Crown Elite: 2 Stock Picks

Here are your 2 Elite stocks for the day. These are our top growth/momentum picks we are watching at the moment.

If you have any questions, please contact me at [email protected].

Bonus: Top 10 Stocks For November 2025

Be sure to check out out our recent list of our Top 10 Stocks For November 2025.

Featuring stocks such as SOUN, PLTR, and more.

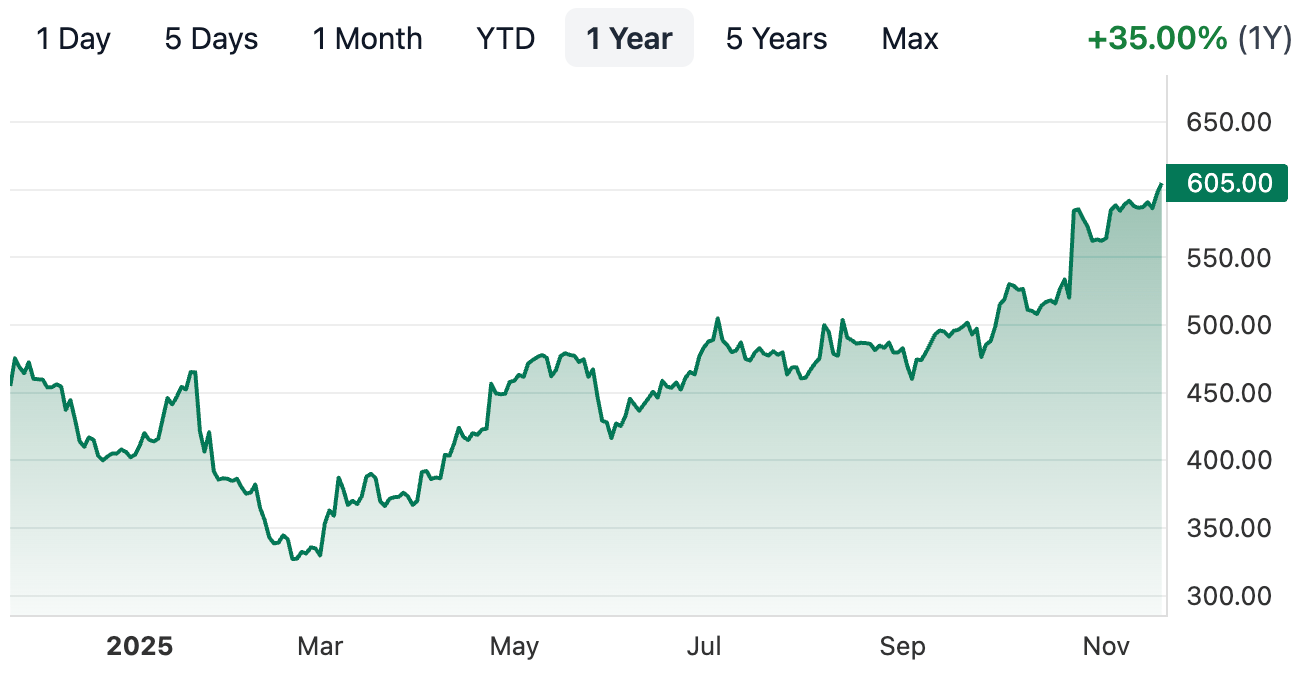

1 Year performance

CACI - 35%

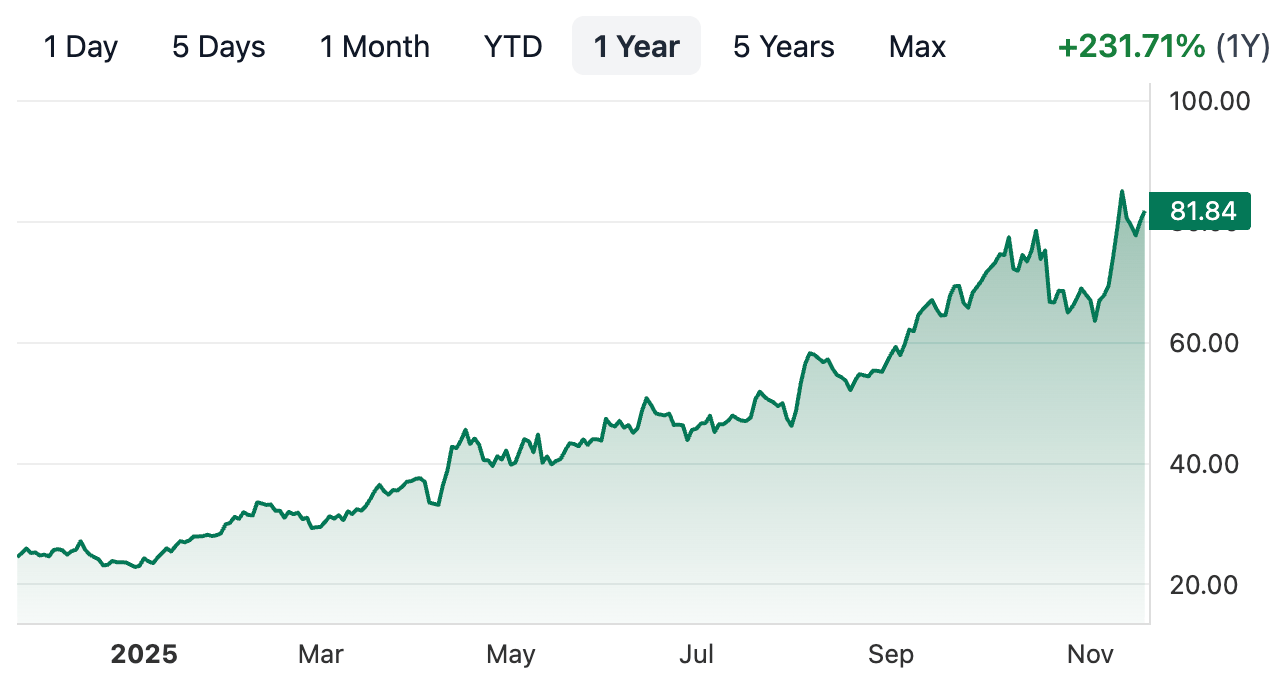

AU - 232%

Your 2 Stock Picks

CACI International Inc. (CACI)

1 Year Chart:

Buy Level:

Looking to buy in the $605 range.

Stop Loss:

Ideal stop loss is around $575.

Price Target:

I’d look to start selling around the $650 range.

Market Cap: $13.33B

Company Info:

CACI International Inc. (NYSE: CACI) is a leading provider of mission-critical technology, intelligence solutions, and enterprise IT services for the U.S. Department of Defense, national security agencies, and federal civilian customers. The company specializes in advanced capabilities such as signals intelligence, electronic warfare, cyber defense, AI-enabled analytics, and secure communications, delivering solutions that support real-time decision-making and protect national interests. With deep expertise across both classified and unclassified domains, CACI’s mission is to advance national security through innovative technology and trusted engineering, positioning it as a key partner in the modernization of U.S. defense and intelligence infrastructure.

Why it’s a buy:

The stock is a buy in 2025 because CACI International (CACI) is positioned at the center of the U.S. defense and intelligence modernization cycle, delivering advanced technologies that address rising global security threats and evolving mission requirements. As demand grows for cybersecurity, electronic warfare, AI-driven analytics, secure communications, and intelligence solutions, CACI’s deep government relationships and long-term contracts provide strong revenue visibility and recurring cash flow. Its work in sensitive, high-barrier-to-entry domains gives the company a strategic moat that few competitors can match.

Despite broader defense budget fluctuations, CACI continues to secure multi-year program awards and expand into higher-margin, technology-focused segments, strengthening both earnings quality and long-term growth potential. With geopolitical tensions driving sustained investment in mission-critical capabilities, CACI stands out as a stable, high-conviction play on national security technology modernization—offering durable upside supported by essential government spending and a robust, tech-enabled project pipeline.

