Our Momentum Scanner Picked Up These

3 Stocks This Week

1 year performance

NEM - 167%

WMT - 29%

DOCN - 50%

Let’s Talk About Each One!

Newmont Corporation (NEM)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $21.5B

Company Info:

Newmont Corporation (NYSE: NEM) is one of the largest gold mining companies in the world.

The company explores for, develops, and produces gold across a diversified global portfolio spanning North America, South America, Australia, and Africa. Gold is the core driver of revenue, with additional exposure to copper, silver, zinc, and lead in select operations.

At its core, the business revolves around:

Gold production from large-scale, long-life mining assets

Operating across multiple geographic jurisdictions

Managing proven and probable reserves while replacing mined ounces through exploration

Disciplined capital allocation within a capital-intensive industry

This is not a speculative junior miner. It is a scaled global producer with established reserves and operating infrastructure.

Why we are watching:

The thesis here is not about short-term price swings. It is about exposure to gold as a strategic defensive asset during periods of macro uncertainty.

Gold has historically acted as a hedge during inflation, geopolitical tension, currency volatility, and broader financial stress. When capital rotates toward defensive positioning, large-cap producers like Newmont often benefit from increased investor interest.

What stands out:

Direct leverage to gold price movements

Diversified production base across multiple regions

Established reserve portfolio supporting long-term output

Scale advantages in operations and access to capital

The risk is clear. Mining is capital intensive, input costs can rise, and commodity prices fluctuate. Operational or jurisdictional challenges can affect production.

But structurally, gold remains embedded in the global financial system as a store of value and portfolio hedge. Central banks continue to hold reserves, and investor demand tends to resurface during periods of uncertainty.

This is exposure to the global gold cycle through a scaled producer, not a high-risk exploration bet.

Revenue:

Walmart (WMT)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $1.07T

Company Info:

Walmart (NYSE: WMT) is the largest retailer in the world, operating thousands of stores across the United States and internationally.

The company sells a broad mix of groceries, general merchandise, household goods, and essentials, serving millions of customers daily through physical stores and a growing e-commerce platform. Its scale gives it significant purchasing power and pricing leverage within the global supply chain.

At its core, the business revolves around:

High-volume everyday essentials retailing

Relentless focus on low prices and operational efficiency

Massive physical store footprint integrated with e-commerce

Strong presence in grocery, which drives consistent traffic

This is not a discretionary niche retailer. It is a scale-driven consumer staple operator embedded in daily spending habits.

Why we are watching:

This here is not about rapid growth. It is about defensive scale and cash flow durability.

Walmart benefits from consistent demand for essentials, particularly during periods of economic uncertainty when consumers prioritize value. Its scale allows it to negotiate favorable supplier terms and maintain competitive pricing, which can support traffic gains when budgets tighten.

What stands out:

Dominant position in U.S. grocery retail

Integrated omnichannel model combining stores and e-commerce

Strong free cash flow generation

Ability to gain share during economic slowdowns

The risk is margin pressure from pricing competition, labor costs, and inventory management challenges. Retail is competitive, and execution matters.

But structurally, consumer demand for essentials does not disappear. Walmart’s scale, supply chain efficiency, and everyday value positioning allow it to remain relevant across cycles.

This is exposure to large-scale consumer spending infrastructure, not a high-beta retail trade.

Revenue:

DigitalOcean Holdings, Inc. (DOCN)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $6.24B

Company Info:

DigitalOcean Holdings, Inc. (NYSE: DOCN) is a cloud infrastructure provider focused on developers, startups, and small to mid-sized businesses.

Unlike hyperscale cloud providers that primarily serve large enterprises, DigitalOcean offers simpler, cost-effective cloud computing solutions designed for smaller teams that want straightforward deployment and predictable pricing.

