Let's be honest: the market's been choppy lately.

November has been turbulent, with notable losses hitting portfolios across the board. And if you've been sitting on the sidelines waiting for "the right moment," you probably felt it too.

But here's what separates winning traders from the crowd:

→ While others panic-sell, we're scanning for oversold opportunities

→ While everyone's frozen, we're identifying which stocks have real support

→ While the news screams "crash," we're positioning for the bounce

This is where momentum research matters most.

Anyone can find stocks going up in a bull market. The real edge is knowing:

Which stocks are getting irrationally hammered (and due for a snap-back)

Which ones are breaking critical support (and should be avoided entirely)

Where institutional money is quietly positioning

That's what this week's watchlist is about.

⚠️ WANT TO SEE THE STOCKS WE’RE WATCHING?

We just dropped a new batch of setups inside Crown Elite — and you're invited.

Elite members got this morning:

Full technical breakdowns on all 3 stocks (including exact entry zones)

Stop-loss levels to protect capital if we're wrong

Risk/reward analysis (so you know when to cut losses)

Position sizing guidance based on current volatility

Our latest Elite alert: $ONDS → Up 80% since SEP 12

3 STOCK PICKS THIS WEEK

1 year performance

COHR - 45%

IONS - 127%

LITE - 230%

This Week (Here’s our top 3 stock picks)

Coherent Corp. (COHR)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $23.70B

Company Info:

Coherent Corp. (NYSE: COHR) is a leading photonics and materials technology company developing advanced optical components, lasers, and semiconductor solutions used across communications, industrial manufacturing, aerospace, and next-generation computing. Its portfolio includes high-performance lasers, silicon carbide materials, and optical connectivity systems that power applications from AI data centers to electric vehicles and precision engineering. Coherent’s mission is to accelerate innovation across the world’s most advanced technologies by delivering cutting-edge photonics and materials solutions that enable faster, more efficient, and more connected global industries.

Why it’s a buy:

Coherent is a buy in 2025 because it sits at the center of multiple high-growth technology megatrends — from AI data centers to electric vehicles to advanced semiconductor manufacturing. The company is one of the world’s leading suppliers of high-performance lasers, optical components, and silicon carbide materials, all of which are seeing accelerating demand as computing power, connectivity, and electrification rapidly scale. Coherent has also made major progress expanding capacity for silicon carbide substrates and optical modules, securing long-term supply agreements with top-tier semiconductor and EV manufacturers.

The company is gaining momentum in AI infrastructure, where its optical connectivity and photonics technologies are essential for powering high-speed data transmission between GPUs. At the same time, Coherent continues strengthening its position across industrial, aerospace, and precision manufacturing, providing mission-critical components that competitors struggle to replicate. With strong technology leadership, expanding end-markets, and a portfolio leveraged to some of the most important innovation cycles of this decade, COHR offers a compelling long-term opportunity as photonics becomes foundational to the next era of advanced technology.

Ionis Pharmaceuticals Inc. (IONS)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $12.46B

Company Info:

Ionis Pharmaceuticals Inc. (NASDAQ: IONS) is a biotechnology company pioneering RNA-targeted therapeutics to treat severe genetic, cardiometabolic, and neurological diseases. Its platform uses antisense technology to precisely silence disease-causing genes, enabling treatment of conditions that traditional medicine cannot easily address. Ionis has developed multiple first-in-class medicines, including collaborations with Biogen, AstraZeneca, and Roche, and continues advancing a broad pipeline that aims to reshape the future of genomic and precision medicine.

Why it’s a buy:

Ionis is a buy in 2025 because it remains one of the strongest players in the rapidly growing field of genetic medicine, even as the broader biotech sector faces heavy selling pressure. While many stocks are correcting on macro fears rather than fundamentals, Ionis continues to generate clinical wins, advance late-stage programs, and expand its portfolio of first-in-class RNA-targeting drugs—a space with limited competition and huge long-term demand.

The company has multiple near-term catalysts, including pivotal data readouts in neurological and cardiometabolic diseases, alongside revenue growth driven by partnerships with Biogen, AstraZeneca, and Roche. Even as the market pulls back, Ionis’ science, platform, and commercial path have not changed—its antisense technology remains one of the most validated approaches in precision medicine. With a discounted valuation, a deep pipeline, and growing strategic partnerships, IONS offers one of the most compelling risk-reward setups in biotech, positioning it for asymmetric upside once sentiment improves.

