Our Momentum Scanner Picked Up These

3 Stocks This Week

1 year performance

FORM - 55%

ONDS - 437%

ZETA - 32%

Let’s Talk About On Each One!

FormFactor, Inc. (FORM)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $5B

Company Info:

FormFactor, Inc. is a leading provider of advanced semiconductor test and measurement solutions, enabling the development and production of cutting-edge chips across logic, memory, and specialized semiconductor devices. The company designs high-precision probe cards, probe stations, and analytical systems that allow chipmakers to validate performance, reliability, and yields at the most advanced process nodes.

Why it’s a buy:

The stock is a buy in 2025 because FormFactor, Inc. sits at the center of the next wave of semiconductor complexity, where advanced testing is becoming just as critical as chip design itself. As AI, high-performance computing, and advanced packaging push chips to smaller nodes and higher power densities, FormFactor’s high-precision probe cards and test systems are essential for validating performance, yields, and reliability—areas where failures are increasingly costly.

Despite near-term cyclicality in semiconductor spending, FormFactor continues to benefit from structural demand tied to AI accelerators, advanced memory, chiplets, and heterogeneous integration. Leading-edge foundries and IDMs rely on its technology as testing requirements grow more complex with every node. With semiconductor innovation accelerating again and testing intensity rising per wafer, FormFactor offers investors leveraged exposure to the AI and advanced computing buildout, backed by deep technical moats and long-term industry tailwinds extending well beyond 2025.

Revenue:

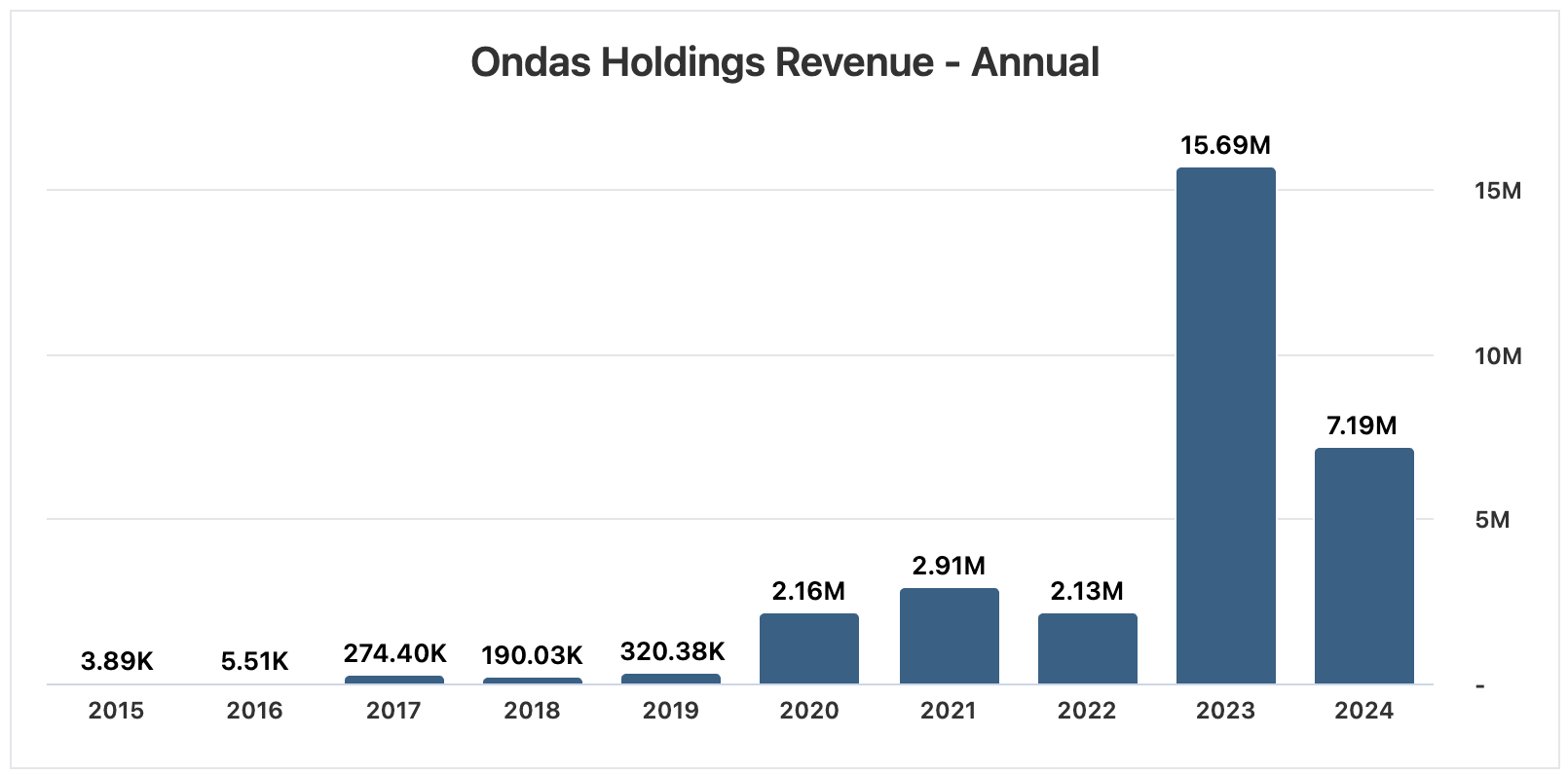

Ondas Holdings Inc. (ONDS)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $5B

