Sponsored on behalf of Minehub Technologies

This Tiny SaaS Stock Is Quietly Powering $15B of Global Metals Trade — Here’s How

This company is MineHub Technologies, ticker symbols MHUB on the TSX Venture Exchange and MHUBF on the OTCQB, and it’s the sponsor of this post.While most investors chase mining stocks digging rock out of the ground, MineHub is building the digital rails that move it. Its platform already processes more than $15 billion in annual transaction volume, connecting nearly 200 counterparties — including global giants BHP, Codelco, Sumitomo, and Trafigura.

MineHub’s system digitizes every step of metals trading — from contracts and shipping logistics to payments and ESG traceability — cutting settlement times nearly in half. With a recurring SaaS + transaction-fee model, each new enterprise user pulls their entire supply chain onto the platform, creating a powerful network effect.

They don’t mine copper — they control the software infrastructure that powers the $2 trillion global metals trade. With real revenue, real adoption, and a micro-cap valuation, MineHub could be one of the most overlooked SaaS plays in the commodities world right now.

⚠️ This is not financial advice. Please read the full disclaimer in the description. We partnered with Minehub Technologies to make this content.

Disclaimer: We have partnered with Minehub Technologies for this post. Crown Trading was compensated for this post on behalf of The Cashu Group. This post is for informational purposes only and does not constitute financial advice. Viewers should consult a financial professional before making investment decisions.

Top 5 Momentum Stocks Right Now

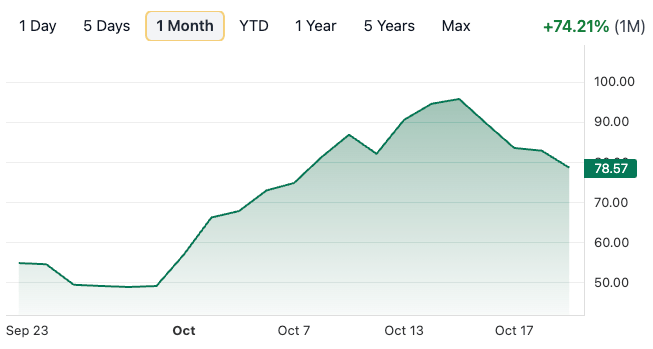

AST SpaceMobile Inc (ASTS)

AST SpaceMobile has rocketed +74% over the past month as investors flock to satellite connectivity plays. The company is building the first space-based cellular broadband network, designed to deliver 5G directly to smartphones without the need for ground towers.

Momentum exploded after successful satellite tests with AT&T and Vodafone, proving the potential for global coverage from orbit. With commercial rollout plans advancing and a growing partnership list that includes major telecoms, ASTS is emerging as one of the strongest momentum names in the entire space tech sector right now.

1 Month Performance:

Rigetti Computing Inc (RGTI)

Rigetti Computing has surged +41% in the past month as investors rotate back into quantum computing leaders. The company develops superconducting quantum processors designed to deliver exponential speedups in AI training, optimization, and simulation tasks.

Momentum picked up after Rigetti announced progress on its 84-qubit “Ankaa-3” chip, which could set new benchmarks in error correction and computing power. With rising investor interest in next-gen computing and AI infrastructure, RGTI is quickly becoming one of the hottest small-cap tech momentum plays on the market right now.

1 Month Performance:

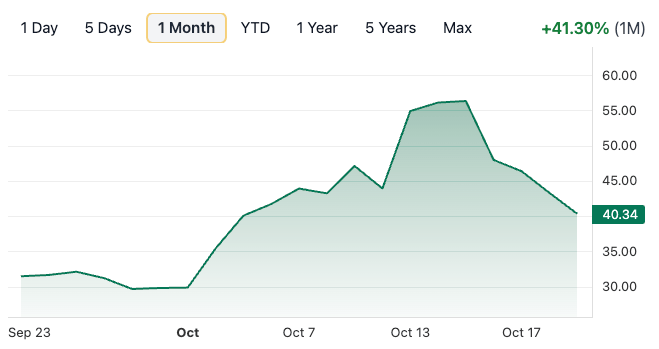

Applied Digital Corp (APLD)

Applied Digital Corp has jumped +60% over the past month as traders pour into AI data infrastructure stocks. The company builds and operates high-performance data centers designed specifically for AI workloads, cloud computing, and blockchain applications.