Revenue:

Lumentum Holdings Inc. (LITE)

1 Year Chart:

Buy Level: Available in Crown Elite

Stop Loss: Available in Crown Elite

Price Target: Available in Crown Elite

Market Cap: $19.68B

Company Info:

Lumentum Holdings Inc. (NASDAQ: LITE) is a leading provider of optical and photonic technologies used in high-speed communications, 3D sensing, and precision industrial applications. The company develops advanced lasers, optical components, and networking solutions that power global data infrastructure, cloud connectivity, and next-generation consumer devices. Lumentum’s mission is to enable the world’s transition to faster, more efficient, and more intelligent optical systems, supporting everything from AI data centers to autonomous technologies and advanced manufacturing.

Why it’s a buy:

Ionis is a buy in 2025 because it is a front-runner in the rapidly expanding field of RNA-targeted therapeutics, a sector positioned to reshape treatment for serious genetic and neurological diseases. While the broader biotech market is selling off on macro fear, Ionis continues to deliver major clinical progress, advance a deep late-stage pipeline, and strengthen its leadership in antisense technology, one of the most validated platforms in precision medicine. The company also benefits from high-value partnerships with Biogen, AstraZeneca, and Roche, which help de-risk development and expand global reach.

Ionis is gaining additional momentum with multiple Phase 3 readouts, growing commercial revenue from approved medicines, and expanding programs in cardiometabolic and rare diseases—areas with multi-billion-dollar market potential. With strong scientific backing, meaningful near-term catalysts, and a pipeline that competitors struggle to match, IONS is positioned to outperform once sentiment stabilizes, offering long-term upside as genetic medicine moves toward mainstream adoption.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Buy Levels, Price Targets and Stop Losses to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

