Sponsored on behalf of Saga Metals Corp.

Disseminated on behalf of Saga Metals Corp.

This Microcap Miner Just Landed a $44M Lithium Deal with Rio Tinto And It’s Still Flying Under the Radar

The third stock is Saga Metals (tickers: SAGA on the TSX-V and SAGMF on the OTCQB) and it’s emerging as a high-upside play in the critical minerals space. The company is advancing three key assets in titanium, lithium, and uranium, all located in Canada.

Its flagship Radar Titanium Project in Labrador spans over 160 km² and is now undergoing a 15,000-meter drill program after equipment-maxing geophysical results. Titanium is essential for jets, armor, and missiles — and with China controlling over 60% of supply, Saga’s North American position is strategic.

The company also holds a lithium project in Quebec, backed by a $44 million earn-in deal with Rio Tinto, plus a high-grade, drill-ready uranium project in Labrador. With over $11 million raised, a market cap under $30 million, and an Outperform rating from analysts, Saga Metals could be one of the most overlooked names in the critical mineral boom.

Disclaimer: This newsletter was sponsored by Saga Metals Corp, and was funded by CAPITALIZ ON IT. We have been compensated for this newsletter. we only express my opinion based on my experience. Your experience may be different. This newsletter is for educational and inspirational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. There is no guarantee of gains or losses on investments. Please do your own due diligence. we are not a financial advisors, and this is not a financial advice channel. All information is provided strictly for educational purposes. It does not take into account anybody's specific circumstances or situation. If you are making investment or other financial management decisions and require advice, please consult a suitably qualified licensed professional.

The securities of Saga Metals Corp are speculative, and the company has not yet achieved consistent positive cash flow from operations. As a growth-stage company, it anticipates negative cash flow for the foreseeable future as it focuses on development and commercialization efforts. Parties viewing this video should thoroughly review the company’s public disclosure and documents available on https://www.sedarplus.ca/home/

See full disclaimer here: https://capitalizonit.com/saga/

Top 5 Momentum Stocks Right Now

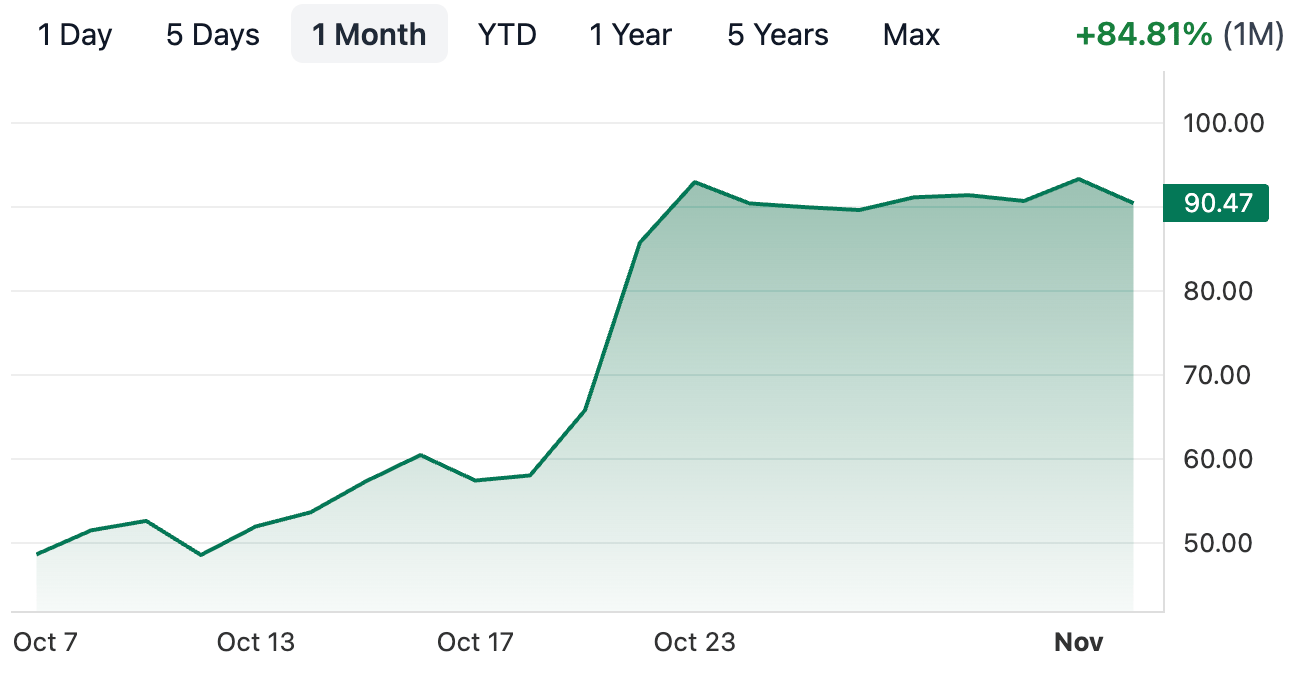

Vicor Corporation (VICR)

Vicor Corporation (NASDAQ: VICR) has surged +84% over the past month, igniting excitement across the AI hardware and semiconductor sector. The company designs high-performance power modules used in AI data centers, GPUs, and advanced computing systems — making it a quiet but critical player in the infrastructure behind the AI boom.

The rally gained momentum after strong earnings and renewed investor focus on next-gen power efficiency solutions essential for NVIDIA, AMD, and hyperscale data centers. As demand for AI accelerators soars, Vicor’s patented power-on-package technology positions it as a key enabler of faster, cooler, and more efficient chips.

