Crown Elite: 2 Stock Picks

Here are your 2 stocks that we have hand-picked based off of your investment criteria. If you haven’t done so yet, fill out your survey form emailed to you so you can receive personalized picks.

If you are interested in receiving different picks then please send me an email at [email protected].

1 Year performance

TPR - 53%

SOFI - 51%

Your 2 Stock Picks

Tapestry Inc (TPR)

1 Year Performance: +53%

Category: Growth

Market Cap: $13.1B

Company Info:

Tapestry, Inc. is a multinational fashion holding company headquartered in New York City, owning iconic brands such as Coach, Kate Spade New York, and Stuart Weitzman. The company designs and markets a wide range of luxury accessories and lifestyle products, including handbags, footwear, jewelry, and ready-to-wear apparel, catering to a global customer base through retail stores, e-commerce platforms, and wholesale channels.

Why it’s a buy:

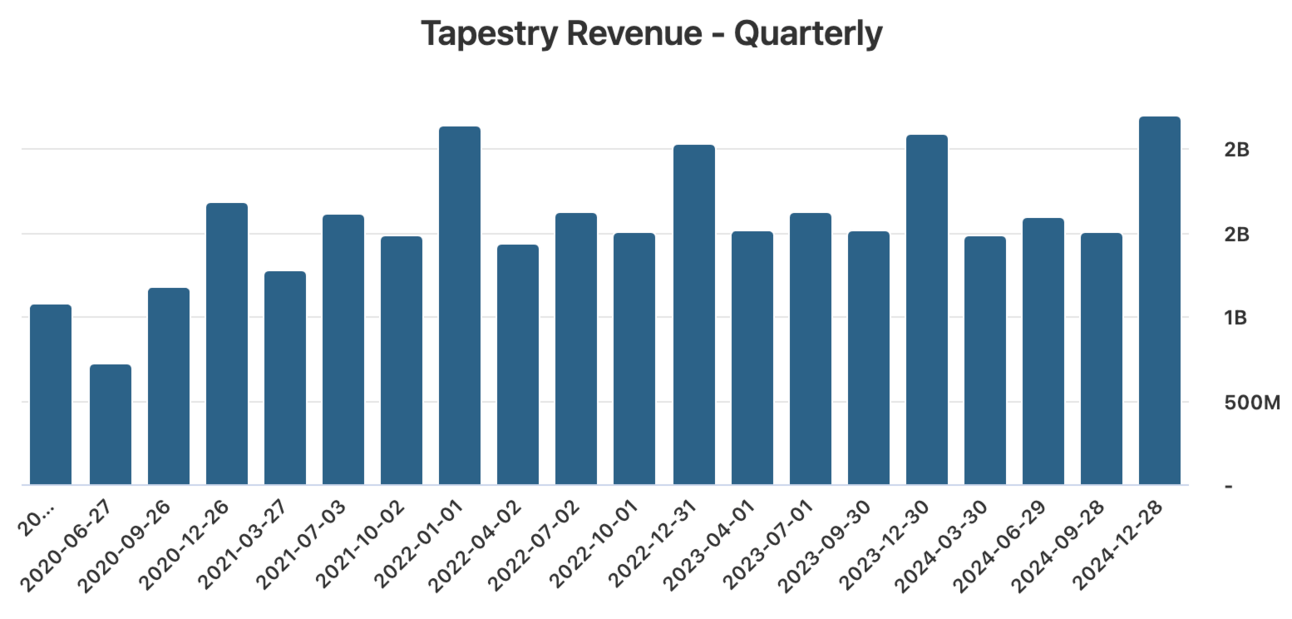

Tapestry, Inc. (NYSE: TPR) is a compelling investment opportunity due to its strong brand portfolio, solid financial performance, and strategic focus on organic growth. In fiscal Q2 2025, the company reported revenue of $2.20 billion, a 5% year-over-year increase, and adjusted EPS of $2.00, both surpassing expectations.

The Coach brand led this growth with an 11% increase in sales, reaching $1.71 billion, while gross margins improved to 75.3%, indicating operational efficiency. Tapestry has raised its full-year 2025 guidance, projecting EPS between $4.85 and $4.90 and revenue of $6.85 billion, reflecting confidence in its growth trajectory.

The company's focus on enhancing digital capabilities and expanding its global reach, particularly in Europe and Asia, positions it well for sustained growth. Additionally, Tapestry's decision to abandon the Capri Holdings acquisition allows it to concentrate on strengthening its existing brands and return capital to shareholders through a $2 billion share buyback program.

With a current stock price around $63.64 and an intrinsic value estimated at $68.25, Tapestry appears to be undervalued, offering potential upside for investors.

