Quick Market Update

Volatility has stayed high into December and continues to test traders’ conviction. Yet the S&P 500 has quietly pushed to fresh record territory while the Nasdaq Composite remains near recent highs, so if you’ve been positioned in quality growth names, your portfolio likely caught another tailwind this week.

⚠️ WANT THE PRICE SETUPS WE’RE TARGETING FOR FREE?

We just dropped a new batch of setups inside Crown Elite this morning with:

Full technical breakdowns on all 3 stocks (including exact entry zones)

Stop-loss levels to protect capital if the market has other plans

Risk/reward analysis so you know how top traders think

Position sizing guidance based on current volatility

Our latest Elite alert: $LITE → Up 78% since OCT 27

3 STOCK PICKS THIS WEEK

1 year performance

RIVN - 37%

TKO - 47%

TPR - 97%

Here’s Our Top 3 Stock Picks For The 3rd Week Of December

Rivian Automotive, Inc. (RIVN)

1 Year Chart:

Buy Level: Unlock Buy Level

Stop Loss: Unlock Stop Loss

Price Target: Unlock Price Target

Market Cap: $23B

Company Info:

Rivian Automotive, Inc. (NASDAQ: RIVN) is an electric vehicle manufacturer developing all-electric pickup trucks, SUVs, and commercial delivery vehicles designed to accelerate the transition to sustainable transportation. Its flagship R1T and R1S platforms, along with a large-scale electric delivery van partnership, position Rivian as a key innovator in the future of EV manufacturing, battery technology, and clean mobility infrastructure.

Why it’s a buy:

RIVN looks like a dip buy right now because the recent selloff has been driven largely by macro pressure, EV-sector pessimism, and risk-off sentiment, not a breakdown in Rivian’s long-term vision. Global demand for electric vehicles continues to grow as governments push for decarbonization and energy independence, and Rivian remains one of the few pure-play EV manufacturers with scaled production, a differentiated product lineup, and a strong brand in trucks and SUVs.

The stock pulled back due to margin concerns, cash burn fears, and broader weakness across growth and EV names, but none of these issues change Rivian’s core technology, manufacturing roadmap, or demand profile. At the same time, the company continues to improve production efficiency, reduce costs per vehicle, and advance next-generation platforms, while maintaining long-term partnerships in commercial EVs. When you combine a compressed valuation with improving execution and a stabilizing EV adoption curve, RIVN sets up as a classic oversold name with asymmetric upside if sentiment shifts back toward growth and electrification.

Revenue:

TKO Group Holdings, Inc. (TKO)

1 Year Chart:

Buy Level: Unlock Buy Level

Stop Loss: Unlock Stop Loss

Price Target: Unlock Price Target

Market Cap: $40B

Company Info:

TKO Group Holdings, Inc. (NYSE: TKO) is a global sports and entertainment company formed through the combination of UFC and WWE, two of the most powerful and recognizable brands in live entertainment. The company operates a premium, IP-driven model built on live events, media rights, sponsorships, and direct-to-consumer monetization, positioning TKO at the center of the global demand for live sports, combat entertainment, and fan-driven content.

Why it’s a buy:

TKO looks like a dip buy right now because the recent pullback has been driven largely by broad market volatility and sentiment, not a deterioration in fundamentals, while the long-term live sports and entertainment story continues to strengthen. Global demand for premium live events is accelerating, media rights values remain resilient, and TKO controls two of the most powerful franchises in entertainment — UFC and WWE — with pricing power that few companies can replicate.

The stock has cooled following post-merger digestion, valuation concerns, and general weakness in discretionary names, but none of these factors change the durability of TKO’s business model, cash generation, or global brand dominance. At the same time, the company continues to expand media rights deals, sponsorship revenue, international events, and direct-to-consumer monetization, building a long runway for growth. When you combine a high-margin, IP-driven model with recurring revenue and a temporary sentiment-driven pullback, TKO sets up as a classic high-quality dip buy with asymmetric upside once markets stabilize.