With AI infrastructure spending expected to exceed $200 billion by 2026, and Vicor’s technology already embedded in leading AI systems, VICR is emerging as one of the most explosive under-the-radar names in the AI semiconductor supply chain right now.

1 Month Performance:

Lumen Technologies, Inc. (LUMN)

Lumen Technologies (NYSE: LUMN) has climbed +65% over the past month as investors return to undervalued telecom and fiber infrastructure plays. The company operates one of the largest global fiber networks, powering enterprise data, cloud connectivity, and high-speed internet across 60+ countries.

Momentum accelerated after better-than-expected earnings and optimism around network modernization efforts and AI-driven data demand. Lumen’s quantum fiber expansion and strategic debt reduction have reignited confidence that the company is turning the corner after years of decline.

With AI workloads, cloud computing, and 5G backhaul fueling record bandwidth needs, LUMN is positioning itself as a revival story in the digital infrastructure sector — transforming from a legacy telecom into a high-capacity data backbone for the next era of global connectivity.

1 Month Performance:

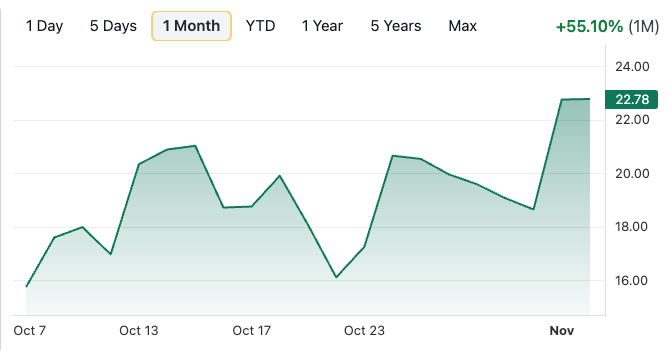

Cipher Minings Inc. (CIFR)

Cipher Mining Inc. (NASDAQ: CIFR) has skyrocketed +55% over the past month, cementing its status as one of the strongest momentum plays in the AI and Bitcoin infrastructure space. The company operates high-efficiency data centers dedicated to Bitcoin mining and next-generation compute infrastructure, with a growing focus on AI-driven energy optimization.

The surge follows record production updates, a sharp increase in Bitcoin prices, and expanding capacity at its Texas facilities, which now rank among the most energy-efficient in North America. Investors are also betting on Cipher’s low-cost power contracts and strategic shift toward AI hosting, positioning it to capitalize on the convergence of crypto mining and AI computing.

With triple-digit growth, scaling operations, and rising exposure to both digital assets and AI infrastructure, CIFR is emerging as one of the top breakout names in the high-performance data and energy tech sector this quarter.

1 Month Performance:

Sandisk Corporation (SNDK)

SanDisk Corporation (NASDAQ: SNDK) has soared +54% over the past month, making it one of the hottest momentum names in the semiconductor and data storage sector. The rally comes as investors pile into memory and flash storage stocks amid surging demand for AI servers, smartphones, and edge computing devices.

The move follows strong earnings results, improved NAND pricing, and renewed optimism around next-generation solid-state storage powering the AI revolution. SanDisk’s high-performance flash solutions are increasingly critical to data centers and device manufacturers looking to handle massive AI-driven workloads efficiently.

With AI infrastructure spending accelerating and memory prices rebounding, SNDK is emerging as a major comeback story in the semiconductor space — positioning itself at the center of the global shift toward high-speed, high-capacity data storage.

1 Month Performance:

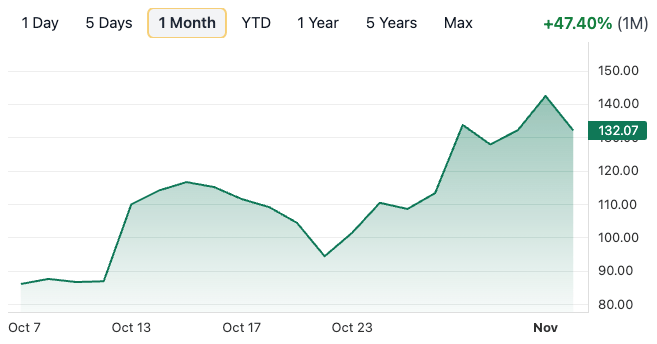

Bloom Energy Corporation (BE)

Bloom Energy Corporation (NYSE: BE) has skyrocketed +47% over the past month, becoming one of the most explosive breakout stories in the clean energy and AI infrastructure sectors. The company develops solid oxide fuel cells that provide on-site, zero-carbon power generation — a technology increasingly sought after for AI data centers, defense, and grid-resilient energy systems.

The massive rally comes after record quarterly results, new AI-focused partnerships, and growing recognition that Bloom’s modular energy platforms can deliver the reliable, low-emission power required by hyperscale data operations. Investors are betting that Bloom’s innovation will play a central role in decarbonizing digital infrastructure and meeting the energy demands of the AI boom.

With its cutting-edge fuel cell technology, surging institutional interest, and a transformational growth narrative, BE is emerging as one of the most powerful momentum leaders in the clean tech and AI energy convergence story this year.

1 Month Performance:

We send stocks like this all the time inside our Crown Elite Research Service.

You get access to real trade setups before they move with —

full breakdowns

ideal buy levels

stop loss levels

price targets

weekly watchlists and reports

and more..

Sign up before November 10th and you’ll also get my Top 5 Elite Stocks for November 2025 list.

After the 10th, the bonus is gone.

Talk soon,

— Jordan

👑 Crown Trading