The surge comes after strong demand from AI clients and new capacity expansions aimed at boosting total power availability across its Texas facilities. With AI infrastructure spending booming and Applied Digital scaling rapidly, APLD has become one of the top-performing data center and AI infrastructure stocks in the market this month.

1 Month Performance:

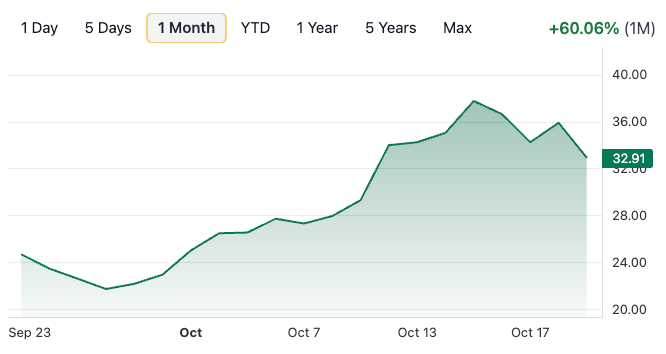

Cipher Mining Inc (CIFR)

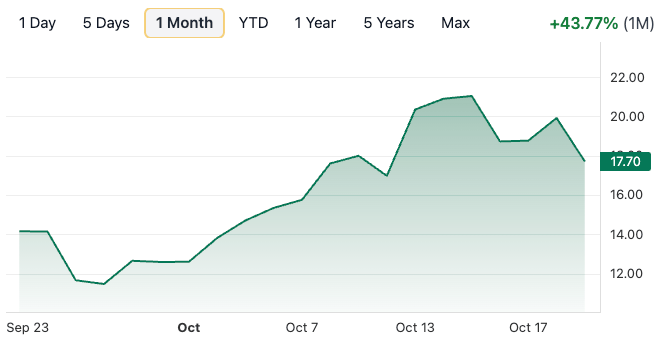

Cipher Mining has climbed +43% over the past month as crypto-linked infrastructure stocks surge alongside Bitcoin’s latest rally. The company operates large-scale Bitcoin mining data centers powered by low-cost renewable energy, giving it a key advantage in profitability and scalability.

The move higher follows record production updates and expanded capacity at its Odessa and Bear sites, signaling strong execution and rising output ahead of the next halving cycle. With institutional demand for Bitcoin mining exposure heating up, CIFR is emerging as one of the most powerful momentum names in the digital infrastructure space right now.

1 Month Performance:

IREN Ltd (IREN)

IREN Ltd has rallied +38% over the past month as investors pile into AI and digital infrastructure stocks with crypto exposure. The company operates renewable-powered data centers that support both Bitcoin mining and high-performance AI computing, giving it a unique hybrid position in two fast-growing industries.

The surge comes after IREN announced major GPU purchases and a new AI cloud division, signaling a strategic shift beyond mining and into AI data services. With demand for clean, scalable compute power accelerating, IREN is quickly becoming one of the strongest momentum names in the AI-infrastructure crossover space right now.

1 Month Performance:

We send stocks like this all the time inside our Crown Elite Research Service.

You get access to real trade setups before they move with —

full breakdowns

ideal buy levels

stop loss levels

price targets

weekly watchlists and reports

and more..

Sign up before October 20 and you’ll also get my Top 5 Elite Stocks for October 2025 list.

After the 20th, the bonus is gone.

Talk soon,

— Jordan

👑 Crown Trading