Revenue:

Tapestry, Inc. (TPR)

1 Year Chart:

Buy Level: Unlock Buy Level

Stop Loss: Unlock Stop Loss

Price Target: Unlock Price Target

Market Cap: $26B

Company Info:

Tapestry, Inc. (NYSE: TPR) is a global luxury accessories and fashion company housing iconic brands including Coach, Kate Spade, and Stuart Weitzman, serving consumers across handbags, footwear, and lifestyle categories. Its portfolio of heritage brands, strong direct-to-consumer platform, and global retail footprint positions Tapestry as a key player in the evolution of modern, accessible luxury, balancing brand desirability with disciplined execution and long-term value creation.

Why it’s a buy:

TPR looks like a dip buy right now because the recent pullback has been driven largely by macro pressure and risk-off sentiment, not a breakdown in the company’s brand fundamentals or earnings power, while the long-term luxury consolidation story remains intact. Demand for accessible luxury continues to normalize post-inflation, and Tapestry’s portfolio of Coach, Kate Spade, and Stuart Weitzman gives it diversified exposure across price points, regions, and consumer segments — a resilience advantage many peers lack.

The stock sold off on concerns around consumer spending, integration risk, and broader retail weakness, but none of these factors undermine Tapestry’s strong cash flow generation, disciplined cost structure, or global brand equity. At the same time, management continues to drive margin expansion, DTC growth, and strategic scale benefits, setting up meaningful earnings leverage as conditions stabilize. When you combine a compressed valuation with improving macro visibility for discretionary spending, TPR shapes up as a classic oversold setup with asymmetric upside once sentiment toward consumer names turns.

Revenue:

WANT TO KNOW HOW WE’RE PLAYING THESE TOP 3 STOCK THIS WEEK?

If you’ve found value in today’s emails… I want to personally invite you to try 30 days of Crown Elite for free.

You’ll learn exactly how we’re navigating the stock market this week with:

✅ Premium stock picks all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my private trade chat

✅ Weekly elite watchlists every Sunday

✅ Buy Levels, Price Targets and Stop Losses to keep you ahead

✅ Full access to the stock pick archives + download vault

SOME OF OUR RECENT ELITE ALERTS:

