Let's be honest: this week was brutal.

The S&P dropped 1.59%, the Nasdaq shed 2.67%, and if you're holding growth stocks, you probably felt it.

But here's what separates winning traders from the crowd:

→ While others panic-sell, we're scanning for oversold opportunities

→ While everyone's frozen, we're identifying which stocks have real support

→ While the news screams "crash," we're positioning for the bounce

This is where momentum research matters most.

Anyone can find stocks going up in a bull market. The real edge is knowing:

Which stocks are getting irrationally hammered (and due for a snap-back)

Which ones are breaking critical support (and should be avoided entirely)

Where institutional money is quietly positioning

⚠️ WANT TO SEE WHAT STOCKS WE ARE WATCHING?

We just dropped a new batch of setups inside Crown Elite — and you're invited.

Elite members got this morning:

Full technical breakdowns on all 3 stocks (including exact entry zones)

Stop-loss levels to protect capital if we're wrong

Risk/reward analysis (so you know when to cut losses)

Position sizing guidance based on current volatility

Our latest Elite alert: $GH → Up 50% In the past month

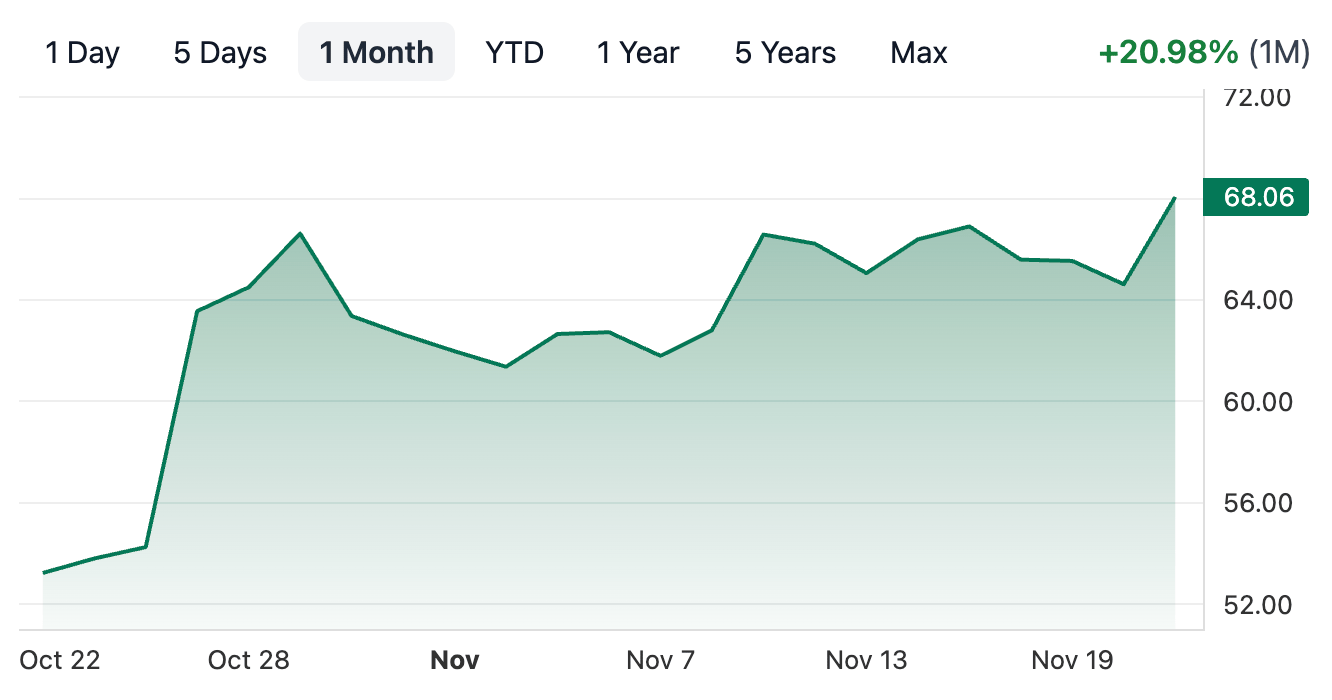

Biotech stocks are heating up again — and this late-stage genetic medicine company has quietly climbed 21% in the past month as investors rotate back into high-conviction clinical names with real breakthrough potential.

The company is BridgeBio Pharma (BBIO) — a leading developer of targeted therapies for rare genetic diseases and serious cardiovascular conditions. After a choppy year for biotech, BridgeBio is emerging as one of the strongest momentum stories in the sector, powered by major clinical progress and renewed confidence in its late-stage pipeline.

So what’s fueling the move? BridgeBio recently delivered positive new clinical updates in its ATTR-CM program, which analysts believe has blockbuster potential in the growing cardiomyopathy market. The company is also advancing multiple Phase 3 and late-stage trials across oncology, neurology, and rare metabolic disorders — creating a packed 2025 catalyst calendar that traders are now positioning ahead of.

Beyond clinical wins, BridgeBio has bolstered its cash runway through smart partnership structures and strategic financing, giving it the capital flexibility needed to fund its highest-value programs without heavy dilution. Management has also highlighted increased inbound interest from large pharma companies looking to collaborate on rare-disease therapeutics — often a precursor to licensing deals or M&A activity in this corner of biotech.

Investors see a durable narrative forming: validated science, big upcoming catalysts, improving financial footing, and a pipeline with real commercial potential. With shares breaking through key resistance zones and momentum building, BBIO is shaping up to be one of the most compelling biotech rebound plays heading into 2025.

We send stocks like this all the time inside our Crown Elite Research Service.

You get access to real trade setups before they move with —

full breakdowns

ideal buy levels

stop loss levels

price targets

weekly watchlists and reports

and more..

Sign up before November 24 and you’ll also get my Top 5 Elite Stocks for November 2025 list.

After the 24th, the bonus is gone.

Talk soon,

— Jordan

👑 Crown Trading