Top 3 Momentum Stocks Right Now

Arrowhead Pharmaceuticals, Inc. (ARWR)

Arrowhead Pharmaceuticals, Inc. (NASDAQ: ARWR) has surged +53% over the past month as investors rotate aggressively into next-generation RNA therapeutics. The company is a leader in RNA interference (RNAi) drug development — a breakthrough technology designed to silence disease-causing genes at the source, offering targeted treatments with fewer side effects.

The rally accelerated after a wave of positive clinical updates, including strong Phase 2 data for multiple cardiometabolic and pulmonary programs, which reinforced confidence in Arrowhead’s expanding pipeline. Partnerships with major pharma players like Amgen, Janssen, and Takeda continue to validate its platform and provide long-term revenue potential. With momentum building across gene-silencing therapies and Arrowhead advancing one of the most diverse RNAi pipelines in the industry, ARWR is quickly becoming one of the most compelling momentum names in biotech right now.

1 Month Performance:

Compass, Inc. (COMP)

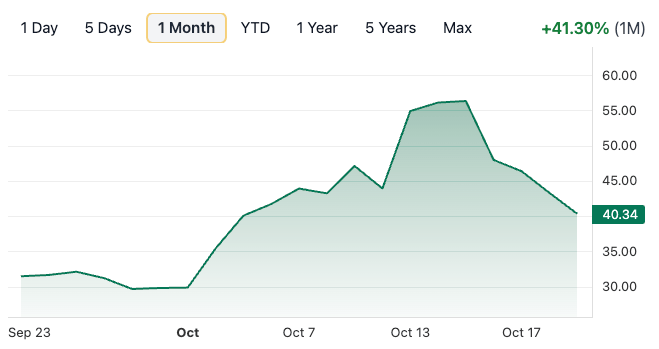

Compass, Inc. (NYSE: COMP) has jumped +41% over the past month as investors pile into real estate tech names showing signs of a cyclical recovery. The company operates one of the largest tech-enabled brokerage platforms in the U.S., using advanced software, AI-driven marketing tools, and centralized data systems to help agents close deals faster and more efficiently.

The surge comes after stronger-than-expected housing activity, rising transaction volume in key coastal markets, and improving profitability metrics that signal Compass may be turning a corner after years of restructuring. With interest rates stabilizing and real estate demand gradually recovering, Compass’s integrated platform and massive agent network position it as one of the strongest momentum plays in the housing-tech sector right now.

1 Month Performance:

Teva Pharmaceutical Industries Limited (TEVA)

Teva Pharmaceutical Industries Limited (NYSE: TEVA) has climbed +35% over the past month as investors rotate back into undervalued large-cap pharma names showing tangible signs of turnaround. As one of the world’s largest producers of generics and specialty medicines, Teva is executing a multi-year restructuring focused on deleveraging, stabilizing revenues, and expanding its branded drug pipeline.

The rally gained momentum after strong quarterly results, improved guidance, and growing optimism around key assets like Austedo and Teva’s emerging biosimilar portfolio. Progress in reducing long-standing legal overhangs has also boosted sentiment, helping re-rate the stock after years of pressure. With financial discipline improving, core products growing, and investor confidence returning, TEVA is emerging as one of the most compelling momentum stories in the global pharma space right now.

1 Month Performance:

Want Done-For-You Market Research And Picks With Strategy?

We manually analyze hundreds of stocks daily and pass our top plays to Crown Elite Members

Every member gets full breakdowns with:

Exact entry zones we want to see before jumping in

Stop-loss levels in case the market has other plans

Position sizing guidance based on current volatility

Risk/reward analysis so you know how top traders think

Sign up before December 8 and you’ll also get my Top 5 Elite Stocks for December 2025 list.

After the 8th, the bonus is gone.

Talk soon,

— Jordan

👑 Crown Trading