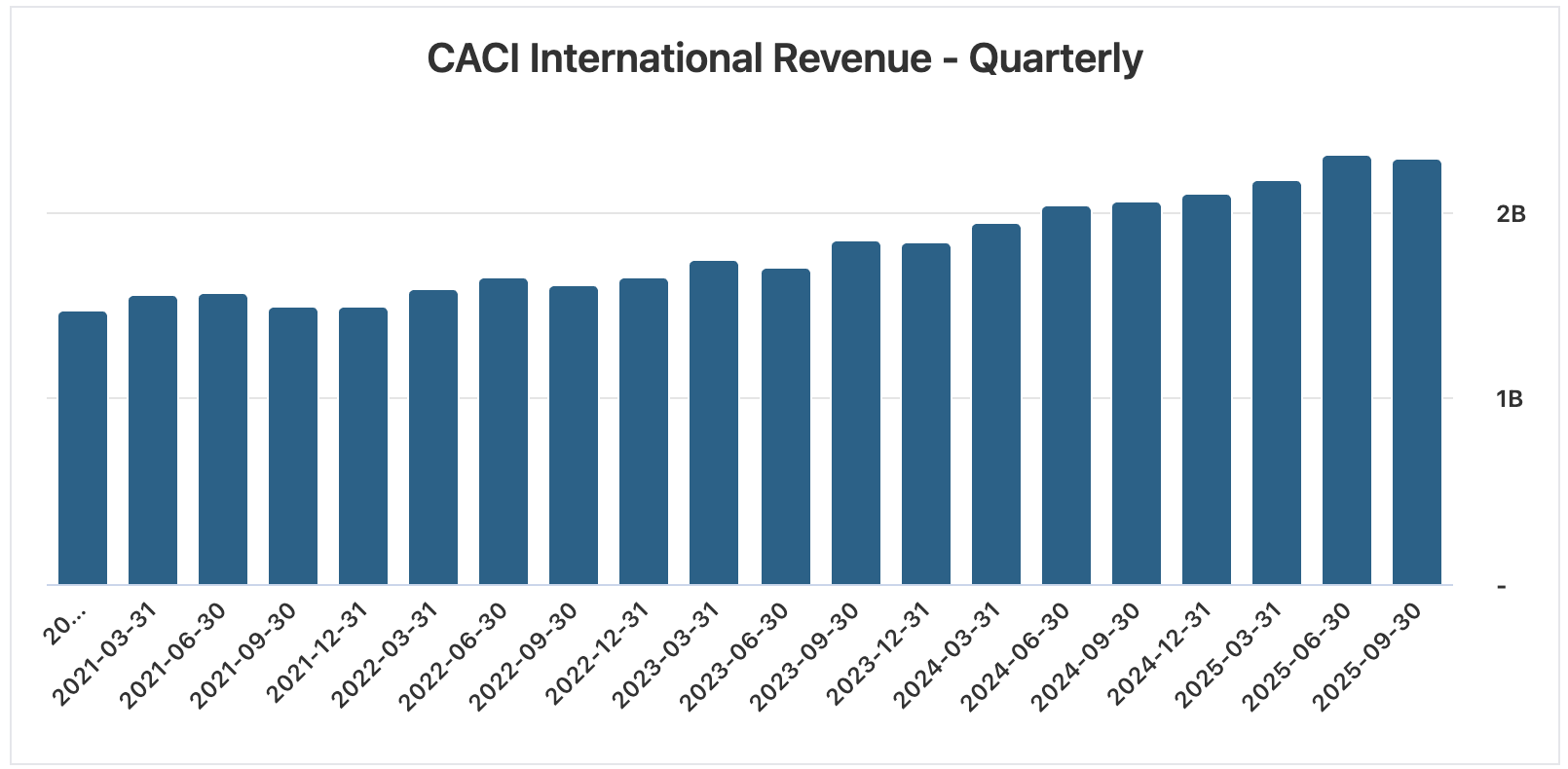

Revenue:

AngloGold Ashanti plc (AU)

1 Year Chart:

Buy Level:

Looking to buy in the $81 range.

Stop Loss:

Ideal stop loss is around $75.

Price Target:

I’d look to start selling around the $90 range.

Market Cap: $41.63B

Company Info:

AngloGold Ashanti plc (NYSE: AU) is a leading global gold mining company with a diversified portfolio of high-quality underground and open-pit operations across Africa, the Americas, and Australia. The company focuses on responsible mining practices, operational efficiency, and disciplined capital allocation while producing gold and other precious metals essential for investment demand, jewelry, and industrial applications. AngloGold’s strategy emphasizes mine-life extension, cost reduction, and exploration-led growth, positioning it as a key player in the global precious metals market and a reliable supplier within the broader commodities sector.

Why it’s a buy:

The stock is a buy in 2025 because AngloGold Ashanti (AU) offers high-quality exposure to the renewed global demand for gold, driven by persistent inflation, geopolitical tensions, and increased central-bank buying. As one of the world’s largest and most geographically diversified gold producers, AngloGold benefits from multiple low-cost, long-life mines across stable jurisdictions, giving it strong production visibility and leverage to rising gold prices. The company has made meaningful progress improving operational efficiency, reducing all-in sustaining costs, and advancing key expansion projects—strengthening both margins and future output.

