3 STOCK PICKS THIS WEEK

1 year performance

AMD - 2%

TSSI - 774%

TDUP - 307%

This Week (Here’s our top 3 stock picks)

Advanced Micro Devices Inc (AMD)

1 Year Performance: +2%

Category: Growth

Market Cap: $258B

Company Info:

Advanced Micro Devices Inc. (NASDAQ: AMD) is a global semiconductor leader that designs and manufactures high-performance processors, graphics cards, and AI accelerators for PCs, gaming consoles, data centers, and embedded systems. Its flagship products include Ryzen CPUs, Radeon GPUs, and EPYC server chips, making it a key competitor to Intel and NVIDIA.

Why it’s a buy:

The stock is a buy in 2025 because AMD is rapidly expanding in the AI and data center markets, with its MI300X AI accelerator gaining traction among cloud providers and enterprise customers. In its most recent quarter, AMD reported $5.5 billion in revenue, with data center sales up 80% year-over-year, signaling strong demand for compute power driven by AI workloads.

The company’s Zen 5 architecture and continued share gains in the CPU space further strengthen its competitive edge. As demand for AI chips, high-performance computing, and edge devices surges globally, AMD offers investors a high-growth opportunity in a mission-critical sector powering the future of tech infrastructure.

Revenue:

TSS Inc (TSSI)

1 Year Performance: +774%

Category: Momentum

Market Cap: $650M

Company Info:

TSS Inc. (OTCQB: TSSI) is a provider of technology solutions and services for the data center industry, offering everything from design and engineering to maintenance and integration of mission-critical infrastructure. The company serves enterprise, government, and cloud clients who rely on secure, high-availability IT environments.

Why it’s a buy:

The stock is a buy in 2025 because TSS operates in a niche but growing segment of the data infrastructure boom, driven by rising demand for AI compute, cloud storage, and edge computing. While small in size, TSS maintains solid relationships with large tech and defense clients and continues to expand its recurring service revenue, improving margin stability.

As data center demand accelerates globally—with hyperscalers and government agencies needing more secure, high-efficiency environments—TSS stands out as a pure-play on backend infrastructure growth, offering asymmetric upside potential from a low base.

Revenue:

ThredUp Inc (TDUP)

1 Year Performance: +307%

Category: Momentum

Market Cap: $960M

Company Info:

ThredUp Inc. (NASDAQ: TDUP) is an online resale platform that enables consumers to buy and sell secondhand clothing, shoes, and accessories. It partners with major fashion brands and retailers through its Resale-as-a-Service (RaaS) program, helping them integrate circular fashion into their business models.

Why it’s a buy:

The stock is a buy in 2025 because ThredUp is positioned at the intersection of sustainability and e-commerce, capitalizing on the growing shift toward affordable, eco-conscious fashion. The company recently reported $79 million in quarterly revenue, up 14% year-over-year, with record highs in active buyers and orders. Its RaaS partnerships with brands like Walmart, Adidas, and J.Crew are expanding, offering long-term, high-margin B2B growth alongside its core marketplace.

As Gen Z and millennial consumers embrace thrift and recommerce, ThredUp offers investors a scalable platform in a fast-growing $250B+ resale market, with improving unit economics and strong brand tailwinds.

Revenue:

WANT MORE TOP STOCK PICKS?

We just dropped a new batch of winners inside Crown Elite — and you’re invited.

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Pro-level market breakdowns to keep you ahead

