Crown Elite: 2 Stock Picks

Here are your 2 Elite stocks for the day. These are our top growth/momentum picks we are watching at the moment.

If you have any questions, please contact me at [email protected].

Bonus: Top 10 Stocks For November 2025

Be sure to check out out our recent list of our Top 10 Stocks For November 2025.

Featuring stocks such as SOUN, PLTR, and more.

1 Year performance

HL - 183%

SOFI- 122%

Your 2 Stock Picks

Hecla Mining Company (HL)

1 Year Chart:

Buy Level:

Looking to buy in the $16 range.

Stop Loss:

Ideal stop loss is around $14.

Price Target:

I’d look to start selling around the $19.

Market Cap: $10.59B

Company Info:

Hecla Mining Company (NYSE: HL) is one of North America’s largest and longest-operating precious metals producers, specializing in the mining and development of silver, gold, lead, and zinc. The company operates several high-grade mines across the United States, Canada, and Mexico, including its flagship Greens Creek and Lucky Friday operations—two of the most productive silver mines in the Western Hemisphere. Hecla’s mission is to responsibly produce the metals essential to economic growth, clean energy, and technological advancement, positioning it as a key player in the global transition toward a sustainable, electrified future.

Why it’s a buy:

The stock is a buy in 2025 because Hecla Mining Company (HL) is a leading U.S.-based silver and precious metals producer, positioned to benefit from the accelerating demand for silver in clean energy, electrification, and industrial technologies. As one of the largest primary silver miners in North America, Hecla provides direct exposure to a metal that is essential for solar panels, electric vehicles, and advanced electronics, making it a strategic play on the global energy transition.

With strong operational performance at its flagship Greens Creek and Lucky Friday mines and growing production capacity, Hecla is expanding both output and margins. The company’s low-cost structure, solid balance sheet, and strategic U.S. assets provide stability amid market volatility, while rising silver prices create additional upside potential. As investors seek leverage to precious metals and green energy materials, HL stands out as a top-tier, long-term play on the intersection of industrial demand, sustainability, and monetary resilience.

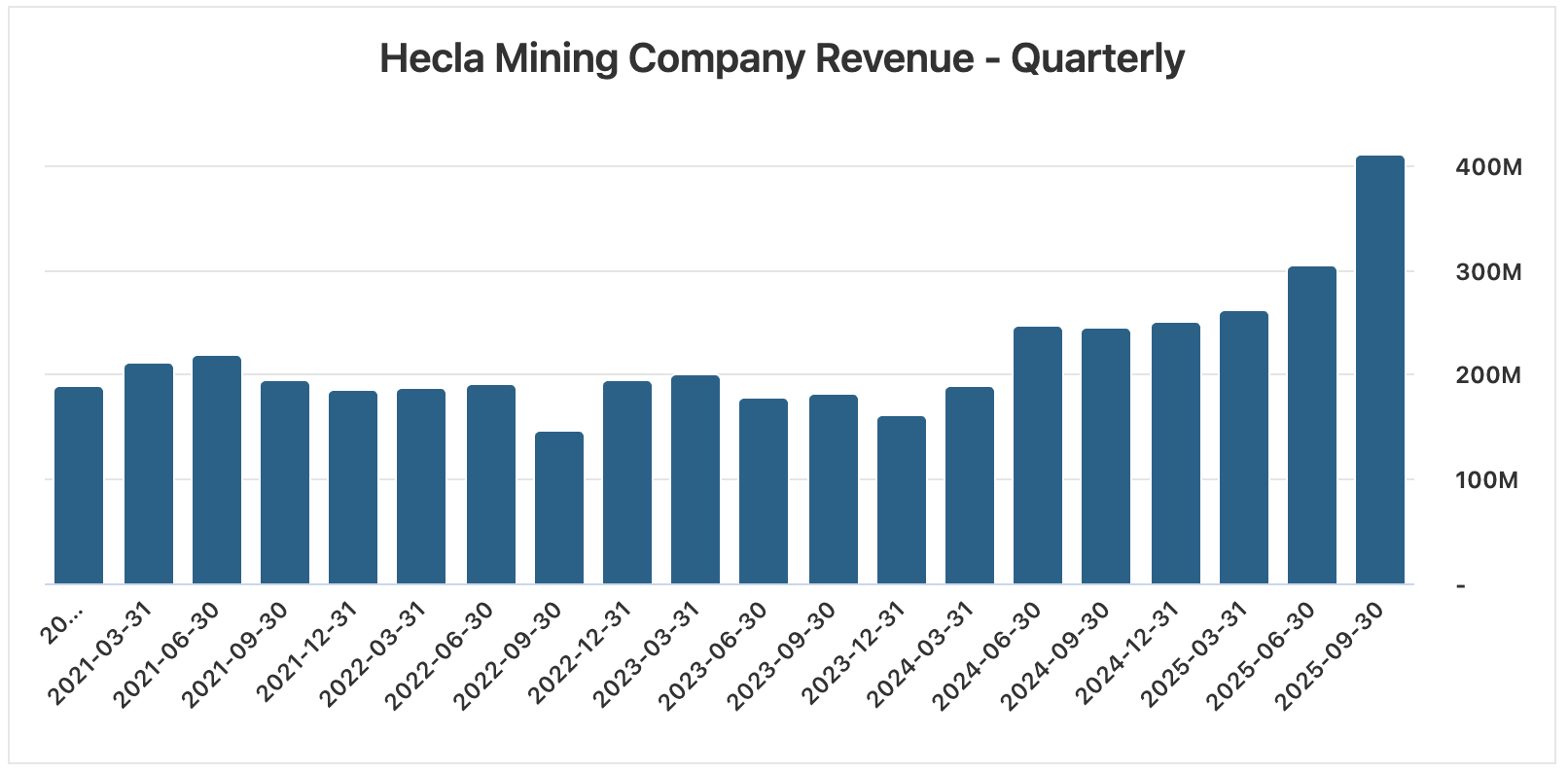

Revenue:

SoFi Technologies, Inc. (SOFI)

1 Year Chart:

Buy Level:

Looking to buy in the $31 range.

Stop Loss:

Ideal stop loss is around $28.

Price Target:

I’d look to start selling around the $35.

Market Cap: $37.73B

Company Info:

SoFi Technologies Inc. (NASDAQ: SOFI) is a leading digital finance and technology company revolutionizing the way consumers manage their money through an all-in-one, mobile-first financial platform. The company offers a comprehensive suite of products, including banking, lending, investing, and credit services, designed to help members achieve financial independence. With its fully licensed SoFi Bank, innovative app experience, and data-driven personalization, SoFi’s mission is to empower people to get their money right—positioning it at the forefront of the digital banking and fintech revolution.

Why it’s a buy:

The stock is a buy in 2025 because SoFi Technologies (SOFI) is a leading disruptor in the digital banking and personal finance space, positioned to capitalize on the accelerating shift away from traditional banks. Its all-in-one platform—offering banking, lending, investing, and credit services—gives SoFi a powerful ecosystem advantage, enabling customers to manage their entire financial lives seamlessly within a single app.

With a fully licensed national bank charter, rising deposit growth, and expanding lending profitability, SoFi is transitioning from a high-growth fintech to a profitable, scalable financial institution. The company continues to grow its SoFi Bank operations, attract new members, and deepen engagement through cross-selling and data-driven personalization. As digital finance adoption continues to surge among younger generations, SOFI stands out as a high-upside play on the future of consumer banking, financial technology, and financial independence.

Revenue:

Check out our Weekly Watchlist!

If you haven’t already, check out our Elite watchlist updated every week:

This is also available in the elite discord.

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.