• DAVE +211%

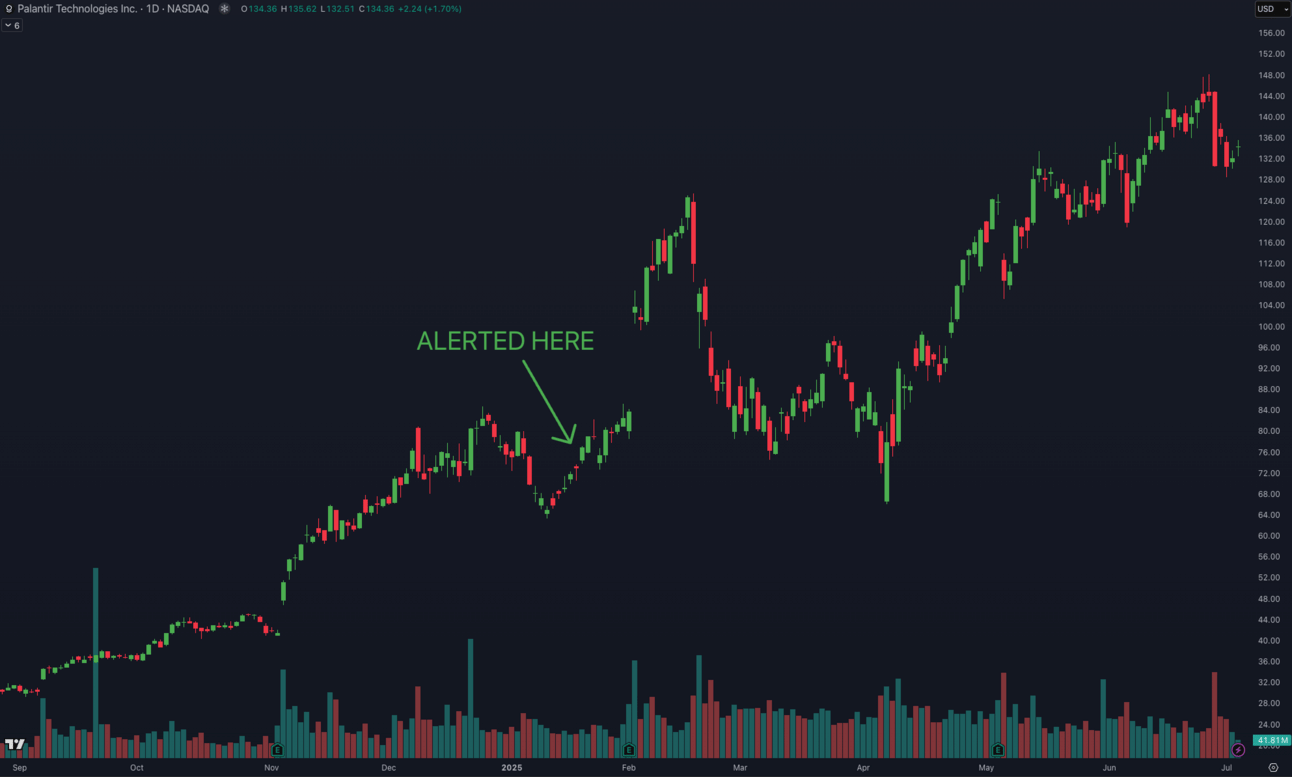

• PLTR +92.3%

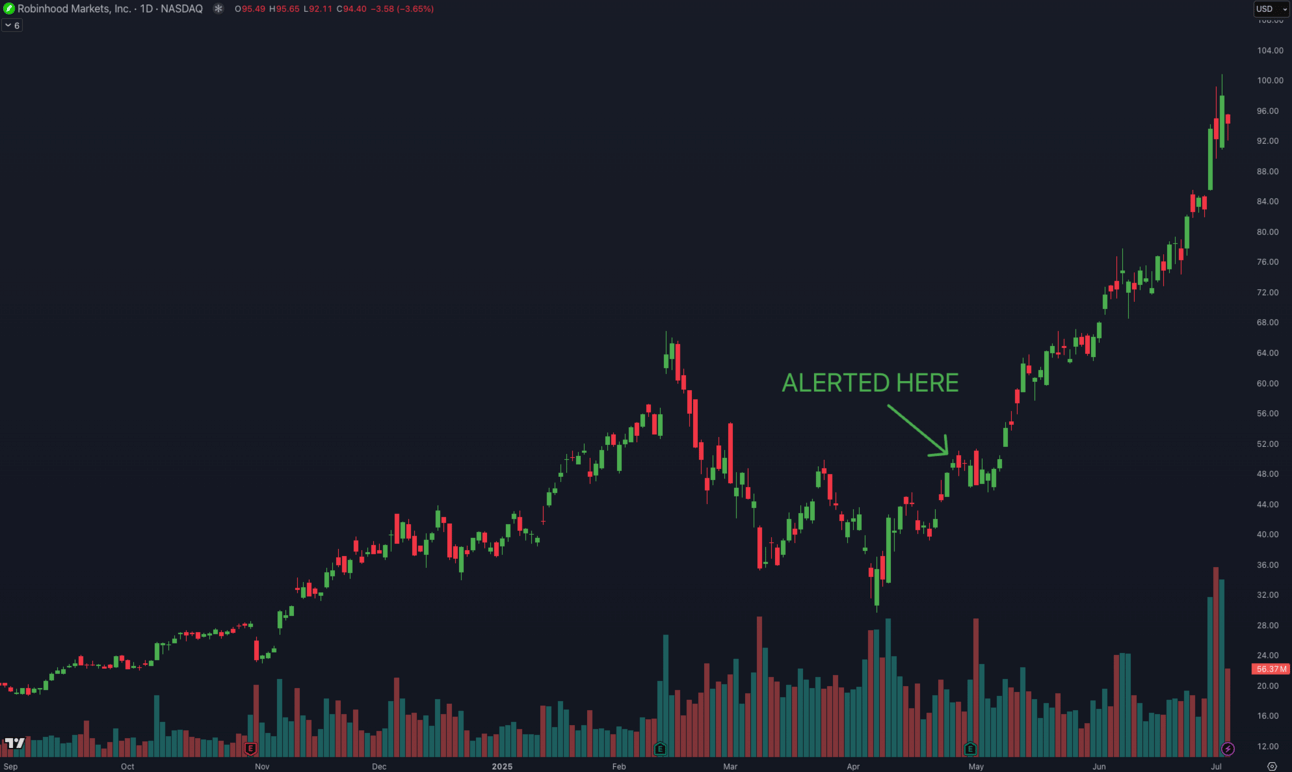

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.