With gold increasingly viewed as a strategic hedge against currency volatility and macro uncertainty, and with AngloGold executing on disciplined capital allocation and exploration-led growth, AU stands out as a resilient, high-conviction play on the next leg of the precious metals cycle—offering investors both defensive stability and significant upside potential if gold prices continue their upward trend.

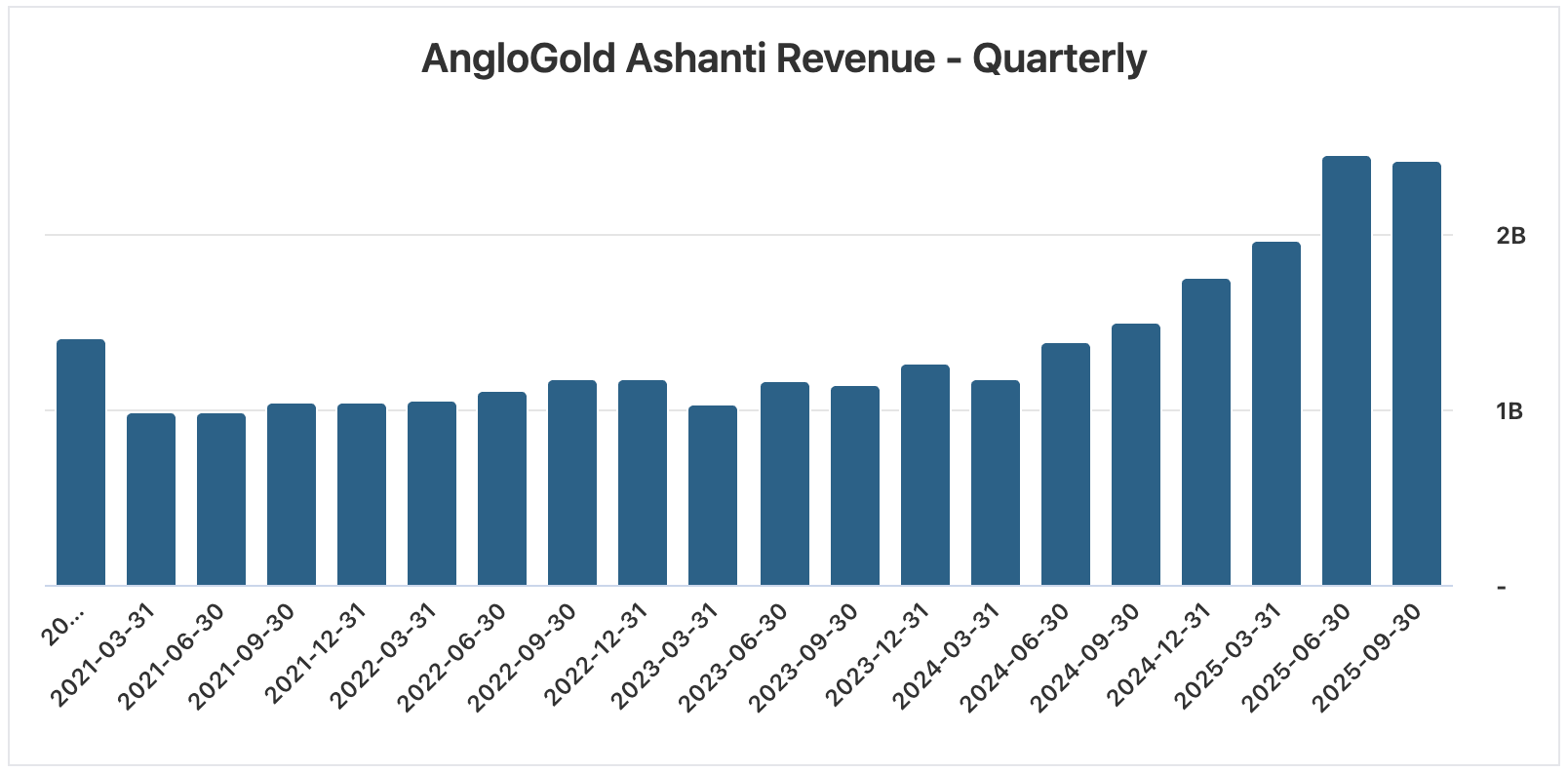

Revenue:

Check out our Weekly Watchlist!

If you haven’t already, check out our Elite watchlist updated every week:

This is also available in the elite discord.

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.