Crown Elite: 2 Stock Picks

Here are your 2 Elite stocks for the day. These are our top growth/momentum picks we are watching at the moment.

If you have any questions, please contact me at [email protected].

Bonus: Top 5 Stocks For September 2025

Be sure to check out out our recent list of our Top 5 Stocks For September 2025.

Featuring stocks such as TEM, AFRM, and more.

1 Year performance

TSLA - 72%

ONDS - 651%

Your 2 Stock Picks

Tesla Inc (TSLA)

1 Year Chart:

Buy Level:

Looking to accumulate under $400. The stock has been clowly rising for months and is setting up for another breakout. Should likely hit $500 in it’s next long term run.

Category: Growth

Market Cap: $1.2T

Company Info:

Tesla Inc. (NASDAQ: TSLA) is a global leader in electric vehicles (EVs), energy storage, and clean energy solutions. The company designs and manufactures EVs, battery packs, solar panels, and autonomous driving software, with operations spanning North America, Europe, and Asia.

Why it’s a buy:

The stock is a buy in 2025 because Tesla is positioned at the intersection of multiple megatrends—EV adoption, AI-driven autonomy, energy decentralization, and robotics. While short-term demand fluctuations and competition have weighed on sentiment, Tesla continues to expand margins through software (like FSD), increase scale in energy storage with products like Megapack, and build moats around charging infrastructure and vertical integration.

Strategic moves like opening its Supercharger network and investing heavily in AI chips and Dojo supercomputing reflect its long-term innovation roadmap. With a loyal customer base, unmatched brand power, and leadership in both EV and energy markets, Tesla remains a multi-industry disruptor with powerful optionality for future growth.

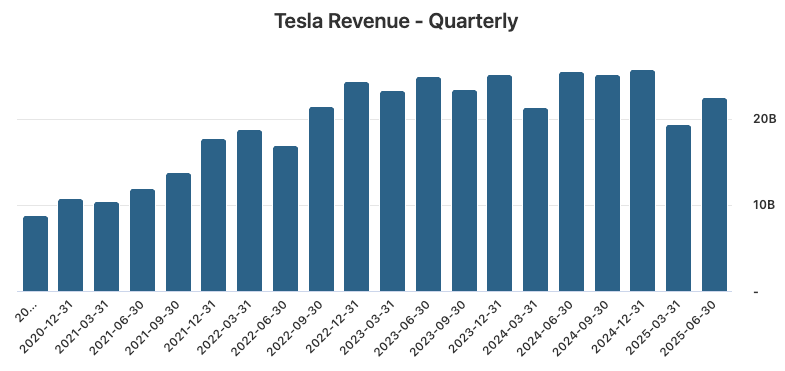

Revenue:

Ondas Holdings Inc (ONDS)

1 Year Chart:

Buy Level:

Looking to accumulate in the $6-$6.50 range. This stock is very volatile but is showing signs of continuation and another breakout. Buying on a dip increases risk to reward massively.

Category: Growth

Market Cap: $2.1B

Company Info:

Ondas Holdings Inc. (NASDAQ: ONDS) is a technology company focused on providing wireless data solutions for mission-critical industries, including rail, public safety, and drone operations. It operates through two main segments: Ondas Networks, which develops private wireless connectivity platforms, and Airobotics, which builds autonomous drone systems for industrial and defense applications.

Why it’s a buy:

The stock is a buy in 2025 because Ondas is tapping into next-generation infrastructure needs across transportation, energy, and national security. Its wireless platform is gaining traction with freight railroads for secure, high-speed data transmission, while its Airobotics drone tech is being deployed in smart city initiatives and defense operations globally.

The company’s recent FAA approvals and partnerships open the door to scaled commercial drone deployments—an industry poised for exponential growth. With a unique dual focus on connectivity and automation, Ondas is a high-risk, high-reward play in the evolving industrial tech and autonomous systems space.

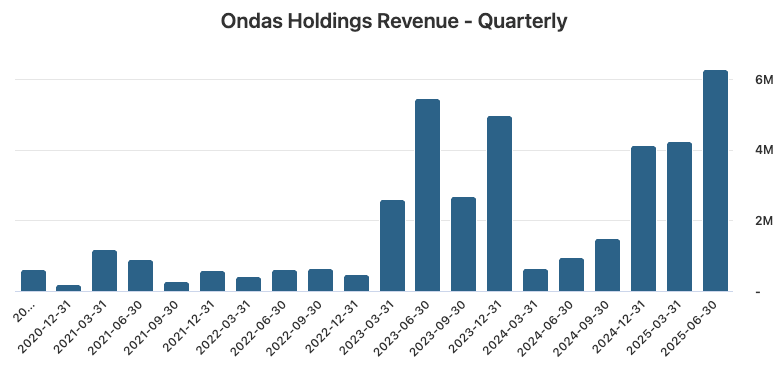

Revenue:

Check out our Weekly Watchlist!

If you haven’t already, check out our Elite watchlist updated every week:

This is also available in the elite discord.

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.