Revenue:

SoFi Technologies Inc (SOFI)

1 Year Performance: +51%

Category: Growth

Market Cap: $12.1B

Company Info:

SoFi Technologies, Inc. is a financial technology company that offers a comprehensive suite of digital financial services, including student and personal loans, mortgages, credit cards, checking and savings accounts, and investment platforms. Operating through its Lending, Financial Services, and Technology Platform segments, SoFi aims to provide an all-in-one solution for individuals seeking to manage their finances digitally.

Why it’s a buy:

SoFi Technologies, Inc. (NASDAQ: SOFI) is a compelling investment opportunity due to its strong financial performance, diversified revenue streams, and strategic growth initiatives.

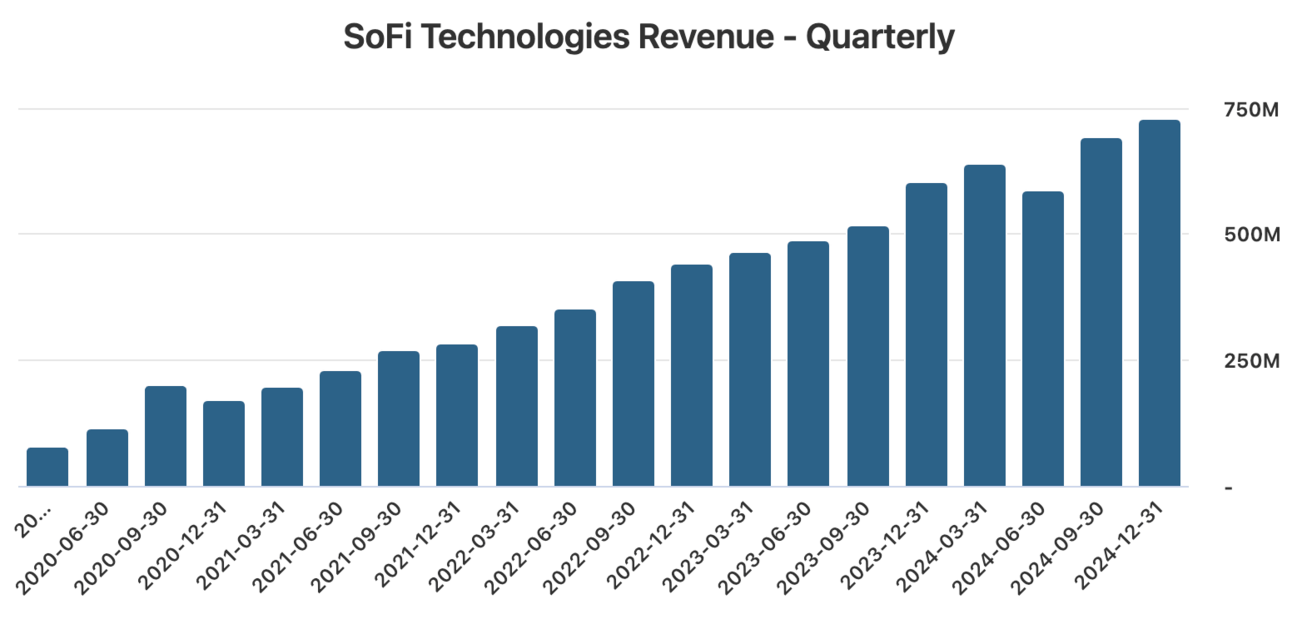

In 2024, SoFi achieved its first full year of GAAP profitability, reporting net income of $499 million and adjusted EBITDA of over $665 million, reflecting a 26% EBITDA margin. The company's Financial Services and Technology Platform segments generated $1.2 billion, up 54% year-over-year, highlighting its successful expansion beyond traditional lending.

SoFi's fee-based revenue grew by 74%, driven by origination fees, loan platform business, referrals, interchange, and brokerage. The introduction of SoFi Plus, a fee-based subscription offering, further diversifies its income sources.

With a projected 2025 revenue between $3.2 billion and $3.275 billion and EPS of $0.25 to $0.27, SoFi is well-positioned for sustained growth in the digital financial services sector.

Revenue:

Check out our Weekly Watchlist!

If you haven’t already, check out our Elite watchlist updated every week:

OUR RECENT ELITE TRADES (updated Mar 12/25)

Date Posted | Ticker | Price | Current Price | Gain/Loss |

|---|---|---|---|---|

Jan 10/25 | SE | $105 | $129 | 22.8% |

Jan 13/25 | DOCS | $49 | $64 | 30.6% |

Jan 15/25 | SPOT | $476 | $535 | 12.4% |

Jan 10/25 | BB | $3.9 | $4.37 | 12.1% |

Jan 13/25 | DAVE | $86 | $81 | 6.1% |

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.