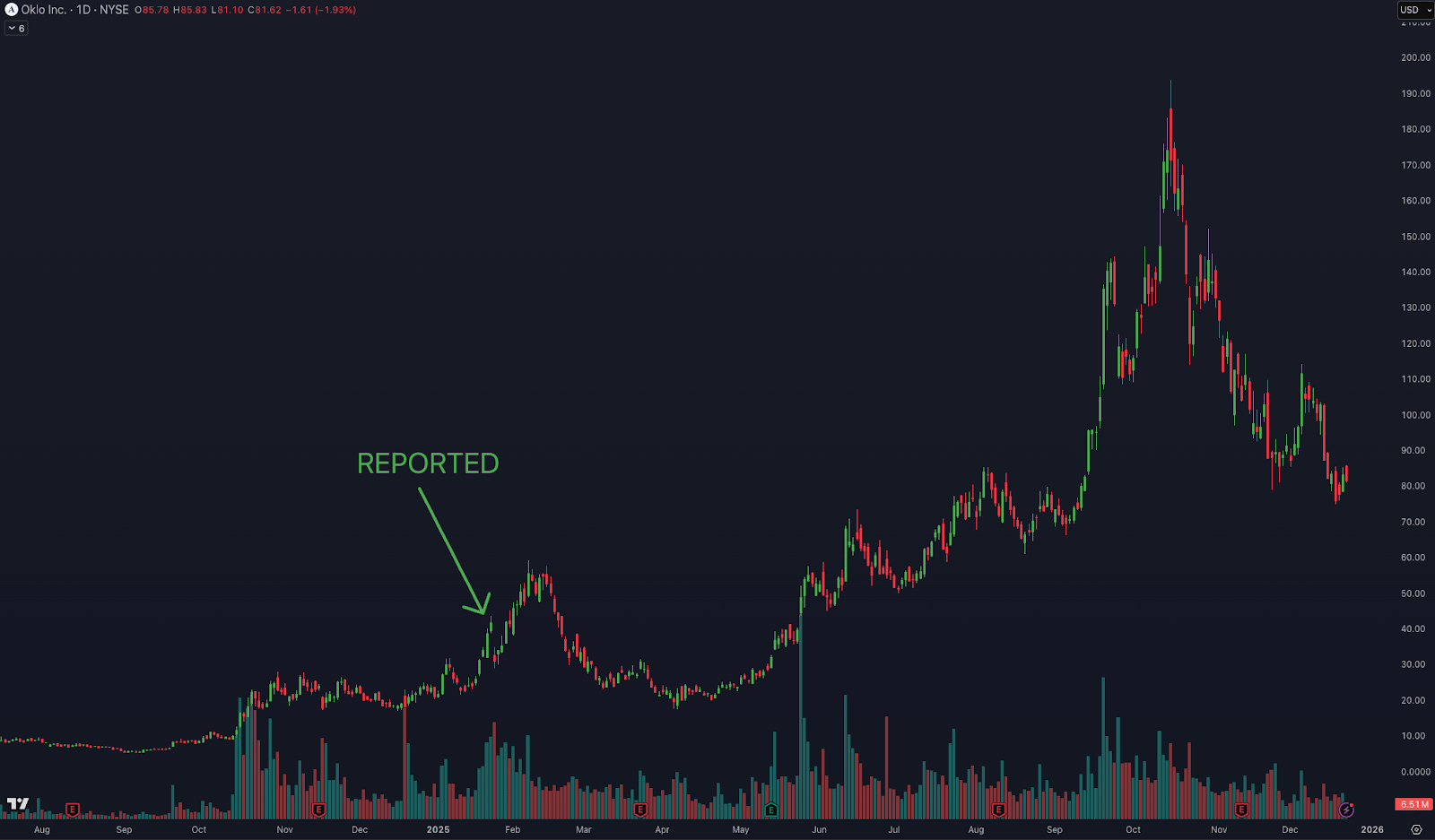

CASE STUDY: How We Tracked OKLO

(Later moved +527%)

It’s easy to look at a stock that moved +500% and think:

“Everyone must’ve made money on that.”

That’s rarely true.

In fact, most traders lose money on big momentum stocks—not because they missed the move, but because they interacted with it the wrong way.

OKLO is a perfect example.

This case study breaks down why tracking momentum properly made all the difference.

And even some smart practices from our Momentum members.

WHEN OKLO FIRST HIT OUR RADAR

Back in late January, Oklo Inc. (OKLO) showed up on our radar:

Not as a headline or a “hot tip.”

But as a stock quietly shifting behavior with:

Strong performance over the prior year

Increasing attention and volume

A change in how price was reacting to pullbacks

This is where momentum starts—before most people care.

We highlighted OKLO for Momentum members and began tracking it in real time alongside everyone.

But the next steps are what made the difference.

WHAT WE DID NEXT

(THIS IS THE PART MOST PEOPLE SKIP)

Instead of rushing in, inside Momentum, we did the work most traders avoid:

We mapped out historical support areas

We identified where momentum would likely stall or reset

And we defined where the whole idea would be invalidated

That meant we weren’t guessing. We knew:

Where buyers had stepped in before

Where traders were likely to take profits

Where the thesis would stop making sense

Sounds simple right?

Wrong.

If you don’t know how to identify these momentum signals properly, it’s easy to mistime everything.

WHY MANY PEOPLE LOST MONEY ON A 500% MOVE

OKLO didn’t go straight up. It moved in phases with:

Sharp runs

Pullbacks

Consolidations

Multiple pushes higher

Each phase created excitement (and traps.)

This made many inexperienced traders:

Buy into strength after big green candles

Chase headlines mid-move

Get shaken out during normal pullbacks

Because they didn’t know:

Where true support actually was

Where momentum was likely to pause

Whether a pullback was normal or a sign of invalidation

Luckily, our members we weren’t reacting to each swing.

We already had context to look out for. And it paid off huge.

HE POWER OF PATIENCE

(TRACKING, NOT CHASING)

This is the unsexy part—but it’s the edge.

We continued to track OKLO week after week inside Momentum:

Watching how it behaved around key levels

Letting momentum reset instead of forcing entries

Staying aligned with the broader market context

That patience is what kept us from:

Buying tops

Panic-selling pullbacks

Second-guessing every move

Some members rode multiple waves of momentum.

Momentum trading rewards people who wait with a plan, not those who rush.

THE RESULT (OVER TIME)

From those early tracking levels, OKLO eventually went on to rally more than +500%.

Not because we predicted it.

But because we:

Understood the structure

Knew where risk changed

Stayed focused while others chased

That’s the difference between watching a stock go up and actually being positioned correctly when it matters.

WANT THIS PROCESS WORKING FOR YOU?

This is exactly how Crown Momentum works.

Every week, members get:

Early watchlists showing what to pay attention to

Clear price context (historical support, likely resistance, invalidation)

Focused stock picks—not noise to clutter your feed

Ongoing tracking so you’re not guessing alone

Discord access to discuss market context and how momentum trading works

No years of trading experience or massive portfolios required.

If you want to stop jumping into moves with horrible timing—and start tracking momentum before the market piles in…

I want to invite you to try Momentum free for 14 days to set yourself up for a big 2026.

We’ll show you how this process plays out in real time, every week.

Trial offer ends Dec 31

— Jordan 👑

Crown Trading