Crown Elite: 2 Stock Picks

Here are your 2 Elite stocks for the day. These are our top growth/momentum picks we are watching at the moment.

If you have any questions, please contact me at [email protected].

Bonus: Top 5 Stocks For September 2025

Be sure to check out out our recent list of our Top 5 Stocks For September 2025.

Featuring stocks such as TEM, AFRM, and more.

1 Year performance

AVAV - 52%

Z - 47%

Your 2 Stock Picks

AeroVironment, Inc. (AVAV)

1 Year Chart:

Buy Level:

Looking to accumulate in the $260 range. This stock had a massive revenue spike last quarter and can continue to run, nearing it’s highs of $280 again.

Category: Growth

Market Cap: $13B

Company Info:

AeroVironment, Inc. (NASDAQ: AVAV) is a defense and aerospace technology company specializing in unmanned aircraft systems (UAS), loitering munitions, and robotic systems used by the U.S. military and allied forces. Its products include tactical drones like the Puma, Switchblade, and Raven, which are widely deployed in intelligence, surveillance, and precision-strike missions.

Why it’s a buy:

The stock is a buy in 2025 because AeroVironment is a pure-play leader in battlefield robotics and drone warfare, a sector experiencing rapid global demand due to rising geopolitical tensions. With defense budgets climbing and asymmetric warfare becoming the norm, AVAV’s small, portable drones are in high demand for their real-time intel and precision strike capabilities.

The company has secured major contracts from the U.S. Department of Defense and NATO allies, with its Switchblade system becoming a critical asset in modern combat zones like Ukraine. As conflicts shift toward drone-centric operations, AeroVironment is positioned as a key supplier of next-gen military tech, offering strong growth potential and strategic relevance in a rapidly evolving defense landscape.

Revenue:

Zillow Group Inc Class C (Z)

1 Year Chart:

Buy Level:

Looking to accumulate in the $90 range, which lines up with recent support levels in the $80 area. Steady moving stock with potential for a spike to $100.

Category: Growth

Market Cap: $21B

Company Info:

Zillow Group Inc. Class C (NASDAQ: Z) is a leading real estate technology platform that connects home buyers, sellers, renters, and agents through its suite of digital tools and services. The company operates popular consumer brands like Zillow, Trulia, and StreetEasy, and has built a dominant presence in U.S. residential housing search and data.

Why it’s a buy:

The stock is a buy in 2025 because Zillow is transforming into a housing super app, integrating search, financing, rentals, and agent services into one seamless ecosystem. While the housing market has faced headwinds from interest rates, Zillow continues to gain share in digital real estate services, with strong growth in its rentals and mortgage segments.

The company is shifting from a lead-gen model toward transactional monetization, improving unit economics and positioning itself for long-term margin expansion. With over 200 million monthly users and a trusted brand, Zillow is a category leader in a massive, high-friction market—offering compelling upside as the housing cycle turns and digital adoption accelerates.

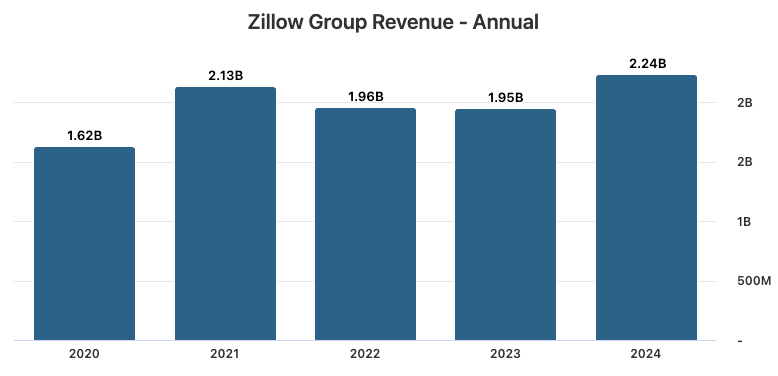

Revenue:

Check out our Weekly Watchlist!

If you haven’t already, check out our Elite watchlist updated every week:

This is also available in the elite discord.

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.