Well-Researched Traders Win Again

November tested and scared a lot of traders. Yet the S&P 500 inched higher and the Nasdaq Composite added to its winning streak last week, so if you’re holding growth stocks, you probably saw a nice bump in your portfolio.

This is why good research matters most.

→ While others panic-sold, we scanned for oversold opportunities

→ While everyone froze, we identified which stocks had real support

→ While the news screamed "crash," we positioned for the bounce

And it’s paying off, AGAIN.

⚠️ WANT IN ON OUR EXACT PLAYS AND RESEARCH?

We just dropped a new batch of setups inside Crown Elite this morning with:

Full technical breakdowns on all 3 stocks (including exact entry zones)

Stop-loss levels to protect capital if the market has other plans

Risk/reward analysis so you know how top traders think

Position sizing guidance based on current volatility

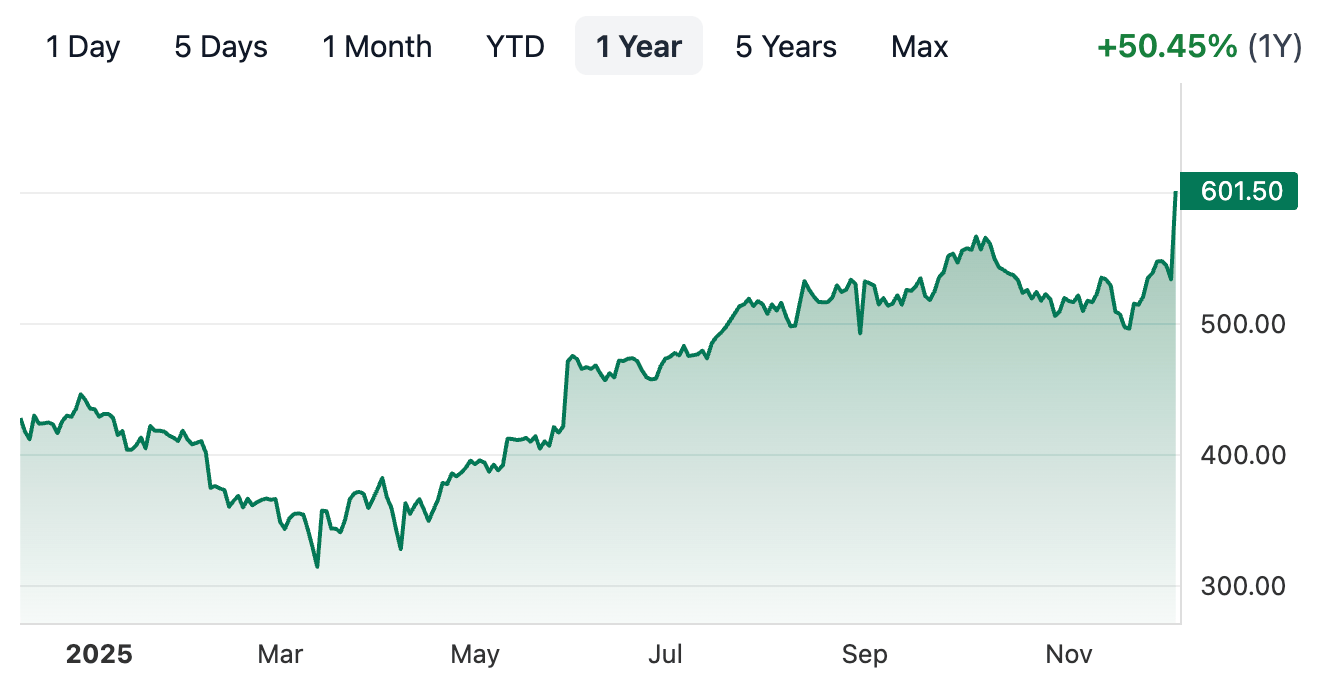

Our latest Elite alert: $LITE → Up 78% since OCT 27

3 STOCK PICKS THIS WEEK

1 year performance

U - 73%

FN - 97%

ULTA - 50%

Here’s our top 3 stock picks for the 2nd week of December

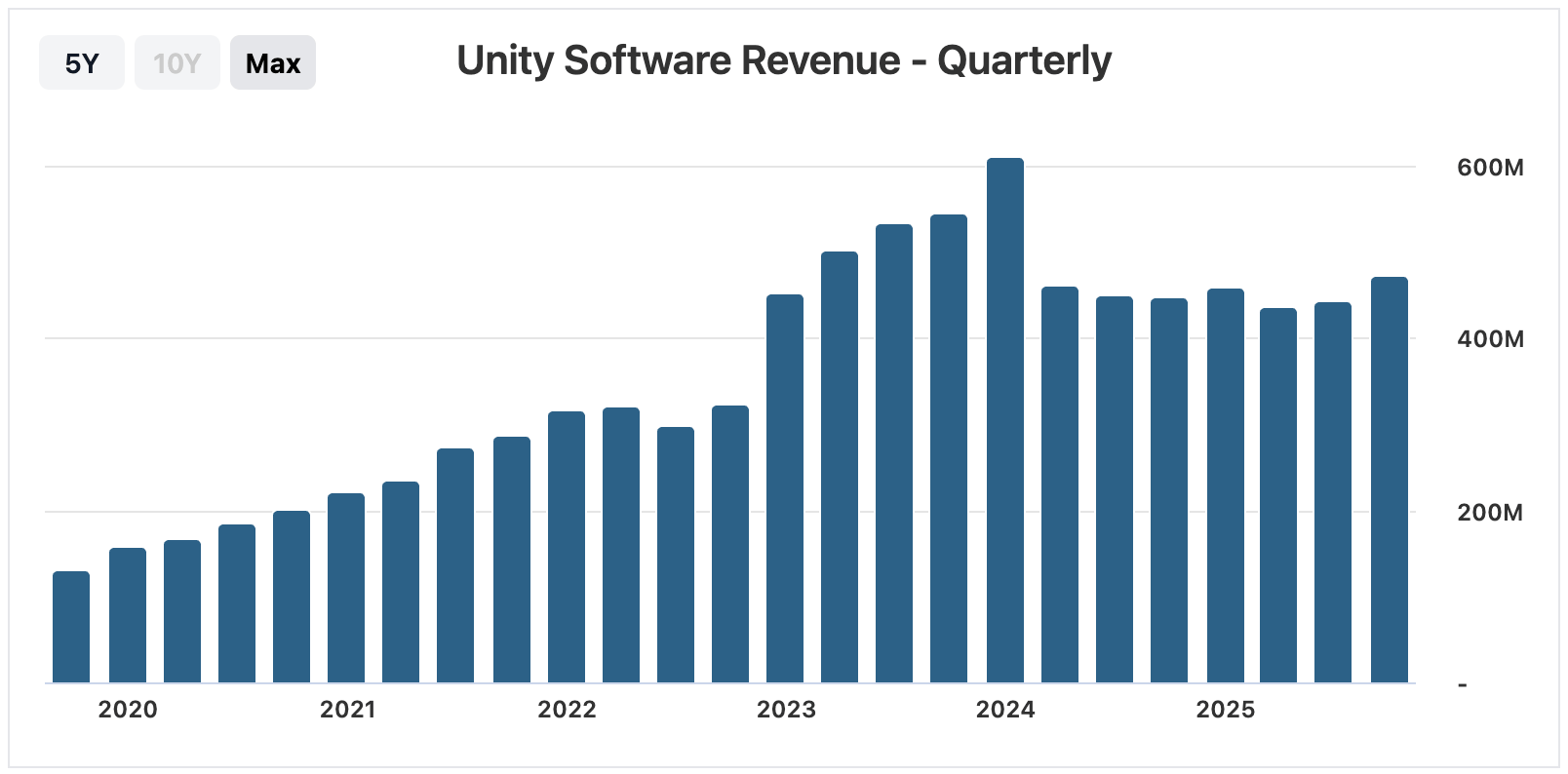

Unity Software Inc. (U)

