (NASDAQ: RKLB) is a leading space launch and space systems company powering the growing small-satellite and space infrastructure ecosystem. Rocket Lab provides end-to-end space solutions through its Electron launch vehicle, upcoming Neutron rocket, and a rapidly expanding portfolio of spacecraft components, satellite platforms, and mission services.

Why it’s a buy:

The stock is a buy in 2026 because Rocket Lab USA, Inc. sits at the center of a multi-year space infrastructure super-cycle, driven by surging demand for satellite launches, national security missions, and space-based services. Unlike legacy aerospace primes, Rocket Lab operates a vertically integrated, end-to-end space platform—combining launch, spacecraft manufacturing, and on-orbit systems—creating durable moats and multiple recurring revenue streams beyond launches alone.

Despite near-term volatility tied to launch cadence, development costs, and broader risk-off market conditions, Rocket Lab is entering a major catalyst phase with the continued scaling of its space systems business and the anticipated debut of its Neutron rocket, which expands the company into larger, higher-value missions. As governments and commercial customers accelerate investment in Earth observation, communications, and defense-focused space capabilities, Rocket Lab stands out as a next-generation space infrastructure leader, offering investors high-conviction exposure to the long-term growth of the modern space economy with outsized upside potential into and beyond 2026.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

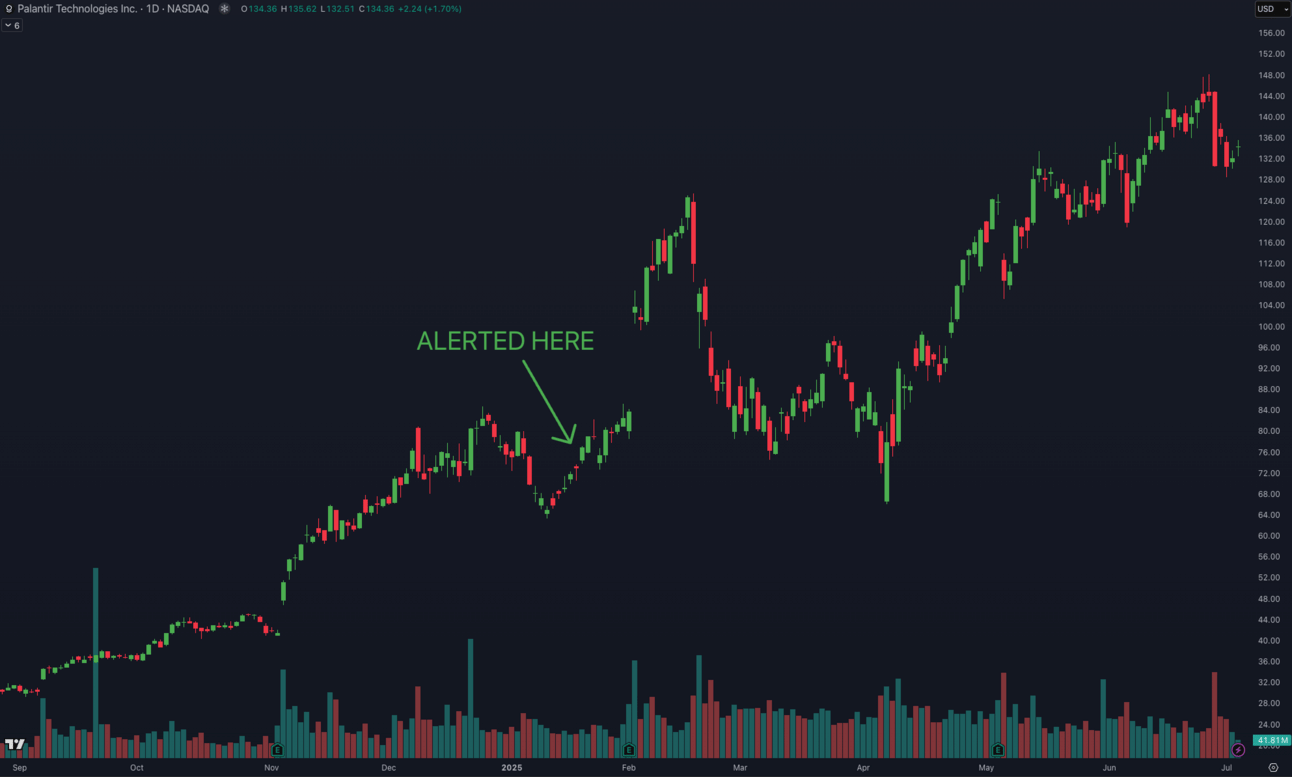

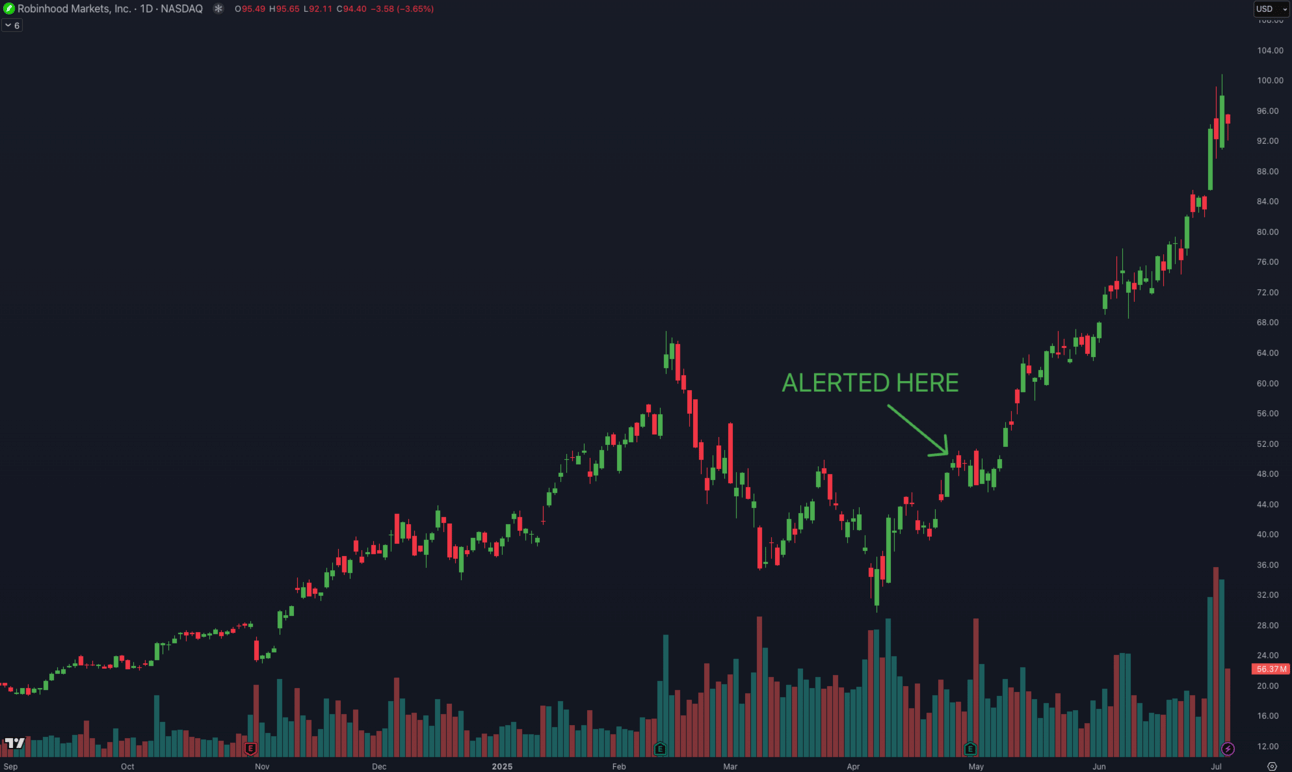

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.