Sponsored on behalf of SPARC AI

Disseminated on behalf of SPARC AI.

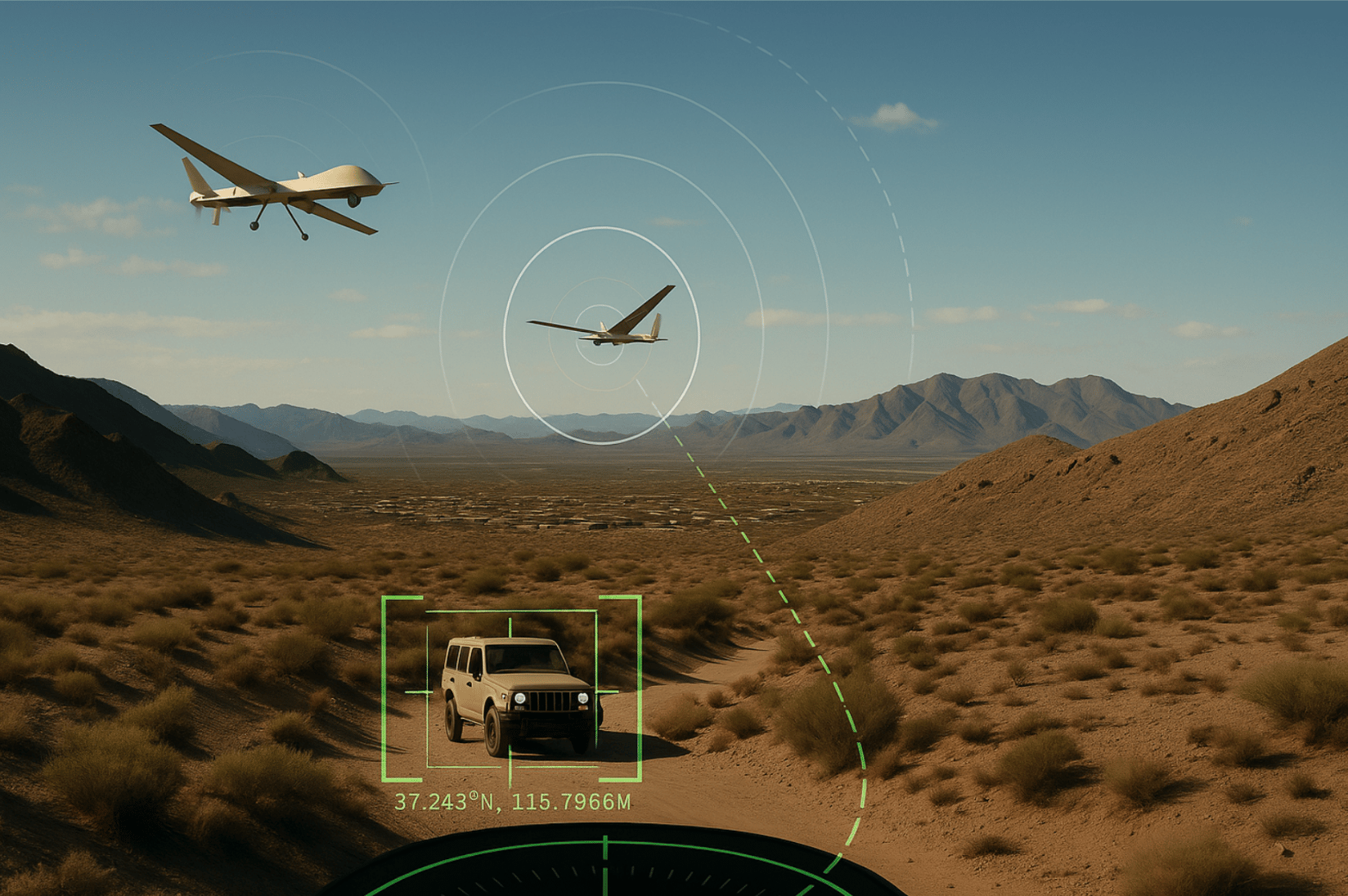

This Microcap AI Stock Just Entered the Defense Chat — And It’s Flying Under the Radar

This company is SPARC AI (CSE: SPAI, OTC: SPAIF) and is the sponsor of this post. Shares surged as defense investors discovered its breakthrough tech: GPS-free autonomous drones. SPARC’s flagship product, the STRIKE 1, is an AI-powered loitering munition designed for electronic warfare zones where GPS and communication are jammed. It operates completely independently, using onboard geospatial vision to navigate and target — even in swarms.

SPARC isn’t trying to build giant hardware platforms — it’s licensing high-margin AI software to defense contractors, with a capital-light model and recurring revenue potential. With a small market cap, real demos, and tech that solves a critical military problem, SPARC AI could be one of the most asymmetric AI-defense plays on the market right now.

⚠️ This is not financial advice. Please read the full disclaimer in the description. We partnered with Sparc AI to make this content.

Disclaimer: We have partnered with Sparc AI. for this post. Crown Trading was compensated for this post on behalf of Senergy Communications Capital Inc. This post is for informational purposes only and does not constitute financial advice. Viewers should consult a financial professional before making investment decisions.

AI infrastructure is quietly becoming the next battleground of the AI boom — and this telecom giant just surged over 41% in the past month as investors catch on to its massive pivot.

The company is Lumen Technologies (LUMN) — and it’s quickly turning from a struggling legacy telecom into one of the hottest emerging plays in AI connectivity. Lumen operates one of the largest fibre networks in North America, and it’s now marketing that network as the backbone for AI data movement — connecting cloud providers, data centers, and enterprises demanding lightning-fast performance.

What’s driving the surge? Lumen recently announced a multi-year partnership with Palantir Technologies, combining Palantir’s AI platform with Lumen’s private network infrastructure in a deal reportedly worth over $200 million. At the same time, the company unveiled plans to expand its fibre footprint by millions of miles and upgrade to 400 Gbps connections, directly targeting AI workloads that require low-latency data transfers between cloud regions and edge devices.

After years of decline, Lumen’s rebranding as an AI infrastructure company has reignited investor enthusiasm. Traders are betting the company’s network assets — once overlooked — could suddenly become essential as demand for AI compute and connectivity explodes.

If momentum continues, Lumen could be entering its own breakout phase — positioning itself as a critical player in the AI ecosystem, not by making chips, but by powering the high-speed digital highways that every AI model runs on.

We send stocks like this all the time inside our Crown Elite Research Service.

You get access to real trade setups before they move with —

full breakdowns

ideal buy levels

stop loss levels

price targets

weekly watchlists and reports

and more..

Sign up before October 20 and you’ll also get my Top 5 Elite Stocks for October 2025 list.

After the 20th, the bonus is gone.

Talk soon,

— Jordan

👑 Crown Trading