1 Year Chart:

Buy Level: Unlock Buy Level

Stop Loss: Unlock Stop Loss

Price Target: Unlock Price Target

Market Cap: $19B

Company Info:

Unity Software Inc. (NYSE: U) is a leading platform for real-time 3D content creation, powering interactive experiences across gaming, film, automotive, architecture, and emerging technologies like augmented and virtual reality. The company provides a suite of powerful development tools that enable creators to design, simulate, and deploy high-performance digital environments across mobile, console, PC, and spatial computing devices. Unity’s mission is to democratize real-time 3D development, empowering millions of developers and enterprises to build immersive applications that drive innovation in entertainment, industrial simulation, digital twins, and next-generation computing.

Why it’s a buy:

The stock is a buy in 2025 because Unity Software (U) is at the forefront of the real-time 3D revolution, powering the next generation of interactive experiences across gaming, simulation, digital twins, and spatial computing. Unlike traditional development engines, Unity’s platform is highly flexible, creator-friendly, and optimized for rapid deployment, making it the top choice for developers, enterprises, and emerging AR/VR ecosystems seeking immersive, cross-platform solutions.

Despite recent volatility from restructuring efforts and slower enterprise adoption, Unity continues to secure major partnerships across gaming, automotive, industrial simulation, and defense. With rising demand for real-time 3D content, digital twin technology, and spatial computing applications, Unity stands out as a first-mover in a rapidly expanding ecosystem—giving investors early exposure to a transformative computing shift with massive long-term growth potential.

Revenue:

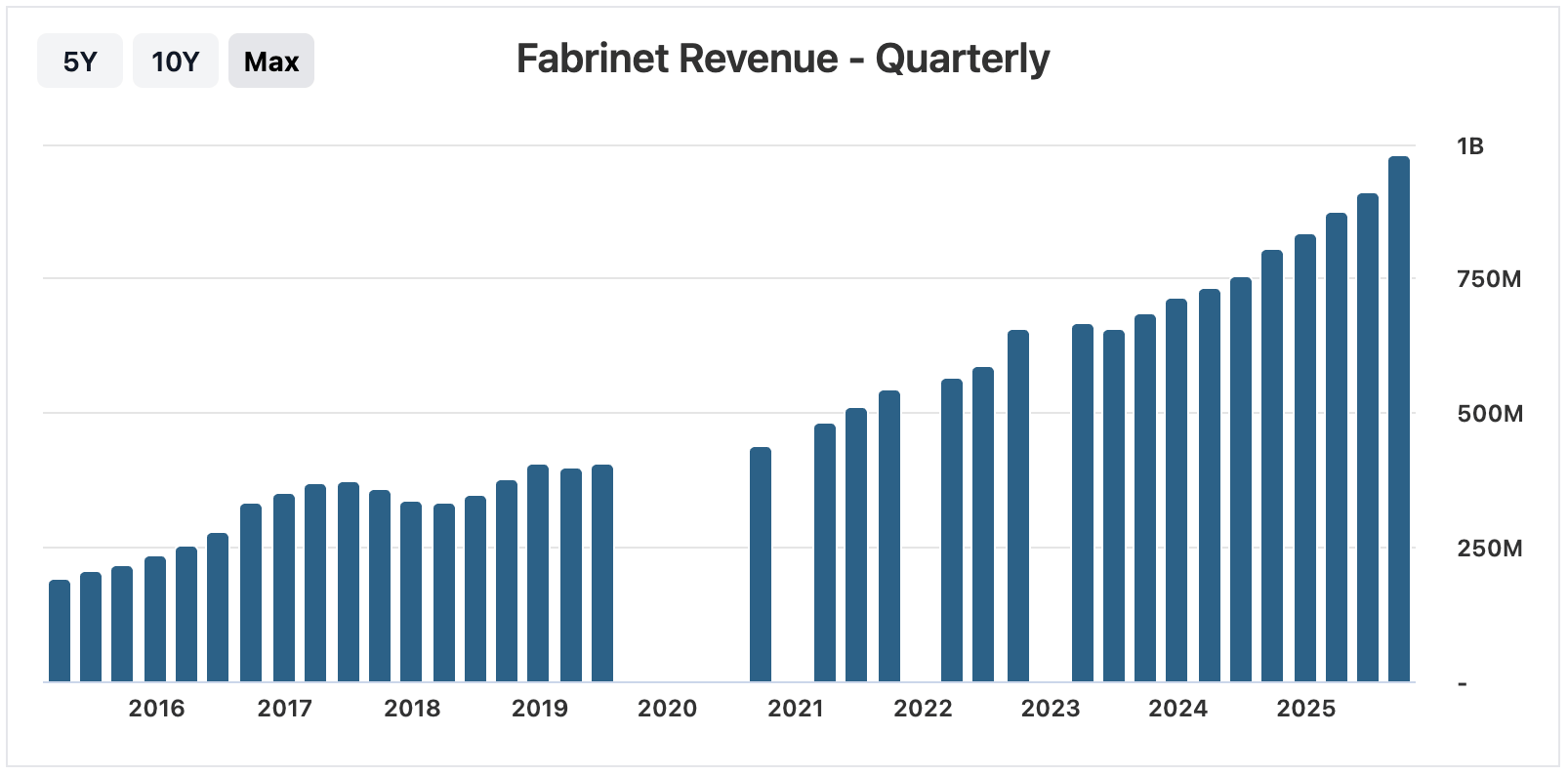

Fabrinet (FN)

1 Year Chart:

Buy Level: Unlock Buy Level

Stop Loss: Unlock Stop Loss

Price Target: Unlock Price Target

Market Cap: $17B

Company Info:

Fabrinet (NYSE: FN) is a leading advanced manufacturing and optical packaging company specializing in the production of high-precision optical, electro-optical, and electronic components used across communications, automotive, industrial, and cloud infrastructure markets. Its flagship expertise in precision optical assembly and high-complexity manufacturing makes Fabrinet a trusted partner for global technology leaders developing next-generation photonics and high-speed connectivity systems — marking a significant milestone in the growth of mission-critical optical technologies.

Why it’s a buy:

The stock is a buy in 2025 because Fabrinet (FN) is at the forefront of the global photonics and high-speed connectivity boom, providing the precision manufacturing capabilities that enable the next generation of AI infrastructure, optical communications, and advanced semiconductor systems. Unlike commodity manufacturers, Fabrinet specializes in high-complexity, high-margin optical assembly, positioning it as a mission-critical supplier for customers scaling AI data centers, autonomous technologies, and telecom networks.

Despite near-term volatility in tech hardware and supply chain cycles, Fabrinet continues to secure major partnerships across cloud, networking, and automotive markets, giving it a multi-year runway of durable demand. With rising investment in AI optics, silicon photonics, and high-speed interconnects, FN stands out as a first-mover in advanced manufacturing, offering investors high-quality exposure to the expanding backbone of global digital infrastructure.

Revenue:

