Sponsored on behalf of First Phosphate Corp.

This North American Battery Materials Company Just Proved It Can Break China’s Grip on LFP — And the Market Is Only Starting to Notice

First Phosphate (CSE: PHOS | OTCQB: FRSPF | FSE: KD0) is emerging as one of the most strategically important names in the battery materials space as Western governments and industries race to secure non-Chinese supply chains for lithium iron phosphate (LFP) batteries.

LFP batteries now account for over 70% of all batteries produced globally, powering everything from AI data centers and grid storage to robots, drones, defense systems, and electric mobility. Yet despite their importance, China currently produces more than 95% of the world’s LFP batteries and dominates critical components like cathode active material — a dependence that is increasingly viewed as a national security risk. That risk intensified further after China threatened to cut off LFP technology exports to the rest of the world earlier this year.

The company recently announced that it has successfully produced commercial-grade LFP 18650 battery cells using fully North American-sourced critical minerals — a milestone that few believed was achievable today. Test results showed the cells met commercial specifications, demonstrated stable performance at high discharge rates, exhibited minimal cell-to-cell variability, and are projected to retain at least 80% of initial capacity after 2,000 cycles — performance levels required for real-world deployment in AI infrastructure, data centers, defense, and energy storage.

With commercial-grade validation now in hand, a rare high-purity igneous phosphate resource at its core, and a clear focus on North American battery independence, First Phosphate is positioning itself as one of the most closely watched emerging players in the LFP battery supply chain — just as the market begins to grasp how critical this capability has become to the Western world.

⚠️ Disclaimer: This content was produced on behalf of First Phosphate Corp. (CSE: PHOS | OTCQB: FRSPF | FSE: KD0) and sponsored by the company. The influencer was compensated $100 to create this content. This is not financial advice, and viewers are encouraged to consult a financial professional before making investment decisions. Investing in companies involves significant risks, and past performance does not guarantee future results. Please do your own research.

Our Momentum Scanner Picked Up These

3 Stocks This Week

1 year performance

TSM - 62%

HUBB - 10%

RDDT - 47%

Before we dive in…

⚠️ WANT EARLY ACCESS TO OUR PRICE BREAKDOWNS ?

The report below covers the top 3 stocks showing signs of early momentum.

But for those who also want:

Full technical price breakdowns on all 3 stocks

Price examples where support has historically held

Price examples that would invalidate the momentum

Early full market reports every Sunday

Free Trial Offer expires 1/07

Our Recent Elite Report: $LITE → Up 78% since OCT 27

Let’s Talk About On Each One!

Taiwan Semiconductor Manufacturing Company Limited (TSM)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $1.31T

Company Info:

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is the world’s leading pure-play semiconductor foundry, manufacturing the most advanced chips that power smartphones, AI data centers, high-performance computing, automotive systems, and next-generation electronics. As the primary producer of cutting-edge nodes like 5nm, 3nm, and beyond, TSM is a critical supplier to the world’s most important technology companies, including Apple, NVIDIA, AMD, and Qualcomm.

Why it’s a buy:

The stock is a buy in 2025 because Taiwan Semiconductor Manufacturing Company sits at the very center of the global AI and advanced computing boom, supplying the most critical chips that power data centers, smartphones, and next-generation electronics. Unlike competitors, TSM leads the industry in cutting-edge process nodes (5nm, 3nm, and upcoming 2nm), giving it an unmatched technological moat and making it indispensable to customers like Apple, NVIDIA, and AMD.

Despite near-term concerns around geopolitics and cyclical semiconductor demand, TSM continues to secure long-term capacity commitments and expand global manufacturing with fabs in Taiwan, the U.S., and Japan. As AI workloads, high-performance computing, and advanced devices accelerate worldwide, TSM stands out as a first-mover and bottleneck supplier in the semiconductor value chain—offering investors exposure to one of the most mission-critical technologies underpinning the global digital economy.

Revenue:

Hubbell Incorporated (HUBB)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $24B

Company Info:

Hubbell Incorporated (NYSE: HUBB) is a leading industrial manufacturer providing electrical, utility, and power infrastructure solutions used across data centers, renewable energy, utilities, commercial buildings, and industrial markets. The company designs and produces critical components—ranging from grid automation and transmission equipment to wiring devices and connectivity systems—that support the safe, reliable flow of electricity.