Company Info:

Ondas Holdings Inc. is a technology company focused on building mission-critical wireless connectivity and autonomous drone solutions for industrial, government, and defense markets. Through its platforms, Ondas delivers secure, private wireless networks and advanced unmanned aerial systems (UAS) designed for use cases where reliability, safety, and data integrity are essential—such as rail, utilities, energy, public safety, and national security.

Why it’s a buy:

The stock is a buy in 2025 because Ondas Holdings Inc. is positioned at the intersection of critical infrastructure modernization, defense technology, and autonomous systems. Unlike consumer-focused connectivity providers, Ondas targets mission-critical, private wireless networks and industrial-grade drone platforms where reliability, security, and regulatory compliance are non-negotiable—creating high barriers to entry and long sales cycles with sticky customers.

Despite near-term volatility tied to commercialization timelines and capital needs, Ondas continues to expand adoption across rail, energy, utilities, public safety, and defense, while advancing its autonomous drone and secure wireless platforms. As governments and industrial operators accelerate investment in infrastructure resilience, automation, and national security, Ondas stands out as a first-mover in niche, high-value markets. This gives investors early exposure to a long-duration growth story driven by infrastructure digitization, defense spending, and the transition toward autonomous, connected industrial systems.

Revenue:

Zeta Global Holdings Corp. (ZETA)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $6B

Company Info:

Zeta Global Holdings Corp. is a data-driven marketing technology company that helps enterprises acquire, retain, and grow customers through AI-powered customer intelligence and omnichannel engagement. The company operates a cloud-based platform that unifies first-party data, identity resolution, predictive analytics, and personalized marketing execution across email, web, mobile, and connected channels.

Why it’s a buy:

The stock is a buy in 2025 because Zeta Global Holdings Corp. sits at the center of the shift toward AI-driven, first-party data marketing, as brands move away from third-party cookies and demand measurable, privacy-compliant growth. Unlike traditional ad-tech platforms, Zeta combines deterministic identity data, advanced machine learning, and full-funnel execution in a single operating system—giving enterprises a durable edge in customer acquisition, retention, and lifetime value optimization.

Despite near-term volatility tied to broader ad-spend cycles, Zeta continues to grow enterprise adoption, recurring revenue, and AI-powered use cases across retail, financial services, travel, and media. As marketing budgets increasingly shift toward performance-based, data-owned channels, Zeta stands out as a next-generation marketing infrastructure provider with strong operating leverage. With AI adoption accelerating and first-party data becoming mission-critical, ZETA offers investors exposure to a structural transformation in digital marketing with long-term, scalable upside.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