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

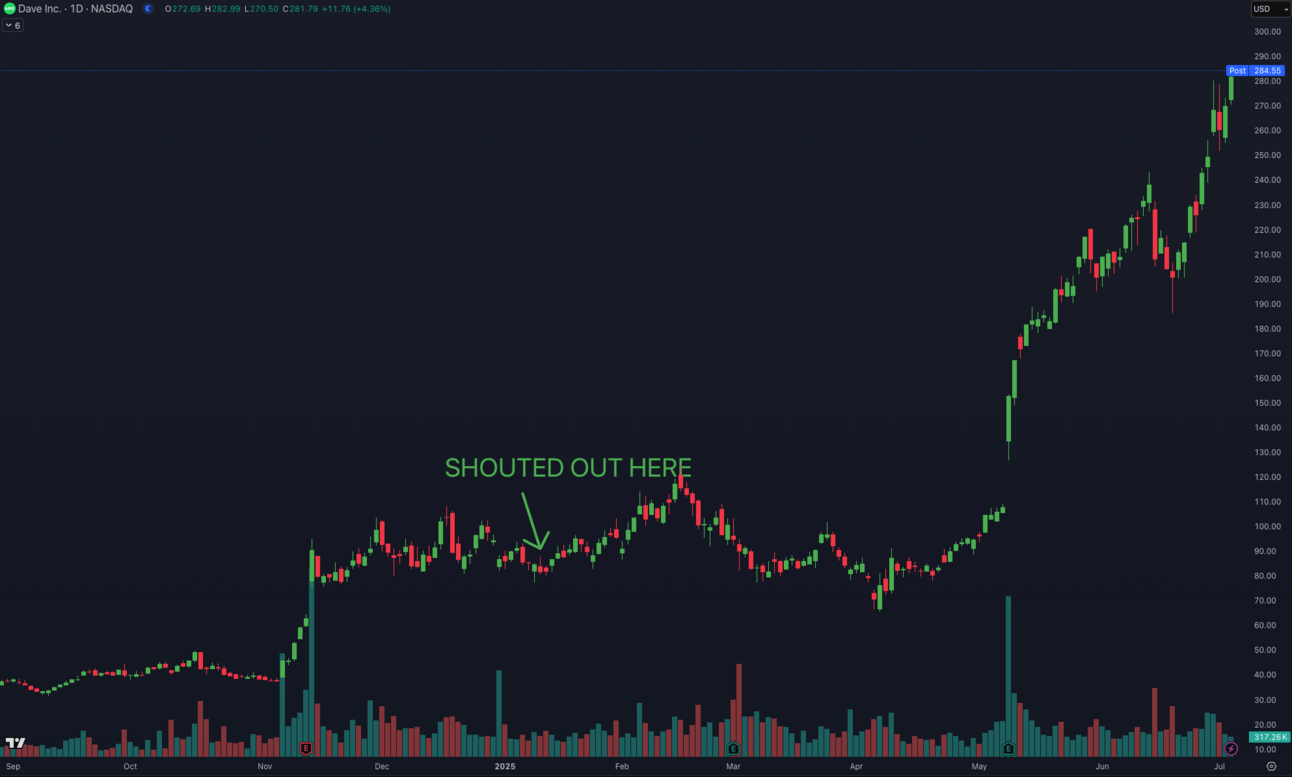

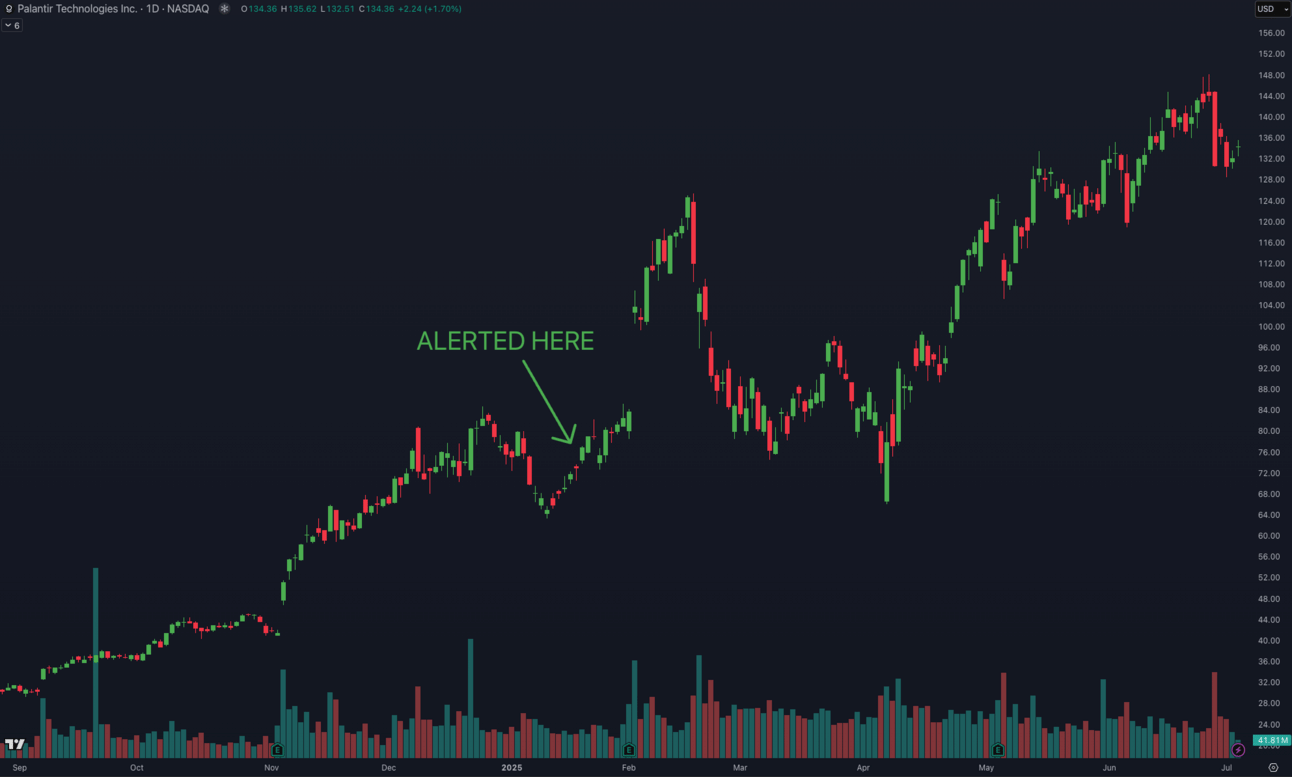

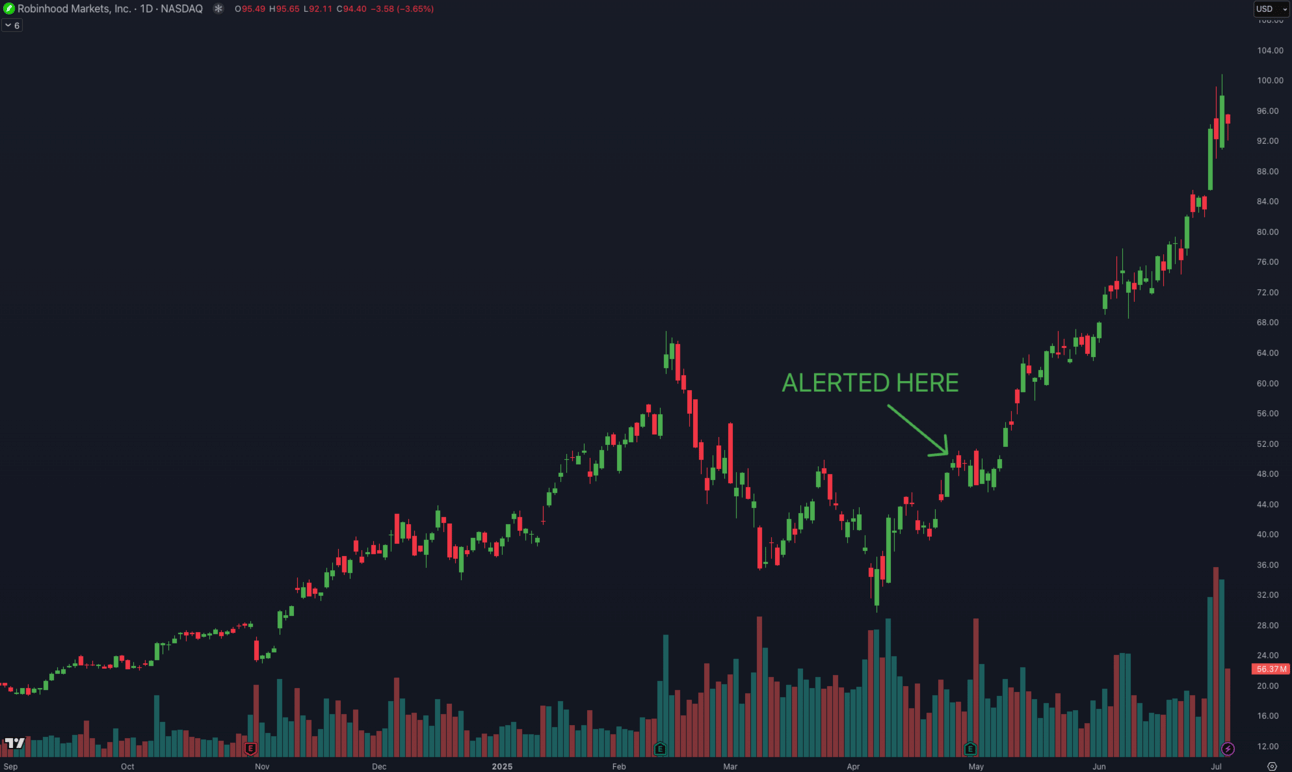

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

I’m sure you get hundreds of emails a day so I thank you for taking the time to read ours. Please follow us on our social media channels below where we post other new and different content related to investing, personal finance, and trading.

Stay tuned for our next free release every Monday.