At its core, the business revolves around:

Providing cloud compute, storage, and networking services

Serving startups and growing digital businesses

Offering simplified pricing and developer-friendly tools

Competing in the broader cloud infrastructure market

This is not a consumer tech company. It is cloud infrastructure built for smaller, agile operators rather than Fortune 500 enterprises.

Why we are watching:

DigitalOcean centers on the continued expansion of cloud adoption among smaller businesses.

As more startups and mid-sized companies build online products, digital services, and SaaS platforms, demand for reliable and scalable cloud infrastructure continues to grow. Not every business needs a hyperscale solution. Many prioritize ease of use and cost clarity.

What stands out:

Focused niche within the broader cloud computing ecosystem

Exposure to long-term digital business formation

Developer-first platform design

Recurring revenue model tied to infrastructure usage

The risk is competition. The cloud market is dominated by large players with significant resources. Pricing pressure and customer churn are ongoing considerations.

But structurally, digital business creation continues. As new applications and services are built, infrastructure demand follows. DigitalOcean offers exposure to cloud growth at the SMB level, rather than competing solely in enterprise hyperscale environments.

This is participation in the broader cloud infrastructure shift, positioned within a defined and differentiated segment of the market.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

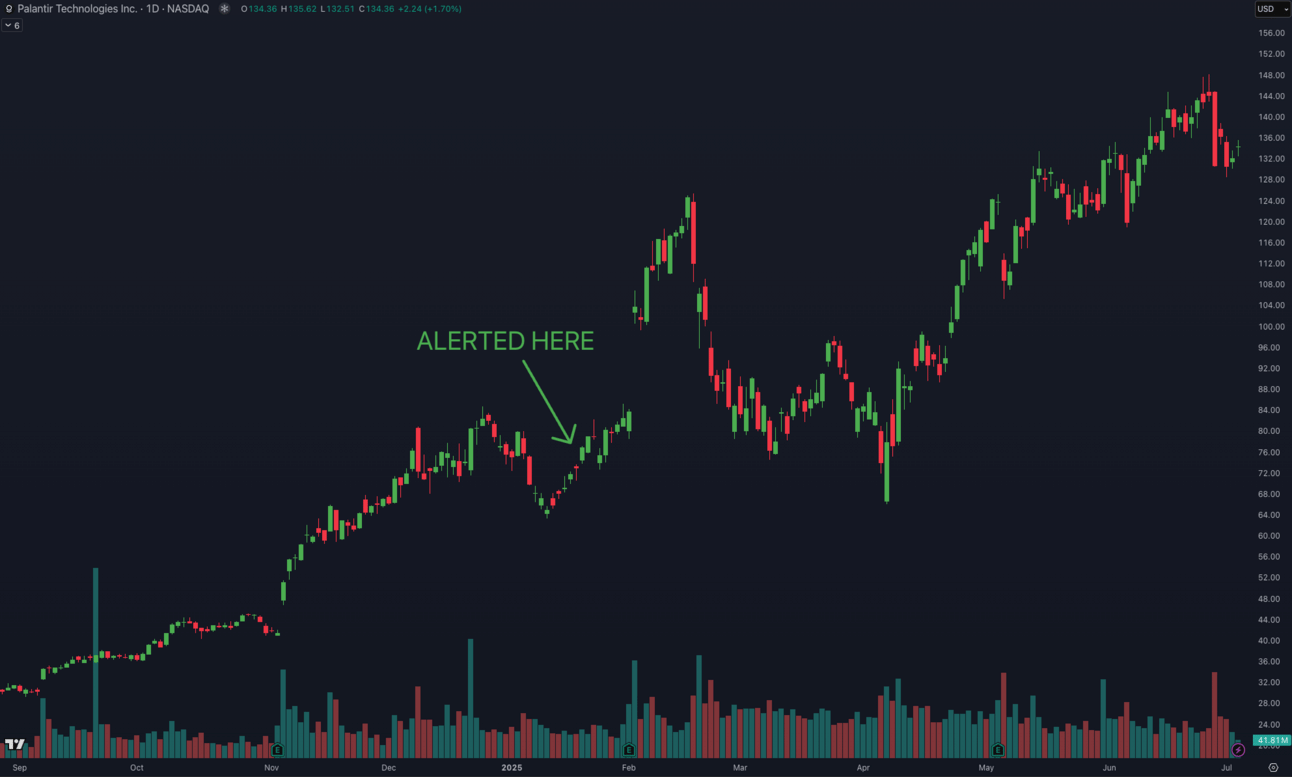

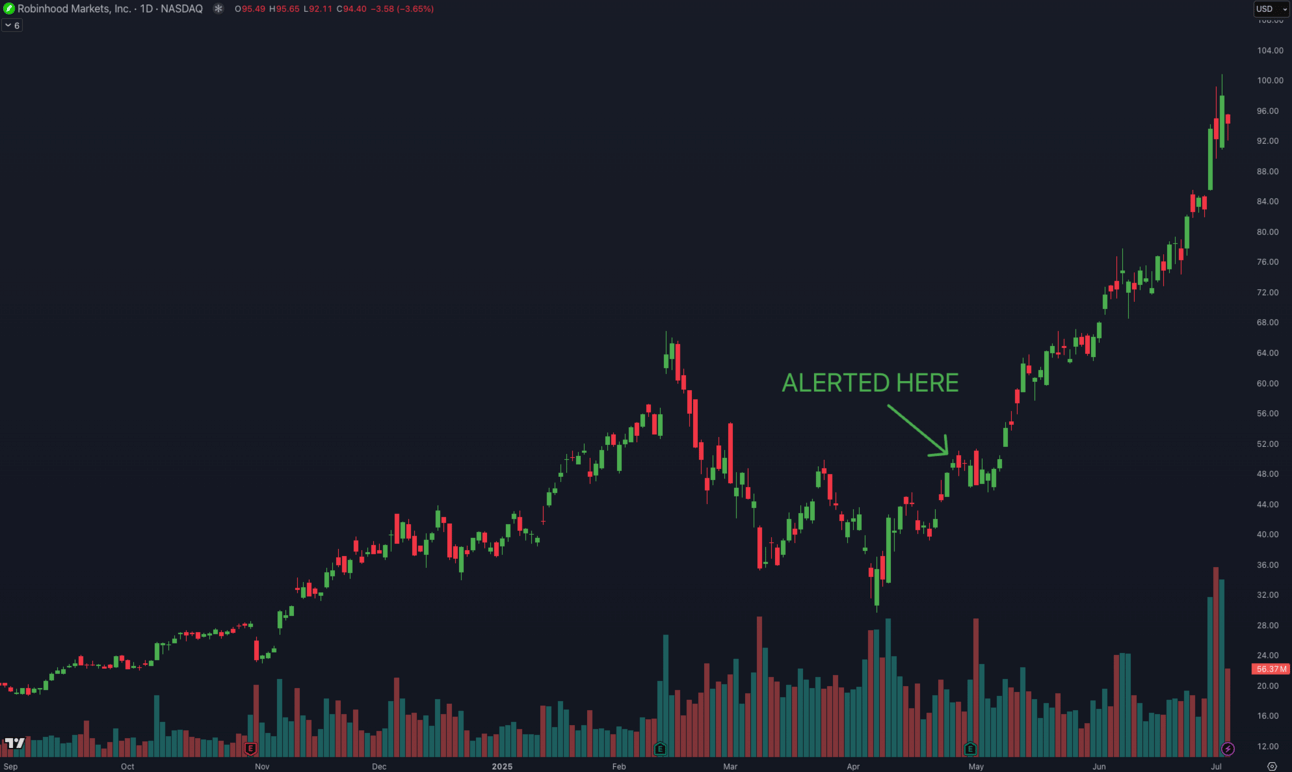

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.