Crown Elite: 2 Stock Picks

Here are your 2 stocks that we have hand-picked based off of your investment criteria. If you haven’t done so yet, fill out your survey form emailed to you so you can receive personalized picks.

If you are interested in receiving different picks then please send me an email at [email protected].

1 Year performance

APP - 739.01%

IBKR - 109.25%

Your 2 Stock Picks

Applovin Corp (APP)

Category: Growth

Market Cap: $109B

Company Info:

AppLovin is a technology company that provides a suite of tools and services to help mobile app developers grow and monetize their apps. It offers an integrated platform with solutions for app discovery, user acquisition, and in-app advertising. AppLovin’s primary products include its ad network, which connects advertisers with targeted audiences, and its AppLovin SDK, which enables developers to integrate ads seamlessly into their apps. Additionally, the company owns and operates a portfolio of mobile apps and games, leveraging its platform to optimize performance and revenue. AppLovin helps developers maximize app engagement and profitability through data-driven insights and machine learning algorithms.

Why it’s a buy:

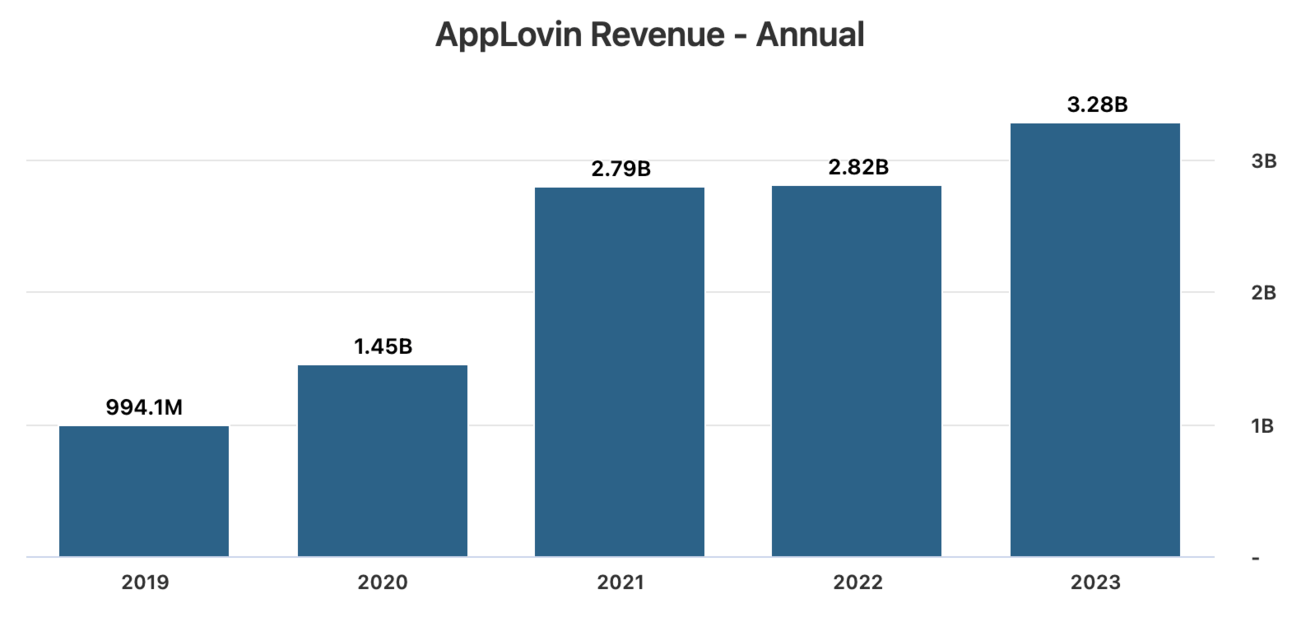

AppLovin is a compelling buy due to its robust financial performance and strategic positioning within the rapidly expanding mobile advertising market. In 2023, the company reported revenue of approximately $3.28 billion, marking a 16.5% increase from the previous year.

This growth trajectory continued into 2024, with a 41.5% year-over-year increase, bringing the trailing twelve months' revenue to $4.29 billion as of September 30, 2024. Such consistent revenue expansion underscores AppLovin's effective monetization strategies and its ability to scale operations efficiently.

The mobile advertising industry is experiencing significant growth, with projections indicating a rise from $214.59 billion in 2024 to over $1 trillion by 2032, reflecting a compound annual growth rate (CAGR) of 21.8%.

AppLovin's comprehensive suite of tools and services positions it favorably to capitalize on this expanding market. Its advanced machine learning capabilities and strategic acquisitions have enhanced its platform, enabling app developers to optimize user acquisition and monetization effectively.