Why it’s a buy:

The stock is a buy in 2025 because Hubbell Incorporated is positioned at the heart of the global electrification and grid modernization cycle, addressing rising demand for reliable power infrastructure across utilities, data centers, renewables, and industrial markets. Unlike more cyclical industrial peers, Hubbell supplies mission-critical electrical and utility components that are essential for grid hardening, energy efficiency, and the expansion of power-hungry technologies like AI data centers and EV charging.

Despite near-term macro uncertainty and infrastructure spending cycles, Hubbell continues to benefit from long-term utility investment plans, resilient end-market demand, and pricing power driven by its specialized product portfolio. As governments and utilities accelerate spending on grid reliability, electrification, and energy transition, Hubbell stands out as a first-call supplier in essential infrastructure, offering investors exposure to durable cash flows and a multi-year growth runway tied to structural upgrades of the global power system.

Revenue:

Reddit, Inc. (RDDT)

1 Year Chart:

Technical Levels To Watch: UNLOCK

Risk Considerations: UNLOCK

Potential Upside: UNLOCK

Market Cap: $45B

Company Info:

Reddit, Inc. is a leading social media and community-driven platform built around thousands of interest-based forums (subreddits) where users engage in real-time discussions across news, entertainment, finance, gaming, technology, and culture. Its unique ecosystem blends authentic user-generated content, deep engagement, and niche communities, making Reddit one of the most influential sources of opinion, trend discovery, and internet culture.

Why it’s a buy:

The stock is a buy in 2025 because Reddit, Inc. sits at the center of the next evolution of digital media, combining deeply engaged communities with growing monetization leverage. Unlike traditional social platforms that rely on passive scrolling, Reddit’s interest-based forums drive high-intent engagement, making its content exceptionally valuable for advertisers, brands, and AI training partners.

Despite near-term volatility tied to its post-IPO transition and ad-market cycles, Reddit is rapidly expanding advertising tools, data licensing agreements, and AI partnerships, unlocking new high-margin revenue streams. As brands shift toward authentic engagement and AI demand for high-quality human conversations accelerates, Reddit stands out as a first-mover in monetizing community-driven data and attention, giving investors early exposure to a platform with massive long-term upside and durable network effects.

Revenue:

WANT TO TRACK THESE TOP STOCK PICKS EVEN EARLIER?

If you’ve found value in today’s emails… I want to personally invite you to Try MOMENTUM for free.

You’ll learn exactly how we’re tracking the stock market this week with:

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

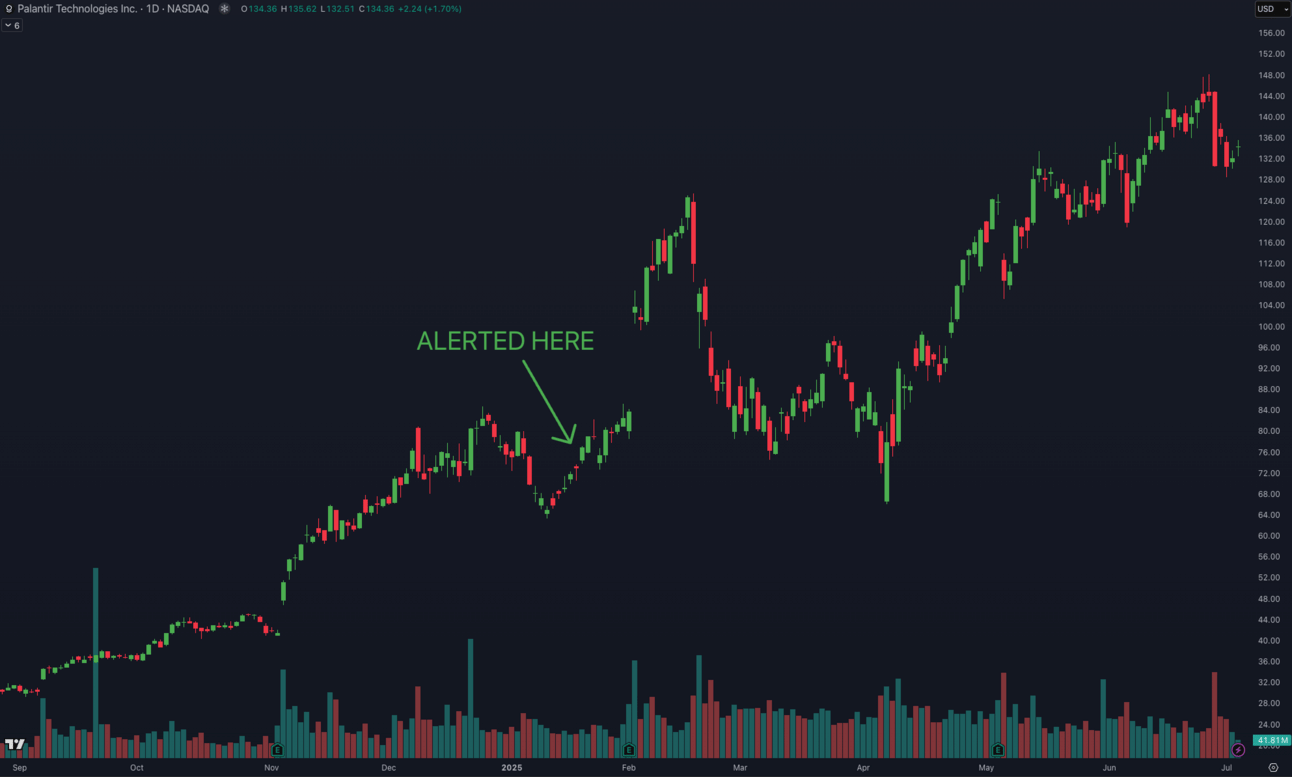

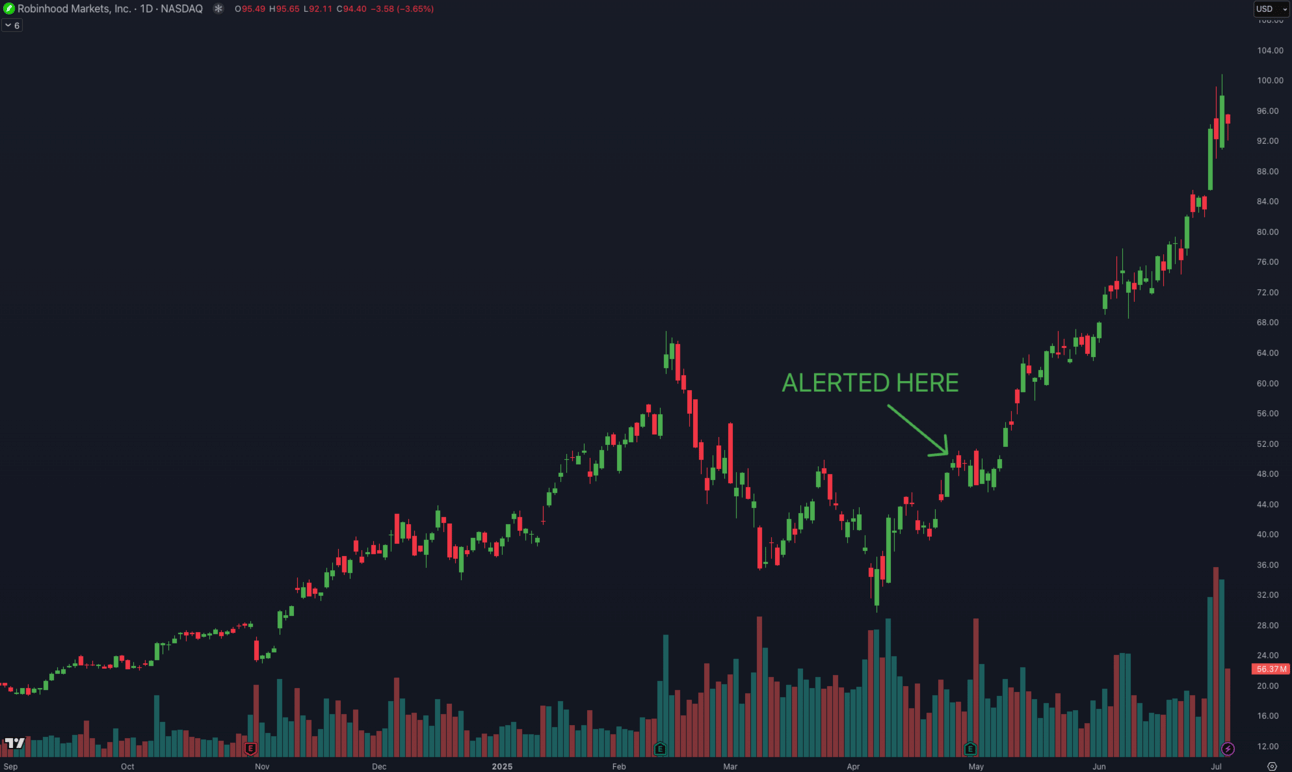

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.