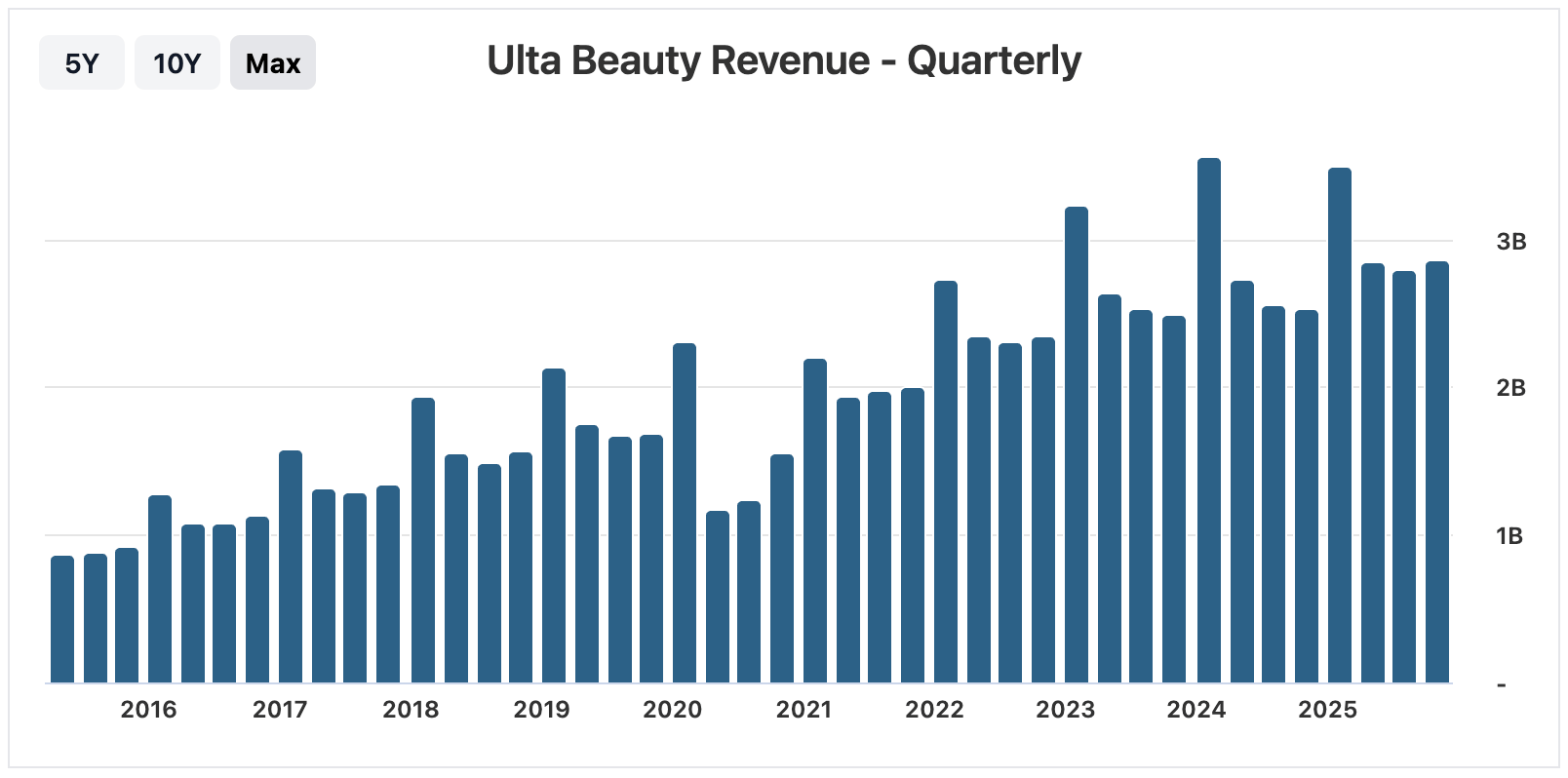

Ulta Beauty, Inc. (ULTA)

1 Year Chart:

Buy Level: Unlock Buy Level

Stop Loss: Unlock Stop Loss

Price Target: Unlock Price Target

Market Cap: $26B

Company Info:

Ulta Beauty, Inc. (NASDAQ: ULTA) is a leading specialty retail company offering a comprehensive range of beauty products, including skincare, cosmetics, haircare, and fragrance, alongside in-store salon services that create a fully integrated beauty experience. Its unique omnichannel model combines nationwide retail locations with a fast-growing digital platform, positioning Ulta as the dominant one-stop destination in the U.S. beauty market. Ulta’s mission is to deliver accessible, high-quality beauty solutions across every category, supported by a powerful loyalty program and strategic brand partnerships—marking it as a long-term leader in a resilient and expanding consumer sector.

