GOOD MORNING

Here’s everything you need to know today: There are currently 14,157 publicly traded companies in the United States and over 1000+ articles released about S&P500 companies alone every single day. Today we will be showing you our top 3 stock picks we have hand picked for this week:

1 year performance

PEN - 47%

DAVE - 213%

WAY - 91%

This Week (Here’s our top 3 stock picks)

Penumbra Inc (PEN)

1 Year Performance: +47%

Category: Growth

Market Cap: $11.6B

Company Info:

Penumbra Inc. is a medical device company that designs, develops, and manufactures innovative technologies for neurovascular and peripheral vascular conditions. Their products are primarily used in thrombectomy (removal of blood clots) and embolization (blocking abnormal blood vessels) procedures.

Headquartered in Alameda, California, Penumbra serves a global market, providing minimally invasive solutions for treating conditions such as stroke, aneurysms, and pulmonary embolisms. The company is known for its Lightning Flash™ and Indigo® systems, which utilize computer-assisted vacuum thrombectomy technology to improve patient outcomes.

Why it’s a buy:

Penumbra Inc. (NYSE: PEN) is considered a buy due to its strong financial performance, innovative product pipeline, and favorable analyst sentiment.

In Q1 2025, Penumbra reported revenue of $324.1 million, a 16.3% increase year-over-year, driven by a 25% rise in U.S. thrombectomy revenue. The company achieved a gross margin of 66.6%, up from 65.0% in the previous year, and an operating margin of 12.4%, reflecting improved profitability.

Penumbra's commitment to innovation is evident in its recent FDA clearance of the Ruby XL device and the upcoming Thunderbolt catheter, which are expected to enhance its market position in thrombectomy and stroke treatment.

Analysts maintain a "Strong Buy" consensus rating, with price targets ranging from $260 to $340, and an average target of $318.59, indicating confidence in the company's growth prospects.

With a robust financial outlook, innovative product developments, and strong analyst support, Penumbra presents a compelling investment opportunity in the medical device sector.

Revenue:

Dave Inc (DAVE)

1 Year Performance: +213%

Category: Momentum

Market Cap: $2.1B

Company Info:

Dave Inc. is a Los Angeles-based fintech company offering a mobile-first banking platform designed to provide accessible financial tools for everyday consumers. Its services include ExtraCash™, which offers interest-free cash advances up to $500, Dave Banking with no overdraft fees, and Side Hustle, a feature that helps users find gig work opportunities.

The company leverages AI-driven tools like CashAI™ for underwriting and DaveGPT for customer support, aiming to simplify personal finance management for its over 11 million members.

Why it’s a buy:

Dave Inc. (NASDAQ: DAVE) is considered a buy due to its exceptional financial performance, strong growth trajectory, and robust analyst support.

In Q1 2025, Dave reported revenue of $108.0 million, marking a 47% year-over-year increase, and achieved net income of $28.8 million. The company's adjusted EBITDA surged by 235% year-over-year to $44.2 million, reflecting significant operational efficiency and profitability. The company's ExtraCash originations grew by 46% to $1.5 billion, with a notable improvement in credit quality, as evidenced by a 28-day delinquency rate reduction of 33 basis points to 1.50%. These metrics underscore Dave's effective risk management and the success of its CashAI underwriting model.

Analysts are optimistic about Dave's prospects, with Barrington Research raising its price target to $150 and maintaining an Outperform rating. The average analyst price target stands at $125.57, indicating potential upside from current levels.

With a strong balance sheet, innovative product offerings, and a clear path to sustained profitability, Dave Inc. presents a compelling investment opportunity in the fintech sector.

Revenue:

Waystar Holding Corp (WAY)

1 Year Performance: +91%

Category: Momentum

Market Cap: $6.9B

Company Info:

Waystar Holding Corp. is a healthcare technology company that provides cloud-based software solutions to streamline and automate the revenue cycle management (RCM) process for healthcare providers. Its platform encompasses services such as financial clearance, claim management, payment processing, denial prevention, and analytics, aiming to simplify healthcare payments and enhance financial performance for its clients.

