Quick Market Update

Volatility is still elevated as December winds down, with sharp intraday swings keeping traders on edge. Yet the S&P 500 continues to hover near record territory and the Nasdaq Composite is holding close to recent highs, so investors positioned in quality growth and large-cap leaders may see the tailwind persist into next week if risk sentiment stays intact

⚠️ WANT PRICE BREAKDOWNS ON TODAY’S STOCKS FOR FREE?

We just dropped a new batch of setups inside MOMENTUM this morning with:

Full technical breakdowns on all 3 stocks

Price behavior we’re tracking

Risk/reward analysis so you know how top traders think

Free trial offer ends Dec 31st!

Our latest Elite alert: $LITE → Up 78% since OCT 27

3 STOCK PICKS THIS WEEK

1 year performance

MDGL - 99%

DAL - 20%

ADI - 32%

This Week: Our top 3 stock picks

Madrigal Pharmaceuticals, Inc. (MDGL)

1 Year Chart:

Technical Levels To Watch: Available in MOMENTUM

Risk Considerations: Available in MOMENTUM

Potential Upside: Available in MOMENTUM

Market Cap: $13B

Company Info:

Madrigal Pharmaceuticals, Inc. (NASDAQ: MDGL) is a biopharmaceutical company focused on developing targeted therapies for metabolic and liver diseases, with a primary emphasis on nonalcoholic steatohepatitis (NASH/MASH). Its lead drug candidate, Rezdiffra™ (resmetirom), is the first FDA-approved therapy for MASH, marking a major milestone in the treatment of a disease with significant unmet medical need and positioning Madrigal at the forefront of the future of metabolic liver care.

Why We’re Watching This Stock:

The stock is a buy in 2025 because Madrigal Pharmaceuticals (MDGL) sits at the center of a major breakthrough in metabolic liver disease, addressing a massive unmet need with its first-in-class MASH therapy, Rezdiffra™ (resmetirom). Unlike prior failed approaches in NASH/MASH, Madrigal’s drug targets the disease at a metabolic and hormonal level, offering a differentiated mechanism with strong clinical validation and regulatory backing.

Despite near-term concerns around launch execution, reimbursement dynamics, and market education, the long-term demand story for MASH treatment is only beginning. With millions of diagnosed patients, no true direct competitors at scale yet, and expanding physician adoption, Madrigal is positioned as a category-defining first mover in a multi-billion-dollar market. As awareness, screening, and treatment rates accelerate globally, MDGL offers investors early exposure to a transformative liver-disease franchise with durable growth potential.

Revenue:

Delta Air Lines, Inc. (DAL)

1 Year Chart:

Technical Levels To Watch: Available in MOMENTUM

Risk Considerations: Available in MOMENTUM

Potential Upside: Available in MOMENTUM

Market Cap: $46B

Company Info:

Delta Air Lines, Inc. (NYSE: DAL) is a global airline and transportation company providing passenger and cargo services across an extensive domestic and international network. As one of the world’s largest carriers, Delta operates a modern, fuel-efficient fleet and serves hundreds of destinations across North America, Europe, Asia, Latin America, and Africa. Through its focus on operational excellence, premium travel experiences, and strategic partnerships, Delta plays a central role in global commerce and mobility—positioning itself as a leader in the long-term evolution of the airline and travel industry.

Why We’re Watching This Stock:

The stock is a buy in 2025 because Delta Air Lines (DAL) is emerging as one of the strongest beneficiaries of a sustained recovery in global travel demand, supported by disciplined capacity management and a growing mix of high-margin premium revenue. Unlike many legacy carriers, Delta has focused on operational reliability, pricing power, and premium cabin expansion, positioning it to capture higher-yield customers as corporate and international travel continue to normalize.

Despite recent volatility tied to fuel prices, macro uncertainty, and broader market selloffs, Delta’s core fundamentals remain intact, with strong cash generation, a modernized fleet, and deep strategic partnerships across Europe and Asia. As travel demand stabilizes and margins expand through cost control and premium offerings, Delta stands out as a best-in-class airline with leverage to an improving macro backdrop—offering investors exposure to a durable recovery story with meaningful upside into 2025.