Why it’s a buy:

The stock is a buy in 2025 because Ulta Beauty is positioned at the forefront of a consumer beauty renaissance, benefiting from resilient demand across skincare, cosmetics, haircare, and wellness categories. Unlike traditional retailers, Ulta’s high-margin omnichannel model, combined with its industry-leading loyalty ecosystem, creates a powerful competitive moat—keeping customers engaged and spending even during periods of macro volatility.

Despite near-term consumer spending pressures and market-wide retail selloffs, Ulta continues to secure strong brand partnerships, expand its in-store salon services, and grow its digital platform, reinforcing long-term revenue visibility. With beauty remaining one of the most defensible discretionary categories and Ulta maintaining dominant market share, the company stands out as a first-mover in the modern beauty retail landscape—offering investors exposure to a durable, high-growth sector with significant long-term upside.

Revenue:

WANT TO KNOW HOW WE’RE PLAYING THESE TOP STOCK PICKS?

If you’ve found value in today’s emails… I want to personally invite you to upgrade to Crown Elite.

You’ll learn exactly how we’re navigating the stock market this week with:

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Buy Levels, Price Targets and Stop Losses to keep you ahead

✅ Full access to the stock pick archives + download vault

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

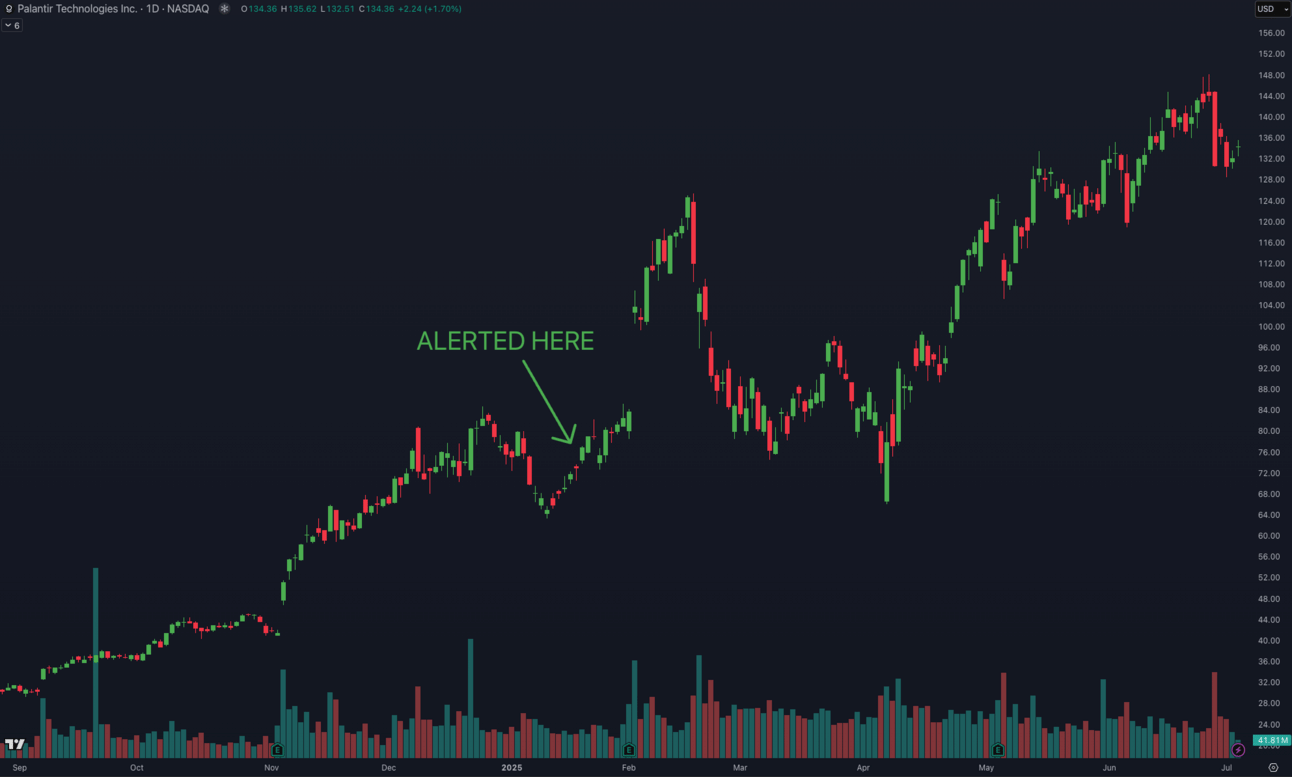

• PLTR +92.3%

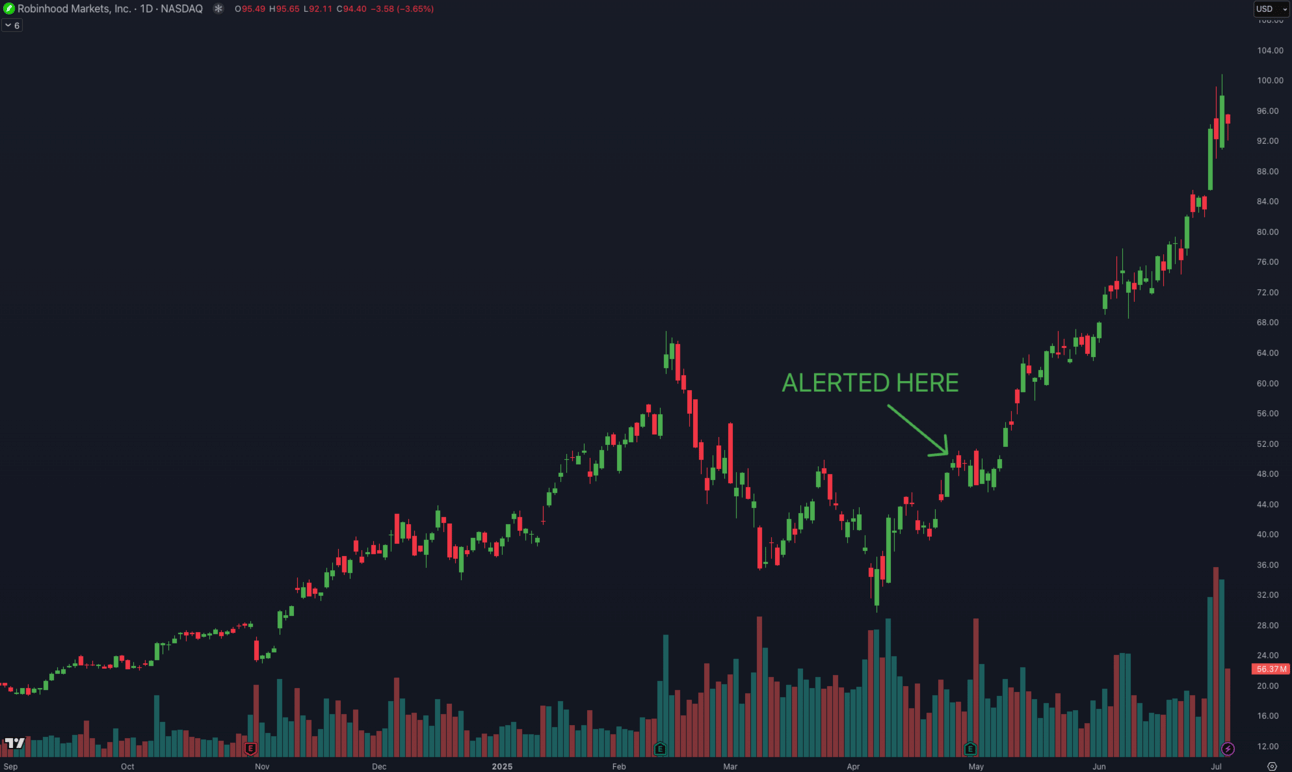

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.