Serving approximately 30,000 clients, including over 1 million healthcare providers, Waystar's platform processes over 5 billion healthcare payment transactions annually, representing more than $1.2 trillion in gross claims and covering about 50% of the U.S. patient population.

Why it’s a buy:

Waystar Holding Corp. (NASDAQ: WAY) is considered a buy due to its strong financial performance, robust growth trajectory, and positive analyst sentiment.

In Q1 2025, Waystar reported revenue of $256.4 million, marking a 14% year-over-year increase, and achieved a net income of $29.3 million, with an adjusted EBITDA margin of 42%. The company also raised its full-year revenue guidance to between $1.006 billion and $1.022 billion, reflecting confidence in sustained growth.

Analysts have shown optimism, with Truist Securities raising its price target to $50, citing strong Q1 performance and strategic growth initiatives. The average analyst price target stands at $48.00, indicating potential upside from current levels.

With a solid financial outlook, strategic initiatives, and strong analyst support, Waystar presents a compelling investment opportunity in the healthcare technology sector.

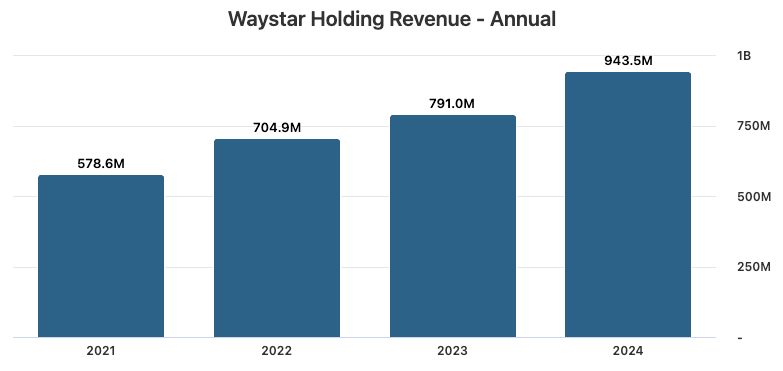

Revenue:

Get more picks like Dave…

If you are interested in receiving more of our top stock picks like Dave sign up to our Elite Membership where you get access to:

3 curated emails a week (monday, wednesday, friday) with 2 hand-picked Elite stocks in each email

1 report a week (sunday) on the general market and state of where the stock market is it currently

Direct email contact with myself to ask any questions regarding stock knowledge

Exclusive offers from any of our partners (trade software, brokers, news sources, etc.)

2 week money back guarantee (100% refund)

Join today for only $19.99/month or $199.99/year.

Otherwise, stay tuned for our next free release at 8:15 am EST (Monday and Friday).

OUR RECENT ELITE TRADES (updated Mar 12/25)

Date Posted | Ticker | Price | Current Price | Gain/Loss |

|---|---|---|---|---|

Jan 10/25 | SE | $105 | $129 | 22.8% |

Jan 13/25 | DOCS | $49 | $64 | 30.6% |

Jan 15/25 | SPOT | $476 | $535 | 12.4% |

Jan 10/25 | BB | $3.9 | $4.37 | 12.1% |

Jan 13/25 | DAVE | $86 | $81 | 6.1% |

If you invested $10,000 in each of these stocks you’d be sitting on:

$58,340

In less than 2 months...

Join Crown Elite today for only $19.99/month or $199.99/year

and get our Elite Picks Emailed to you every Monday, Wednesday and Friday.

Get Over $6K of Notion Free with Unlimited AI

Running a startup is complex. That's why thousands of startups trust Notion as their connected workspace for managing projects, tracking fundraising, and team collaboration

Apply now to get up to 6 months of Notion with unlimited AI free ($6,000+ value) to build and scale your company with one tool.

Thank you for your time!

I’m sure you get hundreds of emails a day so I thank you for taking the time to read ours. Please follow us on our social media channels below where we post other new and different content related to investing, personal finance, and trading.