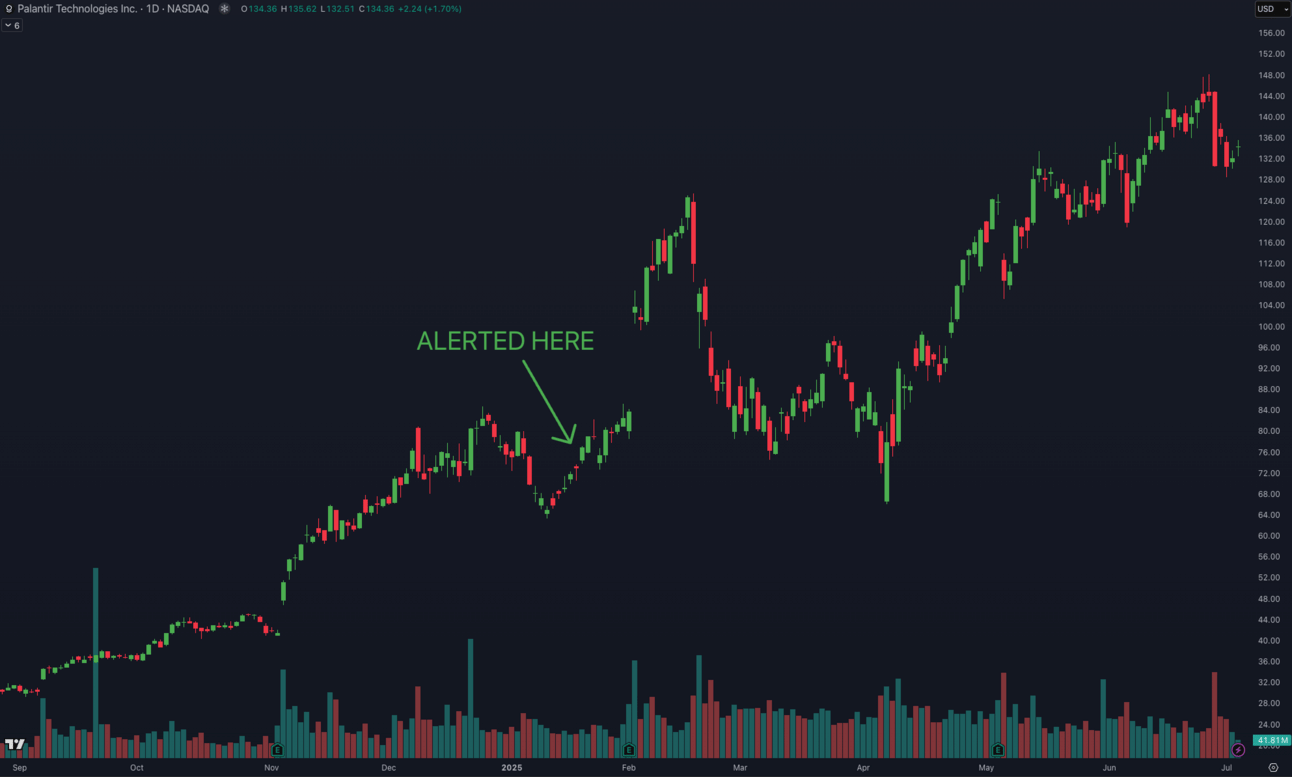

• PLTR +92.3%

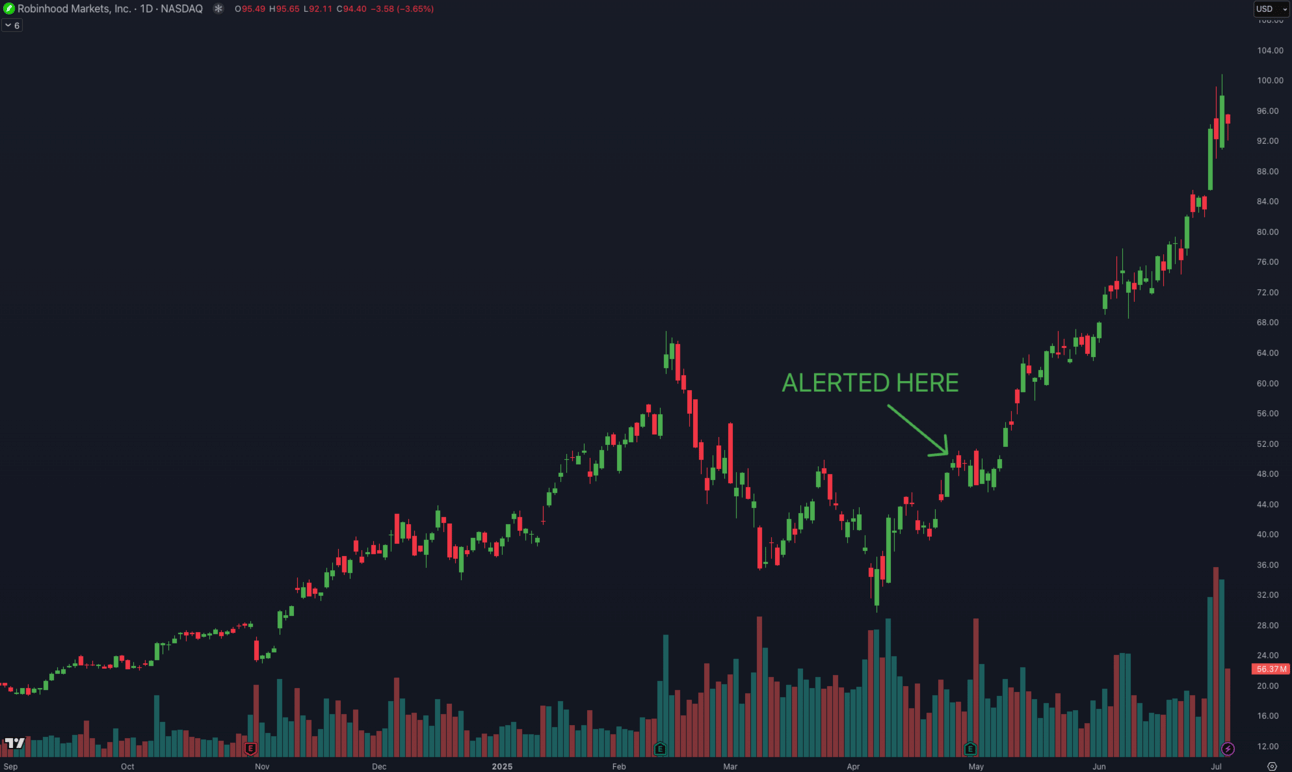

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.