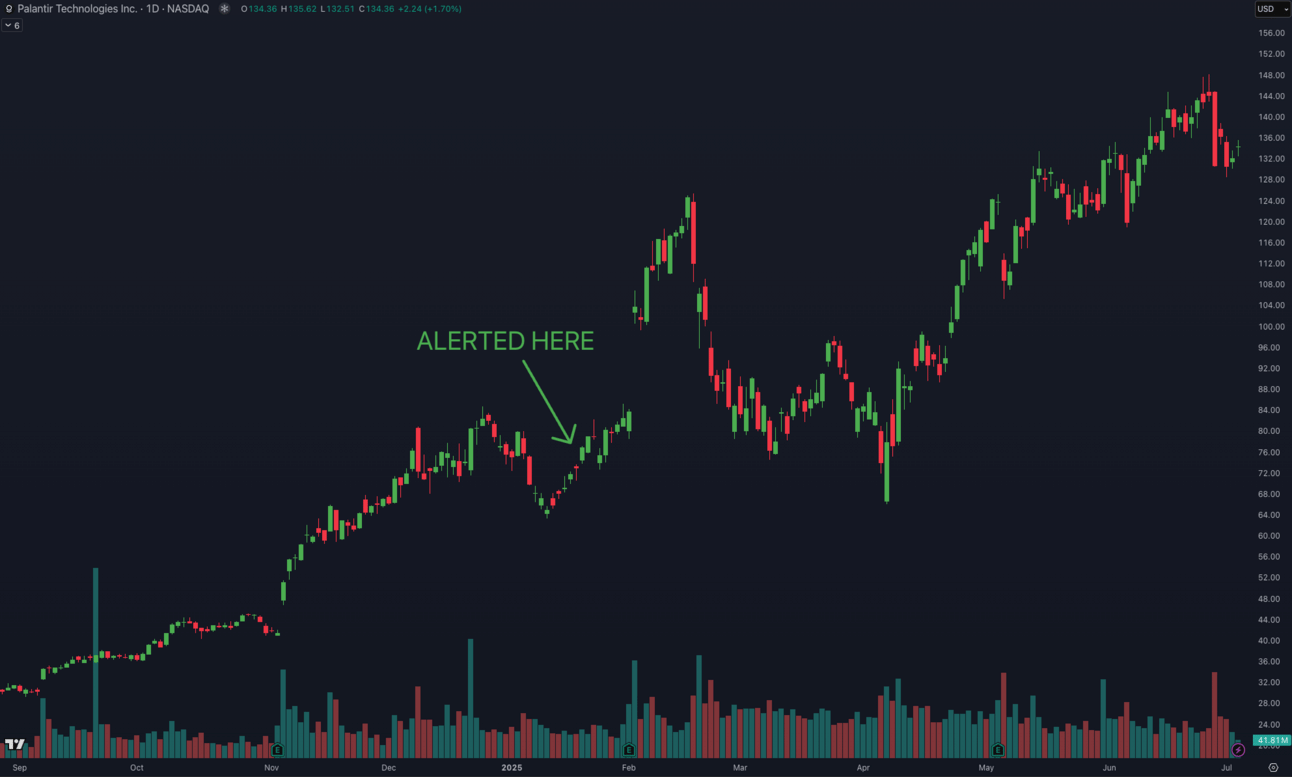

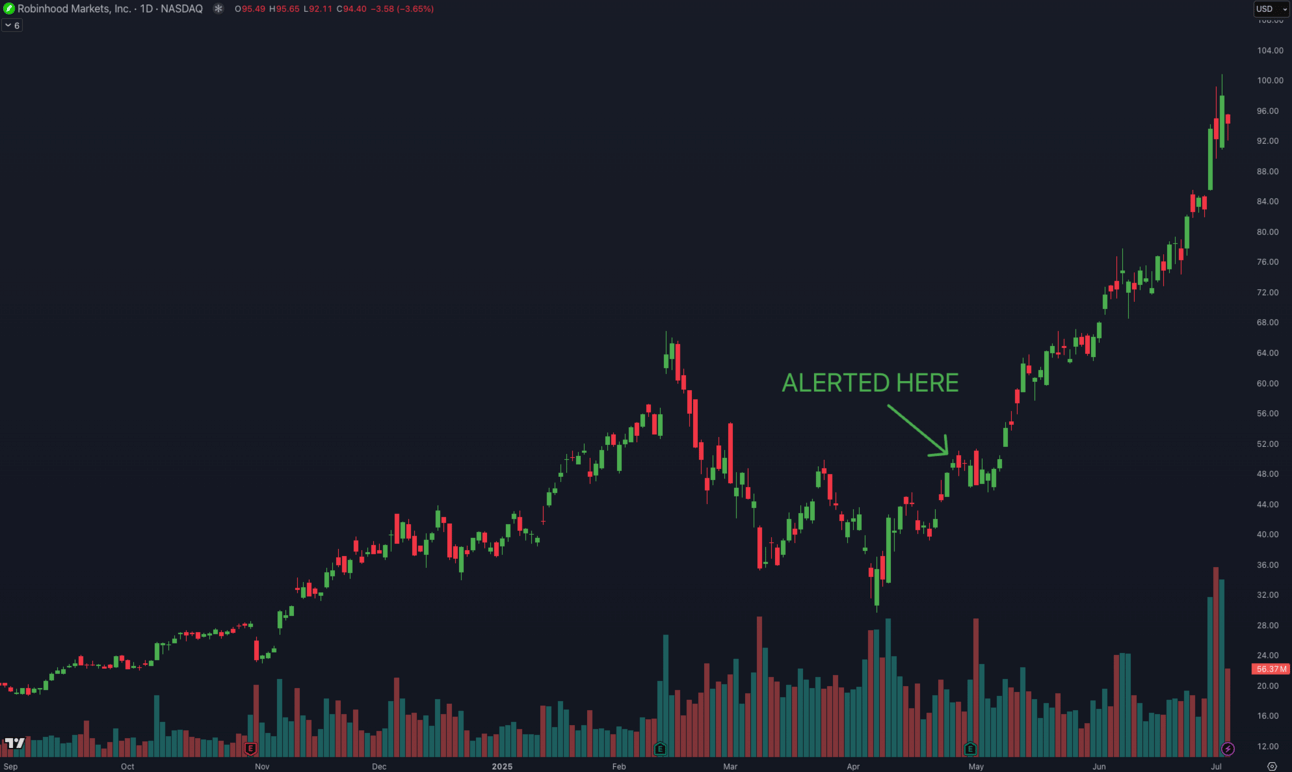

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.