Revenue:

Analog Devices, Inc. (ADI)

1 Year Chart:

Technical Levels To Watch: Available in MOMENTUM

Risk Considerations: Available in MOMENTUM

Potential Upside: Available in MOMENTUM

Market Cap: $134B

Company Info:

Analog Devices, Inc. (NASDAQ: ADI) is a leading semiconductor company specializing in high-performance analog, mixed-signal, and power management chips that serve critical applications across industrial, automotive, communications, healthcare, and data center markets. ADI’s solutions enable the conversion, processing, and interpretation of real-world signals—powering everything from factory automation and electric vehicles to 5G networks and advanced medical equipment. With a focus on precision, reliability, and long product lifecycles, Analog Devices plays a foundational role in the infrastructure behind modern electronics and the ongoing shift toward intelligent, connected, and energy-efficient systems.

Why We’re Watching This Stock:

The stock is a buy in 2025 because Analog Devices (ADI) sits at the center of the global push toward automation, electrification, and intelligent infrastructure, supplying the high-performance analog and power chips that make these systems work reliably in the real world. Unlike commodity semiconductor players, ADI focuses on mission-critical applications—industrial automation, automotive electrification, aerospace, healthcare, and communications—where precision, longevity, and reliability matter more than short product cycles.

Despite cyclical softness in parts of the semiconductor market, ADI continues to benefit from long-term secular demand tied to factory automation, electric vehicles, energy efficiency, and advanced sensing. With a diversified customer base, strong pricing power, and a portfolio designed for multi-year deployments, Analog Devices is positioned as a foundational enabler of the smart, connected economy. As capital spending and industrial demand normalize, ADI offers investors exposure to a durable, high-quality semiconductor leader with significant long-term upside.

Revenue:

WANT PRICE BREAKDOWNS ON THESE TOP STOCKS?

We just dropped a new batch of price breakdowns inside MOMENTUM — and you’re invited.

✅ Weekly watchlists of stocks building momentum all week (Mon, Wed, Fri)

✅ Exclusive Discord access to my live trade chat

✅ Weekly elite reports every Sunday

✅ Full access to the stock pick archives + download vault

If you’ve found value in these emails… this is the next step.

👇 Tap below to get full access:

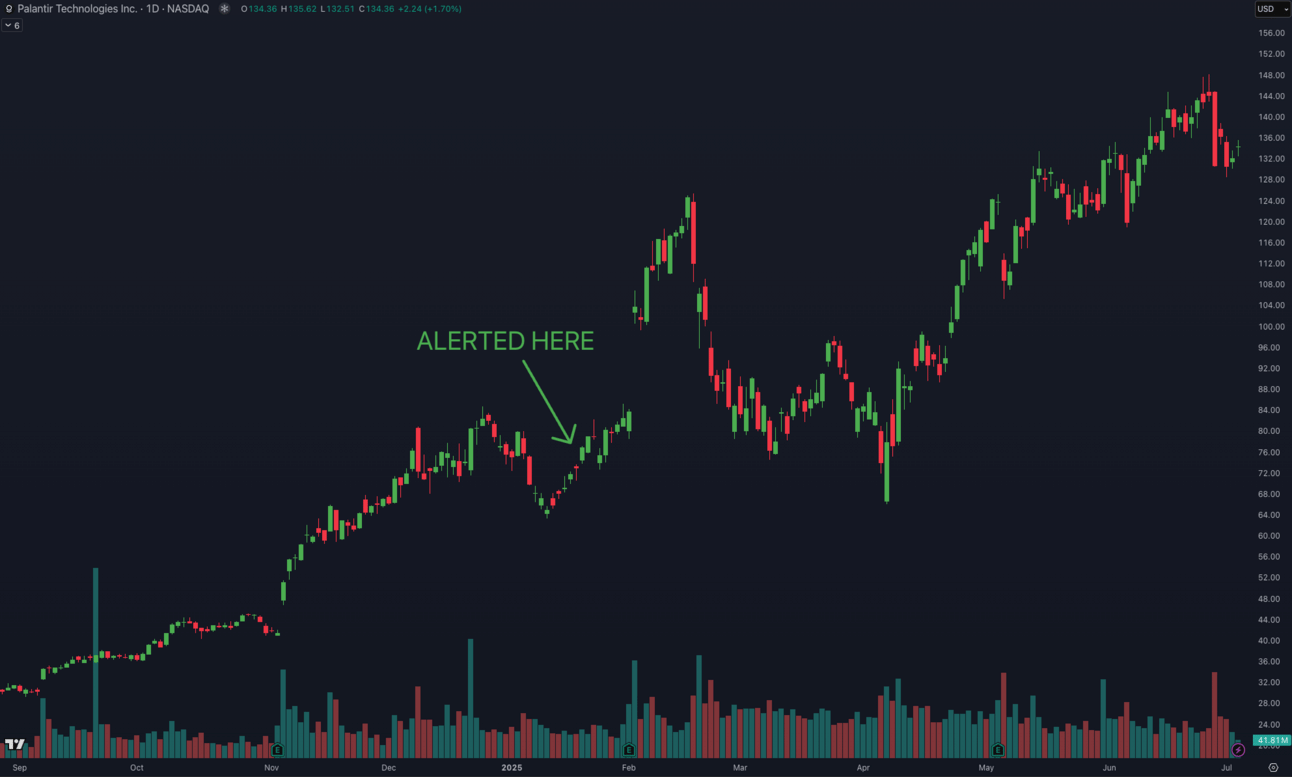

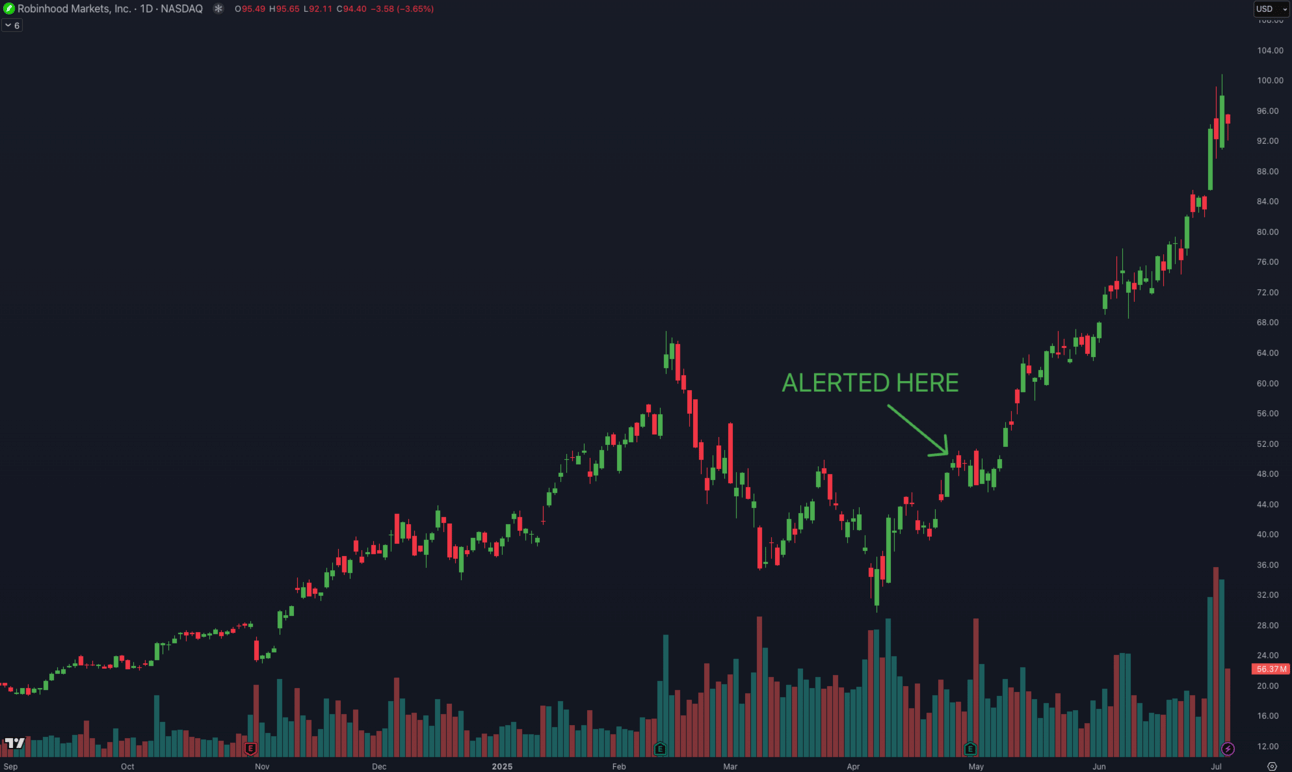

SOME OF OUR RECENT EXAMPLES:

• DAVE +211%

• PLTR +92.3%

• HOOD +95.9%

Thank you for your time!

Stay tuned for our next free release every Monday!

Disclaimer: The stocks mentioned in this email do not represent the exact positions of Crown Trading, but rather ideas and opportunities we are currently monitoring. Just because a stock is featured here does not mean we own or are actively trading it. The buy levels are not recommendations. This is not financial advice, and neither myself nor Crown Trading is recommending that you buy or sell any securities. All information is for educational purposes only and should not be relied upon for investment decisions. Please do your own research before making any trades.