Crown Elite: 2 Stock Picks

Here are your 2 Elite stocks for the day. These are our top growth/momentum picks we are watching at the moment.

If you have any questions, please contact me at [email protected].

Bonus: Top 5 Stocks For September 2025

Be sure to check out out our recent list of our Top 5 Stocks For September 2025.

Featuring stocks such as TEM, AFRM, and more.

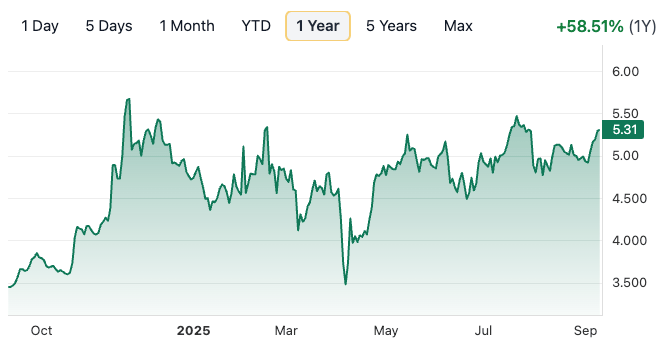

1 Year performance

MU - 62%

GRAB - 58%

Your 2 Stock Picks

Micron Technology Inc (MU)

1 Year Chart:

Buy Level:

Looking to accumulate in the $140 range. There is strong support in the $120’s from the last few months on consolidation. With the stock breaking out of this range, it allows for a solid entry point.

Category: Growth

Market Cap: $156B

Company Info:

Micron Technology Inc. (NASDAQ: MU) is a leading global producer of semiconductor memory and storage solutions, including DRAM, NAND, and NOR flash memory. Its chips are used across data centers, smartphones, AI systems, autonomous vehicles, and countless industrial applications.

Why it’s a buy:

The stock is a buy in 2025 because Micron stands to benefit directly from the AI supercycle, with demand for high-bandwidth memory (HBM) and advanced DRAM soaring as tech giants race to expand GPU-based infrastructure. Micron is one of only a few companies worldwide capable of producing HBM chips, a critical component in NVIDIA’s and AMD’s AI accelerators.

The company is also recovering from a brutal downcycle, with memory prices stabilizing and margins poised to rebound sharply. As AI, 5G, and edge computing continue to drive massive data creation, Micron is uniquely positioned to ride this wave with a leaner cost base and cutting-edge technology—making it a high-conviction semiconductor play for long-term growth.

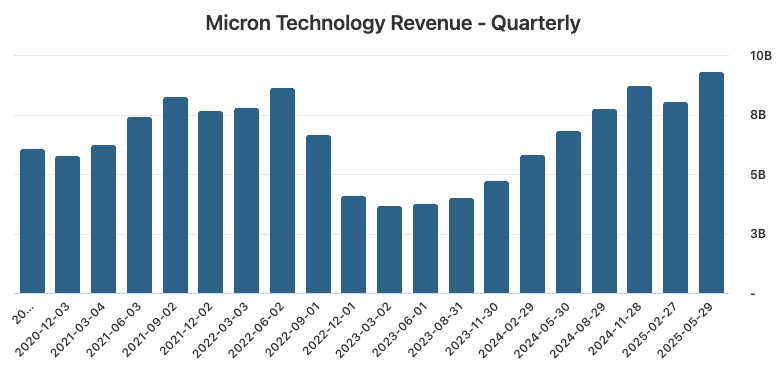

Revenue:

Grab Holdings Ltd (GRAB)

1 Year Chart:

Buy Level:

Looking to accumulate in the $5.20 area. This is a growth stock that has been flying the last few years and I expect it to continue with more revenue beats and earnings rises.

Category: Growth

Market Cap: $21B

Company Info:

Grab Holdings Ltd (NASDAQ: GRAB) is a Southeast Asian super app offering services ranging from ride-hailing and food delivery to digital payments and financial services. Operating across countries like Singapore, Indonesia, Malaysia, and the Philippines, Grab has become a key player in the region’s digital economy.

Why it’s a buy:

The stock is a buy in 2025 because Grab is steadily moving toward profitability while benefiting from powerful network effects and a diversified revenue base. As consumer behavior in Southeast Asia shifts further toward digital-first lifestyles, Grab’s ecosystem of services positions it to capture increasing wallet share.

Its fintech arm continues to gain traction with digital banking licenses and growing payment volume, while ride-hailing margins improve with operational scale. With a large and underpenetrated addressable market, Grab’s long-term upside is tied to the region’s rapid urbanization, rising middle class, and digital transformation—making it one of the most compelling emerging market tech plays.

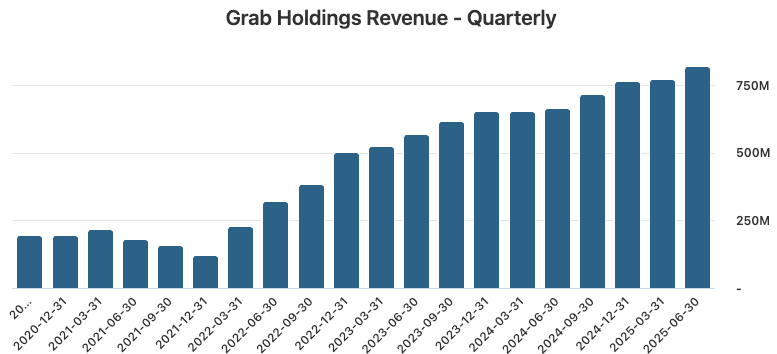

Revenue:

Check out our Weekly Watchlist!

If you haven’t already, check out our Elite watchlist updated every week:

This is also available in the elite discord.

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.