Given these industry dynamics and AppLovin's strategic initiatives, the company is well-positioned for sustained growth, making its stock an attractive consideration for investors seeking exposure to the burgeoning mobile advertising sector.

Revenue:

Interactive Brokers Group Inc. (IBKR)

Category: Growth

Market Cap: $74.3B

Company Info:

Interactive Brokers Group is a global brokerage firm that provides online trading and investment services to individual and institutional clients. The company offers a wide range of financial products, including stocks, options, futures, forex, and fixed-income instruments, through a sophisticated trading platform known for its low-cost structure and advanced tools.

Why it’s a buy:

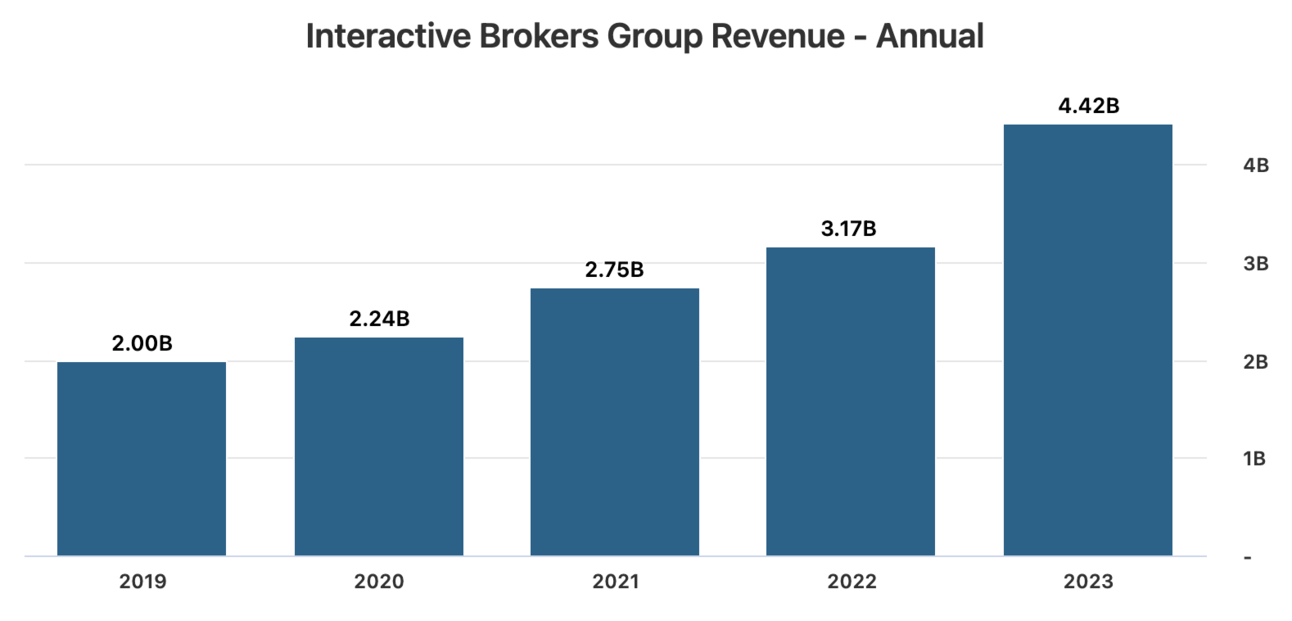

Interactive Brokers is a strong buy due to its robust financial performance and strategic positioning within the global brokerage industry.

In the third quarter of 2024, the company reported revenue of $1.365 billion, a 19.21% increase year-over-year, driven by a 31% surge in commission revenue to $435 million, reflecting higher trading volumes.

This growth trajectory continued into the trailing twelve months ending September 30, 2024, with revenue reaching $4.937 billion, an 18.19% increase from the same period in the previous year.

The company's strong performance is further evidenced by a 74% year-over-year increase in Daily Average Revenue Trades (DARTs) in November 2024, indicating heightened trading activity among clients.

Additionally, IBKR's net income for the twelve months ending September 30, 2024, was $698 million, a 21.18% increase year-over-year, highlighting its effective cost management and operational efficiency.

These financial metrics underscore Interactive Brokers' strong market position and growth potential, making its stock an attractive consideration for investors seeking exposure to the brokerage industry.

Revenue:

Let me know your thoughts!

As always you are more then welcome to send me an email at [email protected] or DM me on instagram @crowntradingllc if you have any questions about the market or stock opportunities.

If you would like to see specific statistics about the companies in these newsletters reach out to me with your suggestions!

Thank you for reading!

Jordan K.